15 min to read

As technological advancements continue to reshape industries, businesses of all sizes must embrace the power of digital solutions to unlock their growth potential. One such game-changer is digital banking, which goes beyond traditional brick-and-mortar banking to offer businesses various innovative services and tools. Digital banking solutions can fuel your business growth by streamlining financial operations, enhancing customer experiences, and more!

CodeDesign is the leading digital marketing agency in Lisbon Portugal.

Enhancing Customer Experiences

In the digital era, customer experience reigns supreme. Digital banking solutions offer tools to create tailored experiences for customers, fostering stronger relationships and brand loyalty. Personalized alerts, notifications, and targeted marketing campaigns based on transaction histories enable businesses to connect with their customers on a deeper level. The availability of user-friendly mobile apps ensures that customers can engage with your business effortlessly, whether they're making purchases or seeking support, thus boosting customer satisfaction and retention.

Improving Cash Flow Management for Sustainable Growth

Cash flow management is critical for business sustainability and growth. Digital banking solutions provide a comprehensive view of cash flow, allowing businesses to anticipate periods of surplus or shortfall. This foresight enables proactive measures, such as optimizing inventory levels, managing accounts payable and receivable more effectively, and strategically timing investments. By maintaining a healthy cash flow, businesses can weather economic uncertainties and seize opportunities for expansion without being hindered by cash constraints.

Facilitating Global Expansion and Trade

Online banking platforms enable cross-border transactions, foreign currency exchanges, and efficient international fund transfers. Additionally, businesses can leverage digital trade finance services, such as letters of credit and documentary collections, to mitigate the risks associated with international trade. With these tools, businesses can tap into new markets, access a broader customer base, and build a global presence with confidence. Check these Amazon FBA tips to grow your business and see how optimising your Amazon listing could help you grow.

Cross-Border Transactions: Digital banking platforms enable businesses to conduct transactions with partners and customers located in different countries. These platforms facilitate seamless cross-border payments, eliminating the complexities associated with traditional banking methods and reducing transaction times.

Foreign Currency Exchanges: When conducting international trade, dealing with multiple currencies can be a challenge. Digital banking solutions offer real-time foreign currency exchange services at competitive rates, allowing businesses to convert funds effortlessly and avoid exchange rate fluctuations.

Efficient International Fund Transfers: With digital banking, international fund transfers become quick and efficient. Businesses can transfer funds to suppliers, partners, or subsidiaries in other countries without the delays often associated with traditional wire transfers.

Digital Trade Finance Services: Digital banking platforms provide access to a range of trade finance services, including letters of credit and documentary collections. These services help mitigate the risks involved in cross-border trade by ensuring secure and timely payment for goods and services.

Strengthening Security and Mitigating Risks

Digital banking solutions are built with robust security measures to protect against cyber threats and fraud. Multi-factor authentication, encryption, and real-time monitoring are just a few examples of the security features integrated into these platforms. Furthermore, the centralized nature of digital banking enables businesses to control access permissions, ensuring that only authorized personnel can perform specific financial tasks. By strengthening security and mitigating risks, digital banking solutions instill confidence in customers and partners, reinforcing your business's reputation as a trustworthy and reliable entity. Read this guide on E-commerce supply chain and voice search optimization.

Harnessing Data Analytics

These platforms often come equipped with sophisticated data analytics tools that can transform raw data into actionable insights. Businesses can make informed decisions to optimize their operations and drive growth by analyzing transaction patterns, customer behaviors, and market trends. Data-driven decision-making enables businesses to identify opportunities, detect potential bottlenecks, and allocate resources more efficiently. With a clear understanding of their financial performance and customer preferences, businesses can adapt and evolve to meet the market's demands and maintain a competitive edge.

Leveraging digital banking solutions is no longer a luxury in a world where digital transformation alters business processes - it is a strategic need. These cutting-edge solutions provide firms several advantages, from simplifying financial processes and increasing client experiences to boosting cash flow management and allowing worldwide development. Businesses can operate with confidence, agility, and a thorough awareness of their financial landscape, thanks to enhanced security measures and data analytics capabilities.

