10 min to read

How to optimize LTV: CAC ratio?

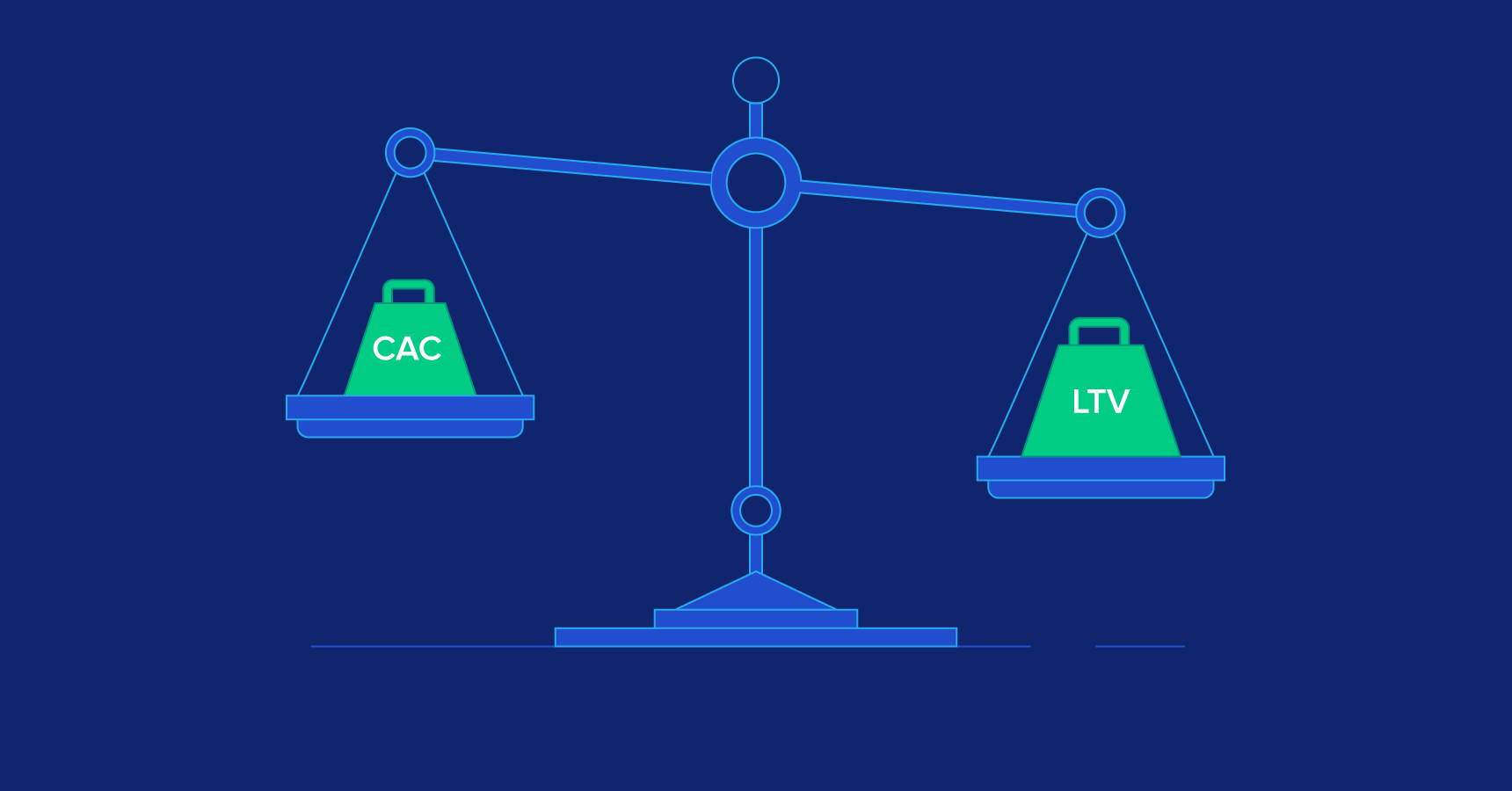

LTV: CAC ratio

The Lifetime Value (LTV) to Customer Acquisition Cost (CAC) ratio is an essential metric for assessing the success of your marketing campaigns. It gives you an understanding of how much you should spend on acquiring a customer.

