15 min to read

As a business, finding the right fit for your funding needs is essential. Whether from angel investors or securing capital funding, you should be picky about where you source your money.

This is because you could end up getting less value for your company's shares or partnering with the wrong individuals or organizations, which could ultimately hinder your success. As a result, it's good practice to approach investors with effective marketing strategies that will secure the funding you want and are best suited for your business.

How you pitch and market your business to attract investors is essential. Forbes found that the time of year you pitch, the detail of data, and the value of the pitch deck can be significant factors that influence the amount of funding a business receives.

With that being said, this guide will explore the marketing strategies your business needs to appeal to investors this year and beyond. You'll also understand how significant investment is for your business, whether you're a startup just finding its feet or an established business heading in its early years of growth. Here is a complete guide for you on developing a business development strategy.

Let's start with what types of companies invest in startups.

Obviously medium size companies and large corporations have different ways to secure capital, loans, and eventually even stock exchange as a way to sort cash problems or investment needs.

we've worked at Codedesign with a lot of funded startups and helped them hit the market ground running adjusting business models and helping the acquired funding. Our startup clients were mainly invested by investors in many different shapes and sizes. Some are venture capitalists, others are angel investors, and others are corporate investors. Each type of investor has its own strengths and weaknesses and comes with different expectations.

Venture Capitalists

Venture capitalists (VCs) are professional investors, usually managing large funds, which invest in startups in exchange for equity. VCs typically specialize in a certain sector, such as technology or healthcare, and they look for companies with the potential to generate high returns. VCs typically invest larger sums of money—upwards of a million dollars—and they usually require a board seat and significant control over the company.

Angel Investors

Angel investors are wealthy individuals who invest their own money in startups in exchange for equity. Unlike VCs, angel investors typically invest smaller amounts—usually between $25,000 and $100,000—and they often don’t require a board seat or significant control over the company. They may also provide mentorship and advice to the startup, in addition to the capital.

Corporate Investors

Corporate investors are companies that invest in startups in exchange for equity. Corporate investors typically invest larger amounts than angels, but they may also require a board seat or significant control over the company. Corporate investors may be looking to acquire startups, or they may simply be looking to diversify their investments.

No matter what type of investor is investing in a startup, it is important for the startup founders to understand the investor’s motivations and expectations. Each type of investor has its own advantages and disadvantages, and the startup should weigh these carefully before accepting an investment.

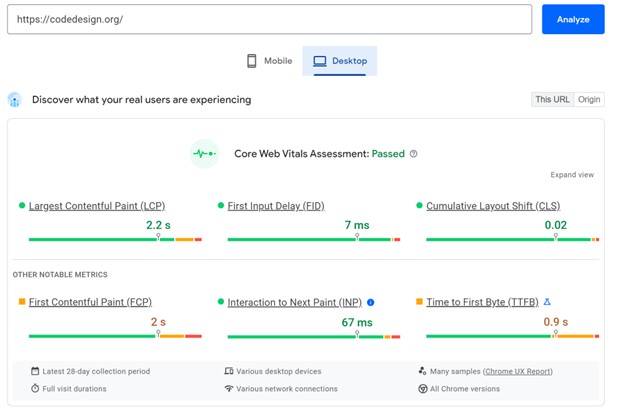

CodeDesign is a leading digital marketing agency ranked #1 in Lisbon, Portugal. Work with us to accelerate your business growth.

The importance of investment for your business.

Why is an investment so integral to your company in this day and age? Well, it would be naive to think that money doesn't make the world go round because it certainly has quite a significance. While not all businesses need investment, there are benefits to securing funding, even if you're doing well and you're financially comfortable.

Provides the resources for innovation, development, and growth

The proper funding enables businesses to secure the resources needed to deliver innovation within their organization. It can help hire staff members and offer the right equipment or tools necessary to take your business up to the next step. Regarding development and growth, it's not all financially influenced, but it helps.