How can a digital performance team enhance your digital bank

As a leading authority in performance marketing, we at Codedesign excel in optimizing campaigns to maximize results. If we're looking at a digital bank, the campaign's optimization would be a unique blend of data-driven insights, understanding customer behavior, and leveraging the right digital channels.

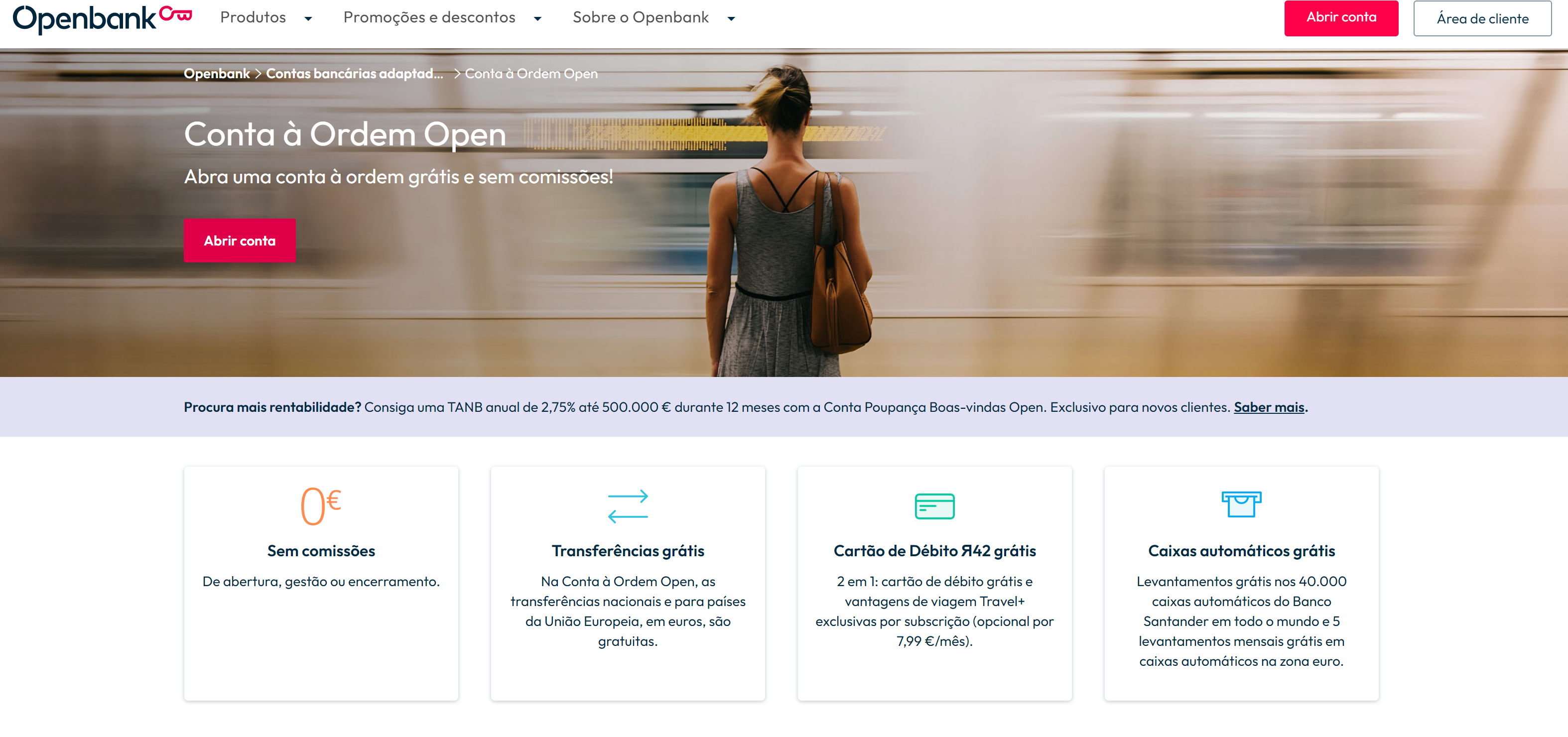

Let's take a case study: "Openbank."