If the ratio is low, it indicates a fault in your strategy and that your marketing budget will soon get exhausted without giving you the expected return on investment. In simple terms, a higher LTV implies increased profitability from a single customer.

In this blog post, we will look at actionable steps you can take to improve your LTV to CAC ratio and maximize your return on investment. In addition, read this article to learn how customer lifetime value and customer experience are related.

CodeDesign is the leading digital marketing agency in Lisbon Portugal.

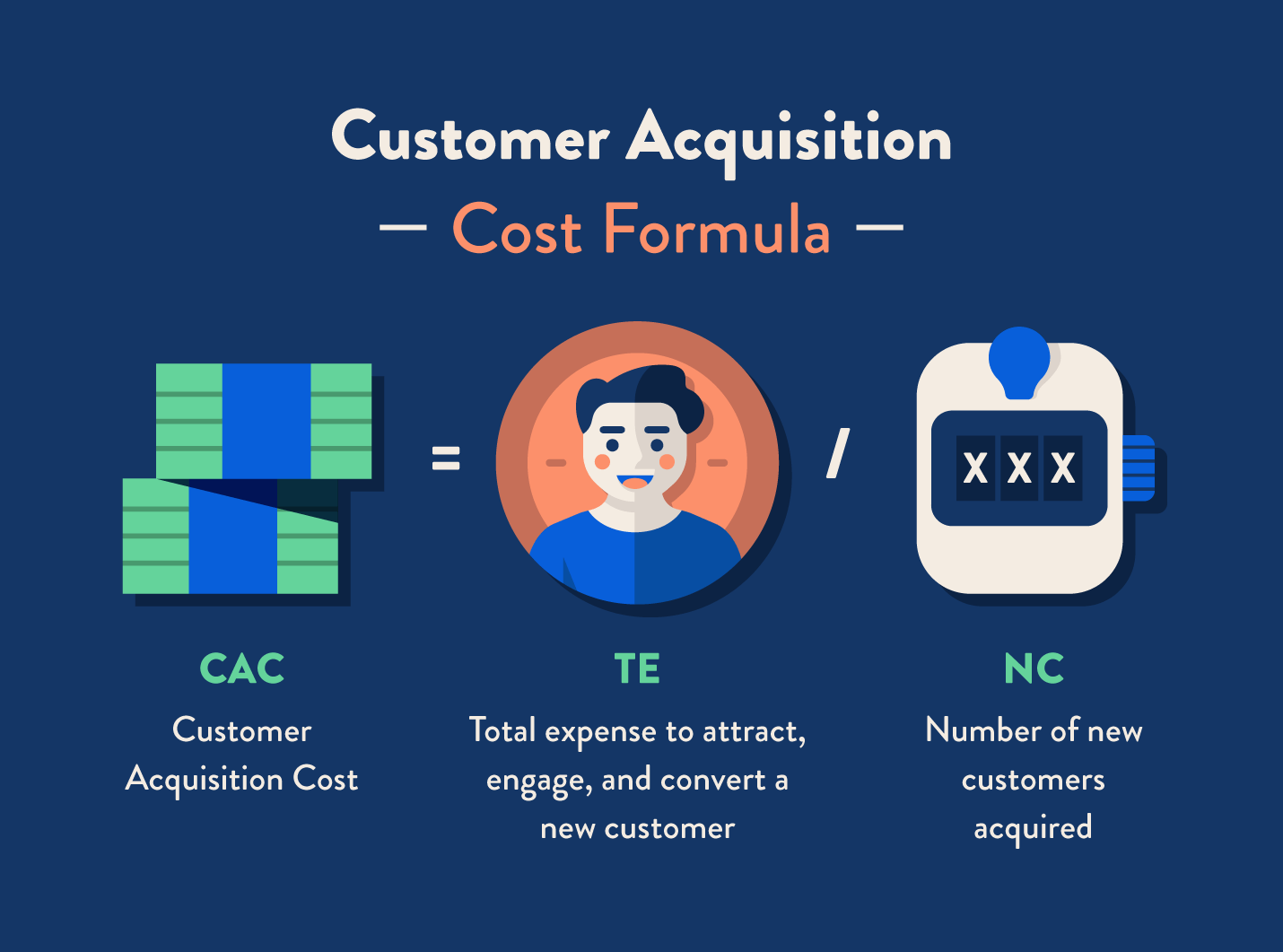

Customer Acquisition cost(CAC)

Customer acquisition cost

CAC is the total cost of acquiring a customer, which includes all expenses associated with finding and converting prospects into paying customers. Marketing expenses, prospecting resources, and lead conversion costs are all included.