Helps improve productivity

The proper funding can help give your business the push it needs to thrive in a competitive market. Not only that, but businesses can become stagnant if they don't seem to be going anywhere. With an extra funding boost, it could be the money a company needs to make the right decisions moving forward.

It opens doors to opportunities previously closed.

With money and investment, you'll typically get new opportunities from previously closed doors, whether that's because specific resources weren't available or your current position only got you into so many rooms or scenarios as a business.

Eight marketing strategies to use for attracting investors

There are great ways to go about it when you're appealing to investors. You might not have the best experience when marketing to investors, or perhaps you've only just got around to asking for funding from external sources. Whatever that may be, here are eight marketing strategies to attract investors in 2022.

Use the right tools to create quality proposal templates.

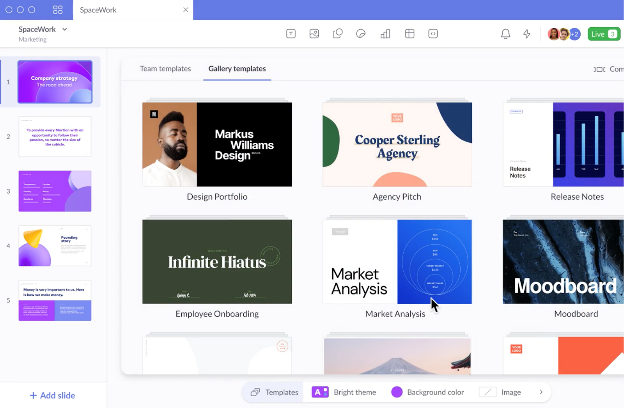

To secure investors, it's important that you're using the right tools to generate the pitch decks needed to sell your brand, business, or products and services to them. These proposal templates from Pitch are a good example of using online tools and software that are as cheap as a cup of coffee per month to utilize.

Whether you're a small business or startup, there are certainly plenty of tools that you can make use of in order to gather a portfolio together or create presentations.

A visual aid is important for investors to have and when it comes to asking for money, you need to provide them with value in the form of literature that explains exactly what they're getting for their money.

Secure evidence of customers or profit before investment.

When investors are willing to spend money or they're interested in what your business has to offer, it's handy to have customers or a little bit of profit before the investment.

This is useful because it shows the investors that there's monetary value in the business already. Even if you've only managed to make a dozen or so sales, it's better than approaching investors without having earnt a single dollar for the business.

Securing this evidence of customers or profit is helpful and can be done easily with a small level of marketing. If your intention is to secure investment, then try not to spend too much on generating those first few sales.

Have co-founders or board members.

One of the great ways to attract investors is by having co-founders for your business or setting up a board where investors will invest in the company in order to have a say on how it's run. As a result, they may also have a stake in the business.

This may not be the ideal option for all businesses as you're giving away chunks of the business depending on how many investors you offer it to. However, if you're after some serious capital, then having others become co-owners of the business or having a certain amount of stake in the business is helpful.

Approach investors through networking opportunities.

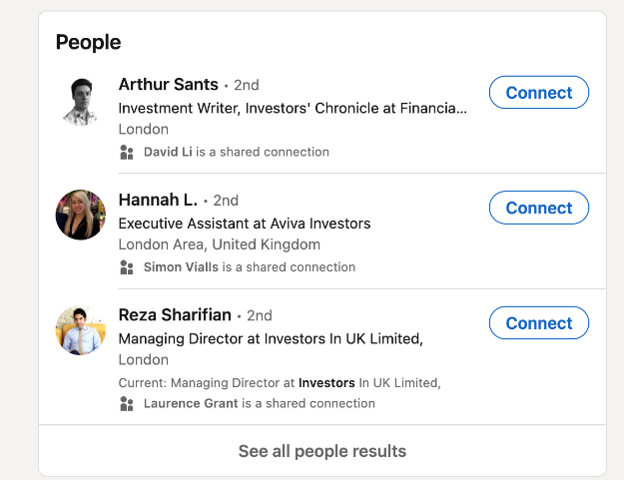

Networking is a great way to find people and, most importantly, investors. If you're taking advantage of networking opportunities in-person and online, then you're creating more personable relationships with your investors. It may also mean that further down the line, they're willing to invest more because of the relationship that you built early on in the process.