Firstly, we would conduct a comprehensive audit of Openbank's current digital marketing efforts to identify what has worked and what hasn’t. We'd dive deep into the data, akin to archaeologists unearthing relics, seeking valuable insights about customer behaviors, conversion points, and areas of friction.

Secondly, we'd profile the ideal customers of Openbank. Openbank's target audience is millennials and Gen Z, who are tech-savvy and value quick, hassle-free banking services. We would craft buyer personas such as 'Investor Irene', a young professional interested in growing her wealth, or 'Traveler Tom', who frequently travels and prefers a bank that can offer global, effortless access to his funds.

Now, let's talk about optimizing different elements.

- For SEO, we would identify high-value keywords related to digital banking, such as 'online banking,' 'digital bank account,' or 'best bank for millennials.' We would then optimize Openbank's website and blog content around these keywords. For example, we might create a blog post, "Why Openbank is the Best Digital Bank for Millennials."

- Email marketing is crucial, and we'd ensure Openbank's emails don't end up unopened or in the spam folder. For 'Investor Irene,' we might send personalized emails about the benefits of Openbank's high-interest savings account or investment options. To 'Traveler Tom', we'd highlight features like zero foreign transaction fees or global ATM access.

- For paid campaigns, we'd target platforms popular among our audience. We could run an Instagram campaign with visually appealing ads showing how easy it is to bank with Openbank. We might use catchy phrases like "Bank on the Go with Openbank" or "Experience Hassle-Free Banking with Openbank." These campaigns would be optimized for mobile devices, considering our tech-savvy audience.

We would also leverage retargeting campaigns. Suppose a potential customer, say 'Casual Carl', visited Openbank's website but didn't sign up. We'd gently remind Carl about Openbank through retargeted social media or Google ads, showcasing the benefits he might be missing out on.

Lastly, we would measure and tweak our strategies based on campaign performance. For instance, if 'Investor Irene' personas have a higher conversion rate, we might allocate more budget towards targeting similar audiences.

Through these steps, we at Codedesign would optimize and orchestrate an integrated performance marketing campaign that resonates with Openbank's audience, amplifying its digital presence and propelling it toward achieving its business goals. It's all about playing the right note at the right time, and we are the maestros of this performance marketing symphony.

To get a better understanding, let's draw up some situations (keeping confidentiality protected):

-

United States Market: Online banking is highly competitive in the U.S., and many established brands invest heavily in digital campaigns. Due to this, the CPA can range quite widely, potentially anywhere from $50 to over $200, depending on the specific product or service.

-

European Market: In European countries like Germany, France, or the UK, online banking is also highly competitive, but the CPA might typically fall in a slightly lower range, let's say between $40 and $150, again depending on various factors.

-

Emerging Markets: In countries like India, where digital banking is still blossoming, the CPA might be lower due to less competition and lower digital advertising costs. You might find CPAs falling within the $20-$50 range here.

It's important to note that these are broad, hypothetical ranges, and actual CPAs can vary widely based on the factors mentioned earlier. As performance marketers, our goal at Codedesign is to optimize your campaigns, leverage the right channels, and target the right audience to drive down CPA while ensuring quality customer acquisition. Whether it's a bustling market like the U.S. or an emerging one like India, we adapt our strategies to ensure the most bang for your buck! Here is a complete guide on how you could use the digital marketing funnels to expand your customer base and how sell directly on Amazon with a detailed plan on Amazon listing optimization.