It is calculated as the total sales and marketing cost of customer acquisition divided by the number of customers acquired in the timeframe. For example, if you spend $10000 over the course of three months and acquire 1000 customers, then your CAC is $10.

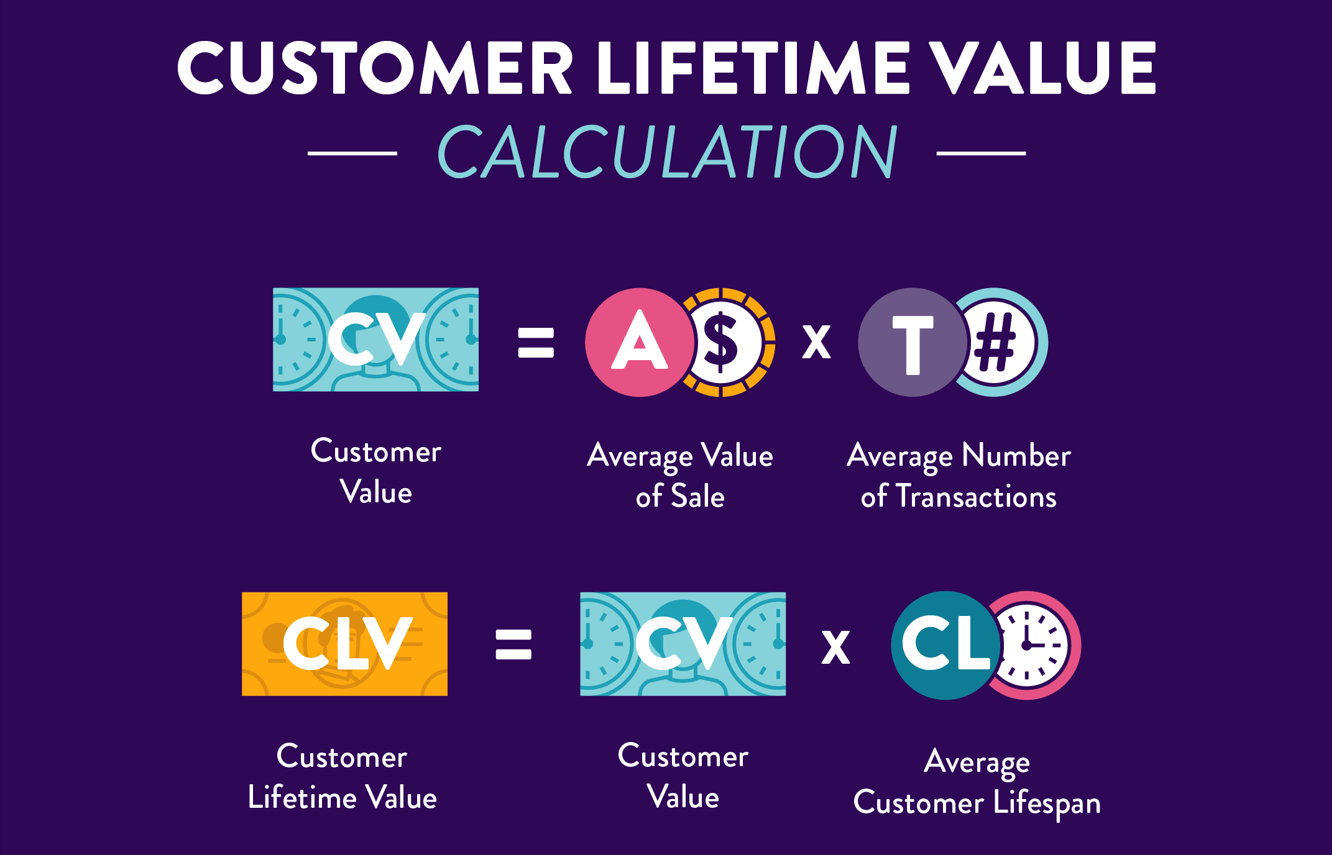

Customer Lifetime Value(LTV)

Customer Lifetime Value

Lifetime Value (LTV) is the total revenue a customer generates over their relationship with a company. LTV optimization is an essential component of any successful business strategy. It can potentially create a virtuous cycle of customer loyalty and long-term profitability.