LinkedIn is a great option for cold pitching to investors, and while online pitching is great, there's nothing quite like going to conferences or networking events. Speaking to people in person helps an investor see the person behind the business, and that might be someone they're willing to invest in, despite the type of business it is.

Find an ROI for the investor to discover the company's appeal.

What could you offer the investor in order to improve the appeal of your company?

Not every investor is just going to give their money willingly for any business. It's going to take a little convincing, for the most part, in order to get the individual or corporation to part with their cash. Read these 7 reasons you should hire a digital agency in Portugal to manage your e-commerce in Europe

The more ROI you can provide for the investor's money, the more likely they'll be to invest in the business. Perhaps it's a certain amount of shares in the company or free products/services for the rest of their lifetime? Get creative in what you can give to them, despite whether you have a lot to give or very little.

Share data on customer reach and engagement.

It's true; a customer is often always right. Customer engagement plays a big part in a company's success because the more engagement and reach achieved, the more customers are likely to purchase something from the business.

With 86% of buyers willing to pay more for a better customer experience, it pays to know this type of data for your business. For investors, sharing the current customer reach and engagement data available is helpful. It shows exactly how much influence your business has and its potential for future investment. Data doesn't lie, which is why it's considered so valuable by any and all businesses that use it. Check this guide on investor outreach process.

Utilize the online fundraising market.

Online fundraising it's a great way of appealing to the general public. As part of that general demographic, you may find the odd investor who is looking for initiatives to contribute to via these online fundraising market platforms. It's worth going on sites like Kickstarter and seeing what the audience market is like when it comes to finding investment for your business.

Investors can often be found in the most unusual and unexpected places. Some simply like to donate to causes they like the look of and don't mind giving their money and getting nothing back. These are the best types of investors!

However, it's good to offer incentives to encourage users to donate. This could be sectioned into different benefits depending on how much the user donates. Have a proper digital marketing funnel in place.

Use social media to reach a wider investor network.

Finally, social media is a great way of reaching a wider investor network. By actively posting on social media channels like Facebook, Twitter, and Instagram, you can attract users to your profile and, more importantly, to what you're up to as a business.

As an investor, you may have those who watch your growth for a while before stepping in and offering a financial incentive in order for a return on the business in some way.

Make use of these convincing marketing strategies.

Whether you've got access to a marketing team or doing it all yourself as a sole business owner, these convincing marketing strategies are worth trying for your business this year. Focus on which ones work best for you, and always be on the lookout for new ways of attracting investors this year and beyond.

How to use social media to acquire an investor?

As a digital agency, we use the resources available to help our clients and partners to acquire safe investments. Social media can prove a critical role in this. Here are a few tips:

1. Use LinkedIn to research potential investors who are active in the space that you are looking for investment in. Connect with them and start a dialogue.

2. Use Twitter to share updates about your business and progress. Post about opportunities for investment and tag potential investors in the post.

3. YouTube or other video platforms to introduce yourself and your company. You can also use these platforms to showcase your successes and explain the potential of your business. Read this complete guide on Amazon Listing Optimization.

4. Create a Facebook page for your business and use it to connect with investors. Share updates, ask questions, and post content that is relevant to your industry.

5. Utilize Instagram to showcase your products and services. Use visuals to capture the attention of potential investors and encourage them to learn more about your business.

6. Take advantage of networking events and conferences. Use social media to promote these events and to reach out to potential investors.