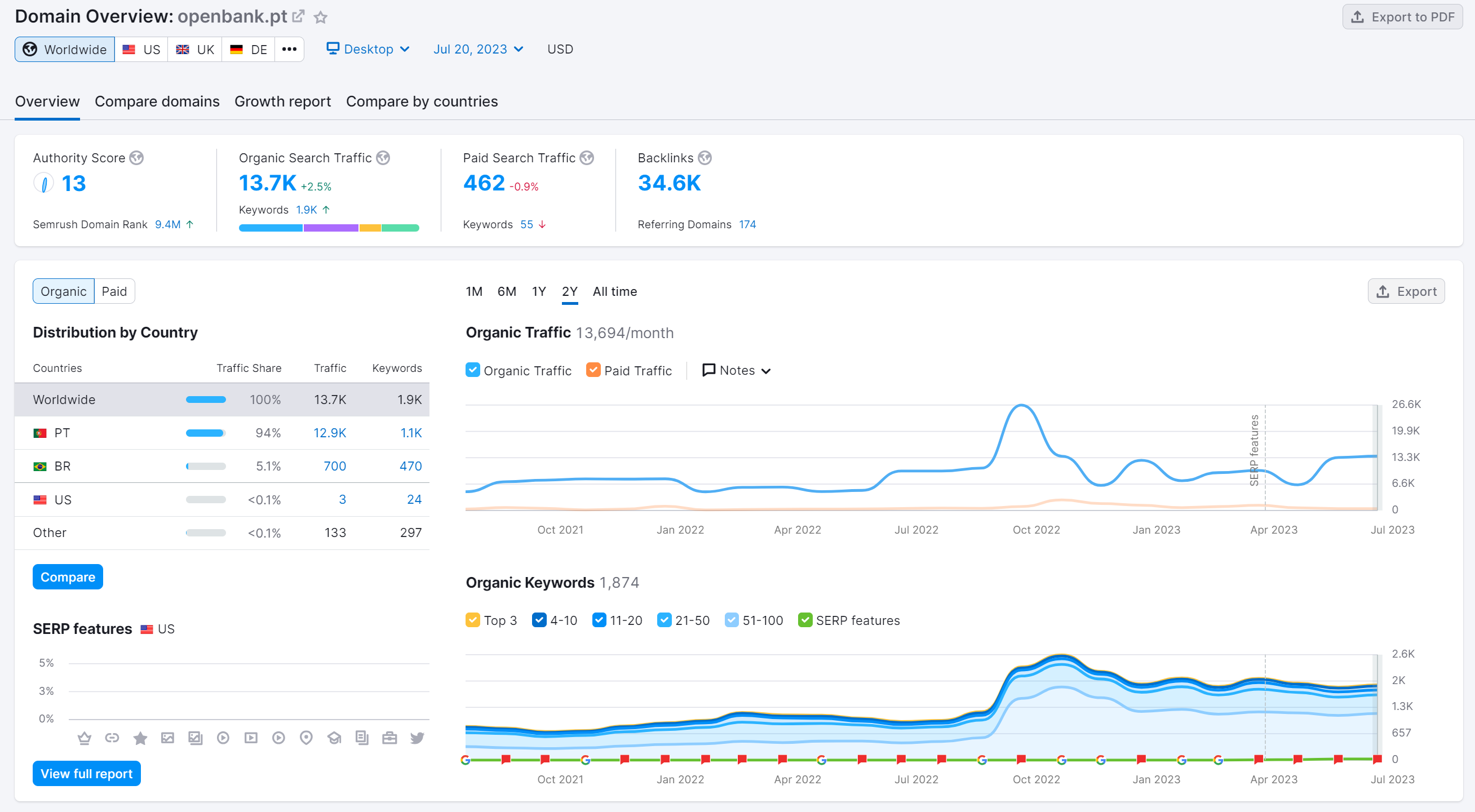

SEO or Search Engine Optimization is a crucial cog in the digital marketing machine. At Codedesign, we understand its importance and how to leverage it to increase the visibility of businesses like OpenBank. Let's explore some strategies we could implement.

- Keyword Optimization: Conducting thorough keyword research to identify high-value keywords relevant to OpenBank's services is the first step. We would then optimize the website's content, metadata, and URLs to reflect these keywords. For example, if 'digital bank accounts,' 'online savings account,' or 'instant money transfer' are valuable keywords, we would incorporate them strategically across the site.