LTV is calculated as the average revenue generated per user divided by the churn rate. To understand your customer's lifetime value, you need to know three things:

1. How often does your customer purchase from your company

2. How much they spend per purchase

3. How long are they active on your platform as a buyer?

What is a good LTV: CAC ratio?

Ideally, a 3:1 LTV: CAC ratio is considered good. It indicates that your business makes three times the amount invested in acquiring a customer. In other words, for every $1 spent on customer acquisition, you receive $3 in return.

If it's anywhere between 1:1, this means your business is neither at a profit nor at a loss. This indicates the need for improvements in your acquisition strategy. Read this complete guide on digital marketing funnel and then choose the right digital marketing channel for your business.

Three strategies to optimize your LTV: CAC ratio

1. Work on your inbound marketing strategy.

The marketing channels that bring in the most customers aren't always a healthy investment. If the customer churn rate is high, there's no point in investing marketing budgets in those channels.

Instead, inbound marketing is what brings in loyal customers. A targeted and knowledgeable inbound marketing approach will draw more leads who will likely be interested in your services/products over the long term, as 81% of consumers conduct online research before purchasing. You acquire good quality customers while paying less.

2. Measure your campaign strategy.

Accurately measure your campaign strategy to understand the efficacy of your marketing efforts and optimize the customer acquisition cost (CAC) to customer lifetime value (LTV) ratio. The first area to look for is the cost per lead (CPL), which evaluates the expense of acquiring a potential customer. Calculating the CPL and comparing it to the average LTV can determine the value generated by campaigns.

The second area to track is user engagement. Analyzing user engagement helps identify which campaigns generate the most qualified leads and whether those leads convert into customers. By considering user engagement alongside CPL and LTV, necessary adjustments can be made to optimize the CAC-to-LTV ratio.

The third area involves refining the user journey. Understanding the complete customer journey allows identifying potential areas for improvement to reduce CAC while increasing LTV. Continuous testing of new ideas and strategies is also crucial for improving the CAC to LTV ratio over time.

3. Experiment with your pricing model

If you have a freemium business model, experiment with pricing to see what factors will convert more paying customers. It could be a higher pricing tier, a feature-based pricing model, seat-based pricing, or something else. The faster you convert freemium users to paid plans, the lower your CAC will be.

Besides this, you can try switching to an annual billing cycle that can help you reduce the customer churn rate. This long-term commitment will give you more time to prove your brand's worth to the customer.

However, it's crucial to maintain customer satisfaction throughout the process, as it's equally important to retain existing customers and attract new ones in the long run.

Three ideas to boost the customer's lifetime value

1. Add a help center to your website and app.

Adding a help center can do wonders in elevating your customers' experience and maximizing their lifetime value (LTV). Help centers offer substantial value by allowing customers to resolve issues independently, eliminating the need to rely on support representatives for assistance.

You can establish a comprehensive knowledge base by adding your product documentation, tutorials, webinars, help center widgets, frequently asked questions (FAQs), and live chat within a unified platform.

This centralized approach saves valuable time for both the customer support team and users and instills greater confidence in customers to navigate and address their concerns effectively. Read this guide on E-commerce supply chain and voice search optimization.

2. Conduct surveys to receive customer feedback.

Conducting surveys is one of the best tactics to understand your customer base and learn insights about their experience with your service/product.

You have many survey options, including NPS- Net promoter score, giving insights into how likely the customer will recommend your brand to others; CSAT- Customer satisfaction score, which shows how satisfied the customer is with your services and products; CES(Customer effort score), and PMF(Product market fit).

3. Offer a loyalty program to your loyal customers.

Implementing a well-structured loyalty program offers mutual advantages for both businesses and customers. From the customer's perspective, such initiatives foster a sense of recognition and appreciation, encouraging them to maintain a long-term relationship with the company. And from the company's perspective, a loyal customer base implies a higher customer lifetime value and increased revenue.

Conduct NPS surveys and analyze responses to identify loyal customers. Your loyal customers are your promoters, who are more likely to recommend your products or services to others.

Focus on your promoters and introduce a loyalty program, offering them discounts, freebies, and so on to foster stronger relationships, enhancing loyalty and greater business success. Check these Amazon FBA tips to grow your business and see how optimising your Amazon listing could help you grow.