7. Use email marketing to reach out to potential investors. Create a mailing list of investors and send them updates about your business and progress.

So, start by putting these to practice and check the results after a couple of weeks. Next, use PR and Digital PR to expand this influence. Check out how voice search optimization could affect your marketing strategy.

How to use digital PR to acquire an angel investor?

1. Develop a Compelling Pitch: Before attempting to acquire an angel investor, you must have a compelling pitch. This should include an overview of your business, market, and competitive advantage. tip from our team: Be sure to include a list of potential returns for the investor and your current financials. Pretty basic but a lot of people neglect this.

2. Utilize Social Media: Use social media to reach potential angel investors. Make sure to create an engaging profile that includes links to your website and other industry news. Use relevant hashtags and join conversations on relevant topics.

3. Reach Out to Industry Influencers: Connect with industry influencers and leverage their networks to create a larger reach. Consider creating an industry-specific Twitter list or inviting them to take part in an industry event.

4. Create Quality Content: Create quality content tailored to the needs and interests of angel investors. Make sure to highlight the value you can bring to an investor and how you will use the funds to grow your business.

5. Develop a Digital PR Campaign: Use digital PR tactics to reach out to angel investors, such as press releases, email outreach, and influencer-driven content.

6. Attend Networking Events: Attend industry events and conferences to meet with potential angel investors. Networking and connecting with angel investors in person can go a long way.

7. Develop a Follow-up Plan: After contacting potential investors, be sure to have a plan in place to follow up with them. This could include sending additional information, updating them on the progress of your business, or setting up meetings. Read this complete guide on traditional marketing vs digital marketing.

How to use my network to get an investor to my company?

1. Create an online presence for your company by setting up social media accounts, such as Facebook, Twitter, and LinkedIn, and using them to post updates about your company, products, and services. Create a website to showcase your company and its offerings. Use online forums and other platforms to promote your company and its products or services.

2. Reach out to venture capital and angel investors through networks such as AngelList and Gust, which offer access to a large network of accredited investors. Join industry-specific networks and use them to connect with potential investors.

3. Attend networking events, such as conferences and meetups, that are specific to the industry in which your company operates. Use these events to meet potential investors and get feedback on your company’s offerings.

4. Connect with potential investors on LinkedIn. Reach out to investors and begin building relationships with them. Use LinkedIn to share updates and news about your company. Read these linkedin ads best practices 2023.

5. Join professional associations and groups related to your industry. Participate in discussions and use these networks to connect with potential investors.

6. Create a website or blog to showcase your company and its offerings. Use it to post updates, news, and other information about your company.

7. Develop relationships with investors by offering them advice and insights. Showcase your knowledge of the industry and your understanding of the market.

8. Pitch your company to investors at trade shows and other events. Make sure to have a well-researched and persuasive presentation.

9. Connect with investors through personal relationships. Use your existing contacts to get introductions to potential investors.

10. Use crowdfunding platforms to engage with potential individual investors. Platforms such as Kickstarter and Indiegogo allow you to reach a large audience of potential investors.

What are the best crowdfunding platforms?

Crowdfunding is huge and lots of personal investors are moving into for the ability to invest in great people and great ideas, with great growth potential. Here the must know list of crowdfunding websites you need to send your idea to:

1. Kickstarter - https://www.kickstarter.com/

2. Indiegogo - https://www.indiegogo.com/

3. GoFundMe - https://www.gofundme.com/

4. Crowdfunder - https://www.crowdfunder.com/

5. Fundable - https://fundable.com/

6. Crowdcube - https://www.crowdcube.com/

7. Crowd Supply - https://www.crowdsupply.com/

8. Fundly - https://fundly.com/

9. Patreon - https://www.patreon.com/

10. Kiva - https://www.kiva.org/

11. WeFunder - https://wefunder.com/

12. FundRazr - https://fundrazr.com/

13. Plumfund - https://www.plumfund.com/

14. RocketHub - https://www.rockethub.com/

15. Razoo - https://www.razoo.com/

16. DonorsChoose - https://www.donorschoose.org/

17. AngelList - https://angel.co/

18. Crowdrise - https://www.crowdrise.com/

19. Causes - https://www.causes.com/

20. Kickstarter Live - https://www.kickstarter.com/live

great, but i don't know if you noticed but a lot of the platforms are crowded with great projects and ideas. so

How to promote an idea on a crowdfunding website?