- Mobile Optimization: Given that many of OpenBank's customers likely use mobile devices for banking, the website must be mobile-friendly. This improves the user experience and positively impacts SEO as search engines prefer mobile-optimized sites.

- Secure Website (HTTPS): A secure website is a non-negotiable in online banking. Not only does it safeguard customer data, but it also contributes positively to SEO. Search engines, like Google, favor secure sites, and transitioning from HTTP to HTTPS can provide a small ranking boost.

- Local SEO: OpenBank can optimize for local SEO by ensuring its presence on Google My Business and maintaining consistent NAP (Name, Address, Phone Number) information across all online platforms. This will help OpenBank appear in local search results and Google Maps, enhancing its visibility among potential customers in the regions it serves.

- Quality Content: We would help OpenBank develop quality, SEO-friendly content that addresses customer pain points, answers their questions, and offers them valuable insights. This might include blog posts, guides, or articles on topics like 'How to choose a digital bank,' 'The benefits of online banking,' etc. Quality content improves SEO and positions OpenBank as a thought leader in digital banking.

- Page Loading Speed: Slow loading pages can be a bane for SEO. We'd work on optimizing OpenBank's website's speed by compressing images, minimizing CSS, JavaScript, and HTML, reducing redirects, and leveraging browser caching.

- Building High-quality Backlinks: We would work on a strategy to earn high-quality backlinks from authoritative websites in the banking and finance niche. This could involve guest blogging, influencer outreach, or creating shareable infographics.

Through these measures, we at Codedesign would aim to enhance OpenBank's visibility on search engines, thereby driving organic traffic and conversions. Remember, SEO is a long-term game, and it's about steady, sustained growth rather than quick wins. With our SEO strategies, we ensure OpenBank is ready to play this game to win.