Bottom Line

Optimizing your customer acquisition cost (CAC) to lifetime value (LTV) ratio is an ongoing process of monitoring and improving campaign performance. In order to decide where to allocate your marketing budget, you must constantly monitor your CAC costs and LTV growth. It is an incredibly effective way to raise your ROI when done correctly.

FAQS - Frequently Asked Questions

What is the LTV:CAC ratio and why is it important for my business?

The LTV:CAC ratio stands for the Lifetime Value to Customer Acquisition Cost ratio. It measures the relationship between the lifetime value of a customer and the cost to acquire that customer. This metric is crucial for your business because it provides insight into the profitability and sustainability of your customer acquisition strategies. A healthy LTV:CAC ratio indicates that you are investing wisely in acquiring customers who will generate more revenue over time than it costs to acquire them. This metric helps in making informed decisions on marketing spend, identifying profitable customer segments, and evaluating the overall health of your business model. For example, businesses we've worked with at Codedesign have seen significant improvements in their profitability by focusing on optimizing their LTV:CAC ratio, using advanced analytics to refine their marketing strategies and improve customer retention.

How can I calculate my company's LTV:CAC ratio?

Calculating your company's LTV:CAC ratio involves two main steps. First, calculate the Lifetime Value (LTV) of your average customer by multiplying the average purchase value by the average number of purchases over the customer's lifetime. Then, calculate the Customer Acquisition Cost (CAC) by dividing the total costs associated with acquiring new customers (including marketing and sales expenses) by the number of new customers acquired. The LTV:CAC ratio is then found by dividing the LTV by the CAC. For instance, if your average LTV is $600 and your CAC is $200, your LTV:CAC ratio would be 3. This simple yet effective calculation provides a clear insight into the return on investment for your customer acquisition efforts.

What is considered a good LTV:CAC ratio?

A good LTV:CAC ratio typically falls within the range of 3:1 to 4:1. This means that the lifetime value of a customer is three to four times the cost of acquiring them. Such a ratio indicates a healthy balance between the cost of acquiring customers and the revenue they generate, allowing for sustainable growth and profitability. However, the ideal ratio can vary based on industry standards, business models, and market conditions. It's essential to benchmark your LTV:CAC ratio against similar companies in your sector to understand how well you're performing. At Codedesign, we've observed that clients who maintain or exceed this ratio threshold tend to have more resources to reinvest in growth and innovation, leading to a strong competitive advantage.

How can improving my inbound marketing strategy affect my LTV:CAC ratio?

Improving your inbound marketing strategy can significantly affect your LTV:CAC ratio by attracting more qualified leads at a lower cost, thus increasing the lifetime value of customers while reducing acquisition costs. Inbound marketing, focused on creating valuable content and tailored experiences, tends to attract customers who are more engaged and likely to convert. By optimizing your content for your target audience and leveraging SEO, social media, and personalized email marketing, you can enhance customer loyalty and encourage repeat purchases, which increases LTV. Simultaneously, the cost-effective nature of these inbound tactics can lower CAC. Clients at Codedesign who have refined their inbound marketing strategies have often seen their LTV:CAC ratios improve as they attract more committed and profitable customers.

In what ways can measuring my campaign strategy optimize the LTV:CAC ratio?

Measuring and analyzing the effectiveness of your campaign strategy can optimize the LTV:CAC ratio by enabling you to allocate your marketing budget more efficiently. By understanding which channels and campaigns yield the highest-quality leads and customers, you can focus your efforts and resources on the most profitable strategies. This targeted approach not only reduces waste in your marketing spend, thereby lowering CAC, but also attracts customers with higher potential LTV through personalized and engaging content. For instance, programmatic media buying, a service offered by Codedesign, allows for real-time optimization of ad campaigns towards audiences most likely to convert, improving both LTV and CAC.

How can experimenting with my pricing model improve the LTV:CAC ratio?

Experimenting with your pricing model can improve the LTV:CAC ratio by finding the optimal balance that maximizes customer value without increasing acquisition costs. Different pricing strategies, such as penetration pricing, value-based pricing, or tiered pricing, can attract different customer segments with varying lifetime values. By testing and analyzing how these pricing models affect customer behavior and acquisition rates, you can identify the most effective strategy for maximizing revenue while maintaining or reducing acquisition costs. Many of Codedesign's clients have successfully increased their LTV:CAC ratio by adjusting their pricing models based on data-driven insights, thereby enhancing both profitability and customer satisfaction.