Start by creating a compelling campaign: Write a strong campaign story that explains what your project is about, why it’s important, and why people should support it. Include a clear call to action and make sure the page is visually engaging. Then, reach out to your network: Share your project with friends, family, and colleagues. Encourage them to share it with their networks as well.

Utilize social media: Use social media to spread the word about your campaign. Create compelling content such as videos, photos, and graphics to share on your social media platforms.

Connect with bloggers and influencers: Reach out to bloggers and influencers who have a following related to your project. Ask them to share your campaign with their followers and audience.

Leverage email marketing: Send out emails to your subscribers and contacts list. Ask them to share your campaign with their networks and encourage them to contribute if they can.

Offer rewards: Offer rewards such as branded merchandise, discounts, or special access to your project for those who contribute. This will help motivate people to contribute and increase your campaign’s visibility.

Participate in forums and discussion boards: A great way to get the word out about your campaign is to post about it in relevant forums and discussion boards.

advertise your campaign: Consider setting up paid ads on crowdfunding websites or other platforms. This can help you reach a larger audience and increase your chances of success.

Awesome, what are the top 10 best-crowdfunded projects?

1. Pebble Time: This project aimed to create a new version of the Pebble smartwatch. It was the most funded Kickstarter project of all time, raising more than $20 million from over 78,000 backers. The watch featured a color e-paper display and a Timeline interface for notifications and alerts.

2. Exploding Kittens: This project sought to create a card game based off a popular web comic. It raised more than $8.7 million from 219,000 backers, making it the 5th most funded Kickstarter project of all time. The game is a mix of Russian Roulette and Uno, and features a variety of different cards and actions.

3. Kingdom Death: Monster: This project sought to create a board game that combined horror and strategic elements. The game was incredibly successful, raising more than $12 million from over 19,000 backers. The game features a variety of monsters, characters, and scenarios, as well as an in-depth campaign mode.

4. Coolest Cooler: This project sought to create a cooler with a variety of high-tech features, such as a blender, USB charger, and Bluetooth speaker. It raised more than $13 million from over 62,000 backers, making it the third most funded Kickstarter project of all time.

5. The Veronica Mars Movie Project: This project sought to create a movie based off the popular TV show Veronica Mars. It was incredibly successful, raising more than $5.7 million from over 91,000 backers. The movie was released in 2014 and was well-received by both critics and fans.

6. Pono Music: This project sought to create a high-quality music player to bring back the emotion and energy of live performances. The project was backed by over 18,000 people, raising more than $6.2 million. The player was designed to play high-resolution audio files and can store up to 64GB of music.

7. Ouya: This project sought to create an open-source video game console. It raised more than $8.6 million from over 63,000 backers, making it the 4th most funded Kickstarter project of all time. The console runs on the Android operating system and allows users to play a variety of different games.

8. Star Citizen: This project sought to create a space-sim game. It is currently the most funded crowdfunding project of all time, raising more than $212 million from over 2 million backers. The game features a variety of space ships and planets, as well as an in-depth story line.

9. Reading Rainbow: This project sought to create a digital version of the beloved children's educational show. It raised more than $5.4 million from over 105,000 backers, making it the most funded Kickstarter project of all time in the Film & Video category. The app includes a library of over 500 books and a variety of interactive activities.