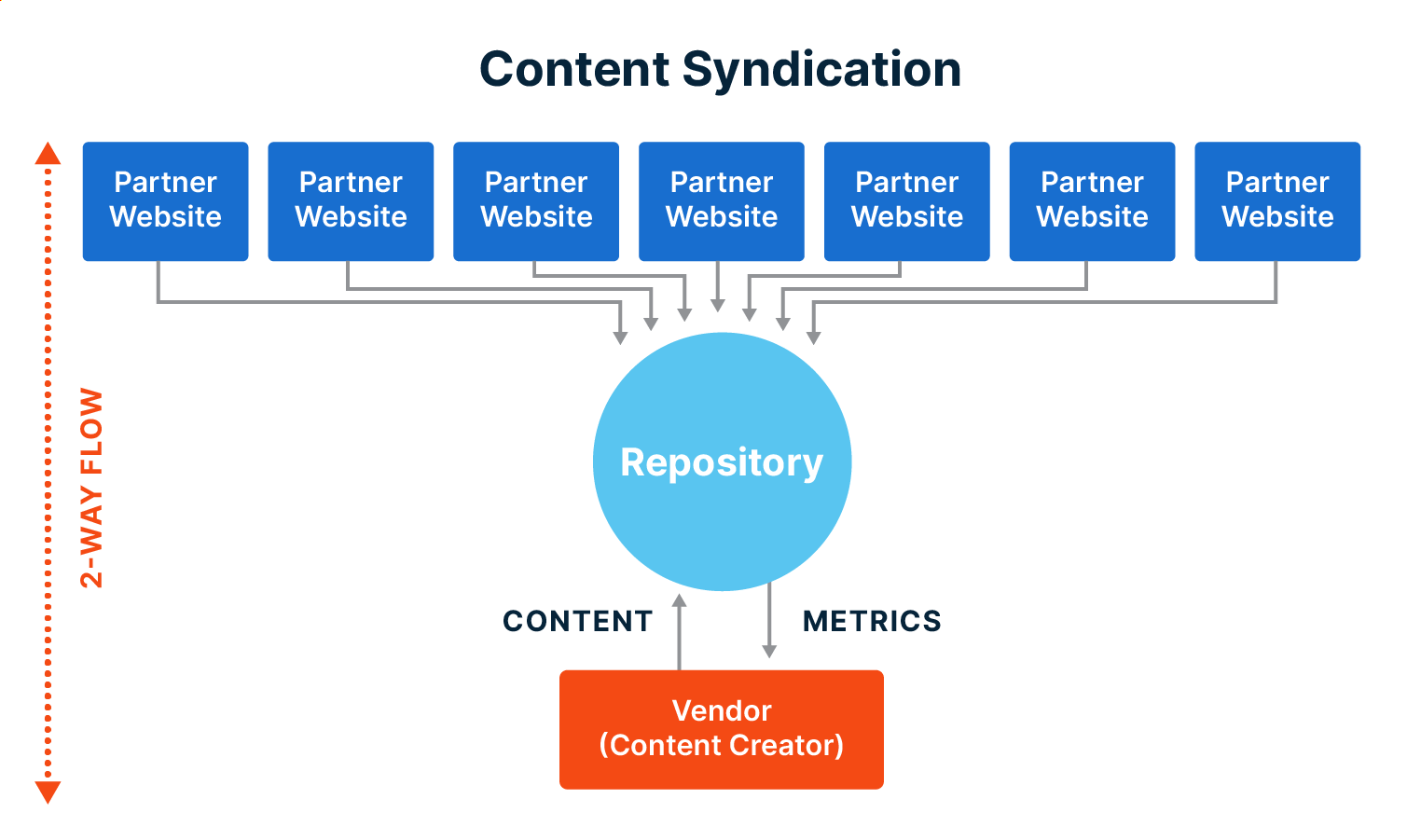

How to leverage content syndication to push a finance brand to another level

Content syndication, used strategically, is a powerful tool for driving new client acquisition and building brand awareness. At Codedesign, we understand how to harness this tool effectively for financial institutions.

Let's use our client E-loan, a financial institution as an example. Here are ways we'd implement content syndication:

1. Identifying the Right Partners: We started by identifying high-traffic, reputable websites that align with E-loan's target audience. Our research indicates that 'Investor A,' a young professional looking to grow her wealth, often visits a personal finance blog called 'WealthWisdom.' This would make WealthWisdom an excellent candidate for content syndication.

2. Syndicating Valuable Content: Once partners were identified, we focused on syndicating valuable, engaging content that resonates with our personas. For 'Investor A,' we syndicated a piece titled "5 Easy Ways to Kickstart Your Investment Journey and consolidate your credits" on WealthWisdom. For 'Investor B,' who values financial security, we could syndicate an article about "Navigating Pension Funds for a Secure Retirement without risk" on a site like 'GoldenYears Guide.'

3. Leveraging Co-Marketing Opportunities: Co-marketing opportunities involved creating original content in collaboration with the syndication partner. For example, we arranged a webinar featuring an E-loan expert on 'WealthWisdom.' This webinar tackled a topic relevant to 'Investor A,' like 'Understanding and Investing in Mutual Funds.'

4. Using Call-to-Actions (CTAs): Each syndicated piece included a compelling CTA leading readers back to E-loan.

5. Measuring Success: We continually monitored key metrics such as referral traffic, lead generation, and brand mentions to measure the effectiveness of our content syndication efforts. If we notice that content syndicated on 'WealthWisdom' generated high-quality leads, we explored additional co-marketing opportunities with them.

In essence, our strategy would make content syndication for E-loan digital marketing, hitting the right notes to entice new clients and elevate brand awareness.

How do we help with privacy laws for our Financial clients?

As a digital agency, Codedesign places a premium on adhering to privacy laws, such as the General Data Protection Regulation (GDPR) in Europe and relevant privacy laws in the U.S., like the California Consumer Privacy Act (CCPA). Here's how we'd help our financial clients navigate these complex waters:

1. Data Audit: We conduct a comprehensive client data audit. This involves understanding what kind of personal data they're collecting, how it's being collected, the purposes for which it's used, and how it's being stored and secured.