What steps can I take to increase my customers' lifetime value?

Increasing your customers' lifetime value involves strategies aimed at improving customer satisfaction, loyalty, and engagement. This can be achieved through personalized communication, high-quality customer service, and offering value that exceeds customer expectations. Implementing a customer feedback loop to continually improve products and services based on customer input can also enhance LTV. Additionally, upselling and cross-selling strategies, when executed thoughtfully, can significantly increase the average purchase value and frequency. For example, by leveraging advanced data analytics, companies can predict customer needs and tailor offers accordingly, resulting in higher customer retention and increased LTV.

How can adding a help center to my website or app boost LTV?

Adding a help center to your website or app can boost LTV by improving customer satisfaction and loyalty through self-service support options. A comprehensive help center addresses common questions and issues, allowing customers to find solutions quickly without needing to contact customer service directly. This convenience enhances the user experience, fostering a positive perception of your brand and encouraging repeat business. Furthermore, by reducing the volume of support queries handled by your team, you can lower operational costs and reinvest those savings into other areas that contribute to customer value. Clients at Codedesign who have implemented effective help centers often report increased customer engagement and loyalty, leading to higher LTV.

Why should I conduct surveys to receive customer feedback, and how does it impact LTV?

Conducting surveys to receive customer feedback is critical for understanding customer satisfaction, expectations, and areas for improvement. This direct input from customers can guide strategic decisions regarding product development, customer service enhancements, and marketing strategies, ensuring that your offerings align with customer needs. Positive changes informed by customer feedback can significantly improve customer satisfaction and loyalty, leading to increased retention rates and higher lifetime value. Moreover, engaging customers in this way demonstrates that you value their opinions, further reinforcing their loyalty to your brand. At Codedesign, we've seen that companies that actively solicit and act on customer feedback tend to have higher LTVs, as they are better positioned to meet and exceed customer expectations.

How can a loyalty program benefit my LTV:CAC ratio?

A loyalty program can benefit your LTV:CAC ratio by encouraging repeat business and increasing customer loyalty, which leads to a higher lifetime value. By rewarding customers for their purchases, loyalty programs provide an incentive for customers to choose your brand over competitors, enhancing customer retention. This increase in customer loyalty and repeat purchases boosts LTV, as loyal customers often purchase more over time. Additionally, effective loyalty programs can turn satisfied customers into brand advocates, leading to word-of-mouth referrals that lower the cost of acquiring new customers (CAC). In our experience at Codedesign, clients who have implemented well-designed loyalty programs have seen significant improvements in their LTV:CAC ratios, contributing to sustainable business growth

About Bruno GavinoBruno Gavino is the CEO and partner of Codedesign, a digital marketing agency with a strong international presence. Based in Lisbon, Portugal, with offices in Boston, Singapore, and Manchester (UK) Codedesign has been recognized as one of the top interactive agencies and eCommerce agencies. Awarded Top B2B Company in Europe and Top B2C company in retail, Codedesign aims to foster personal relationships with clients and create a positive work environment for its team. He emphasizes the need for digital agencies to focus on data optimization and performance to meet the increasingly results-driven demands of clients. His experience in digital marketing, combined with a unique background that includes engineering and data, contributes to his effective and multifaceted leadership style. |

About CodedesignCodedesign is a digital marketing agency with a strong multicultural and international presence, offering expert services in digital marketing. Our digital agency in Lisbon, Boston, and Manchester enables us to provide market-ready strategies that suit a wide range of clients across the globe (both B2B and B2C). We specialize in creating impactful online experiences, focusing on making your digital presence strong and efficient. Our approach is straightforward and effective, ensuring that every client receives a personalized service that truly meets their needs. Our digital agency is committed to using the latest data and technology to help your business stand out. Whether you're looking to increase your online visibility, connect better with your audience, get more leads, or grow your online sales. For more information, read our Digital Strategy Blog or to start your journey with us, please feel free to contact us. |

CodeDesign is leading:

- Digital Agency

- Digital Marketing Agency

- Digital Ecommerce Agency

- Amazon Marketing Agency

Add comment ×