10. Shenmue 3: This project sought to create a sequel to the classic video game series Shenmue. It raised more than $6.3 million from over 69,000 backers, making it the most funded video game in Kickstarter history. The game was released in 2019 and was well-received by critics and fans alike.

ok! These are all fantastic, but they are all direct to consumer B2C projects. Are there B2B funded projects? Absolutely, here a list of some of the ones we love:

What are the top 10 best b2b crowdfunded projects?

1. Omni-Channel Ecommerce Platform: This project aimed to create a platform to enable businesses to engage with customers in an omni-channel approach. The platform was designed to integrate seamlessly with existing ecommerce offerings, allowing businesses to create a unified customer experience across all channels.

2. Hosted Business Intelligence Solution: This project was designed to provide businesses with a comprehensive hosted business intelligence solution, enabling them to access and analyze vast amounts of data to improve their operations.

3. Social Networking Platform: This project was aimed at creating a social network specifically tailored to the needs of businesses. It would provide a platform for businesses to interact with customers, partners, and employees in an interactive and secure environment.

4. Automated Online Advertising Platform: This project was designed to create an automated online advertising platform, allowing businesses to quickly and easily manage their advertising campaigns. It would also provide real-time analytics to help businesses optimize their campaigns.

5. Cloud-Based Collaboration Platform: This project was designed to create a cloud-based collaboration platform for businesses, enabling workers to collaborate and work together in real-time. It would also provide features such as document management, task management, and project management.

6. Mobile Workforce Management Solution: This project was designed to create a mobile workforce management solution, allowing businesses to manage their mobile workers from a central platform. It would provide features such as GPS tracking, scheduling, and payroll management.

7. Virtual Reality Platform: This project was aimed at creating a virtual reality platform specifically for businesses. It would provide a platform for businesses to create immersive, interactive virtual environments for customers, partners, and employees.

8. Electronic Medical Records Platform: This project was designed to create an electronic medical records platform, allowing healthcare providers to securely store and manage patient data. It would also provide features such as prescription management, appointment scheduling, and billing.

9. Online Learning Platform: This project was aimed at creating an online learning platform specifically for businesses. It would enable businesses to create and manage online courses, allowing employees to access and learn new skills and knowledge.

10. Enterprise Mobility Platform: This project was designed to create an enterprise mobility platform, allowing businesses to manage their mobile workforce from a central platform. It would provide features such as device management, application management, and security management.

About Bruno GavinoBruno Gavino is the CEO and partner of Codedesign, a digital marketing agency with a strong international presence. Based in Lisbon, Portugal, with offices in Boston, Singapore, and Manchester (UK) Codedesign has been recognized as one of the top interactive agencies and eCommerce agencies. Awarded Top B2B Company in Europe and Top B2C company in retail, Codedesign aims to foster personal relationships with clients and create a positive work environment for its team. He emphasizes the need for digital agencies to focus on data optimization and performance to meet the increasingly results-driven demands of clients. His experience in digital marketing, combined with a unique background that includes engineering and data, contributes to his effective and multifaceted leadership style. |

About CodedesignCodedesign is a digital marketing agency with a strong multicultural and international presence, offering expert services in digital marketing. Our digital agency in Lisbon, Boston, and Manchester enables us to provide market-ready strategies that suit a wide range of clients across the globe (both B2B and B2C). We specialize in creating impactful online experiences, focusing on making your digital presence strong and efficient. Our approach is straightforward and effective, ensuring that every client receives a personalized service that truly meets their needs. Our digital agency is committed to using the latest data and technology to help your business stand out. Whether you're looking to increase your online visibility, connect better with your audience, get more leads, or grow your online sales. For more information, read our Digital Strategy Blog or to start your journey with us, please feel free to contact us. |

CodeDesign is leading:

- Digital Agency

- Digital Marketing Agency

- Digital Ecommerce Agency

- Amazon Marketing Agency

Feel free to contact us to see the unprecedented growth of your business and download digital marketing plan template.

Add comment ×