2. Privacy Policy and Cookie Policy: Based on the data audit, we assist our clients in creating or updating a clear, comprehensive privacy policy and cookie policy. These documents explain to users what data is being collected, how and why it's being used, and their rights concerning their data.

3. User Consent: We ensure that our clients' websites are set up to obtain explicit, informed consent from users before collecting personal data. This involves implementing a clear, unambiguous cookie consent banner or a checkbox for consent to data collection on sign-up forms.

4. Data Protection Measures: We advise our clients on appropriate data protection measures. This includes encryption, secure data storage, regular security audits, and having a system in place for quickly and effectively dealing with potential data breaches.

5. Data Access and Deletion Requests: We set up systems to enable our clients to swiftly respond to users' requests for access to their data or deletion of their data in compliance with GDPR and CCPA rights.

6. Marketing Practices: Our marketing efforts prioritize privacy and consent. All email marketing, retargeting, or personalized advertising efforts would strictly adhere to GDPR, CCPA, and other relevant laws.

7. Staff Training: We assist in training our clients' staff about these laws' essentials, ensuring everyone understands their obligations and the importance of data privacy.

8. Regular Reviews and Updates: As privacy laws can be updated and new laws can effect, we conduct regular reviews of our client's privacy practices to ensure ongoing compliance.

We at Codedesign believe privacy is not a roadblock but a roadmap to gaining and maintaining user trust. We help our financial clients follow this roadmap, ensuring they comply with privacy laws and build stronger relationships with their customers through respect for their privacy.

How can Codedesign help?

At Codedesign, we are well-versed in tailoring and optimizing lead acquisition strategies for financial institutions. Our approach is data-driven, comprehensive, and integrated, addressing different facets of digital marketing.

Let's use a hypothetical financial institution, "WealthWave," as an example. Here's how we could assist WealthWave in optimizing their lead acquisition strategy:

- Understanding the Audience: We'd start by deeply understanding WealthWave's target audience, carving out distinct buyer personas. The personas could range from 'Young Yolanda,' a millennial seeking her first credit card, to 'Investor Ivan,' who's hunting for promising investment options.

- SEO Optimization: Leveraging high-value keywords relevant to WealthWave's services, we'd optimize their website and content to boost organic traffic and attract high-quality leads.

- Paid Advertising: We'd run targeted ad campaigns on platforms where WealthWave's potential customers are most active. For 'Young Yolanda,' this might be Instagram; for 'Investor Ivan,' it might be LinkedIn. The ads would be carefully crafted to resonate with each persona and compel them to engage.

- Content Marketing: We'd create engaging, value-packed content that positions WealthWave as a thought leader and draws potential leads. This could include blog posts, e-books, infographics, or webinars addressing key financial topics relevant to each persona.

- Social Media Marketing: We'd leverage social media platforms to amplify WealthWave's reach, engage with potential customers, and drive them to WealthWave's offerings.

- Email Marketing: We'd implement a nurturing strategy using personalized email campaigns for leads that have shown interest but haven't yet converted. These emails would offer helpful financial tips, highlight the benefits of WealthWave's services, and include persuasive CTAs.

- Conversion Rate Optimization (CRO): We'd closely monitor WealthWave's website to identify and rectify any pain points that may be hindering conversions. This could involve improving website speed, simplifying the navigation, or making forms easier to fill.

- Measuring and Refining: We'd continuously monitor and analyze campaign performance to identify what's working and what's not. Using these insights, we'd fine-tune the strategy, always seeking to lower the Cost Per Acquisition (CPA) and improve the lead quality.

Our approach at Codedesign is akin to a master chef preparing a gourmet meal. Each ingredient, or tactic, is chosen and prepared with care, the flavors are balanced to create an enjoyable experience, and the final dish is continuously tasted and tweaked to perfection. This comprehensive, thoughtful, and adaptable approach ensures that WealthWave's lead acquisition strategy not only delivers quantity but also quality, driving business growth and customer satisfaction.

FAQS - Frequently Asked Questions

How do digital banking solutions enhance customer experiences?

Digital banking solutions significantly enhance customer experiences by providing convenience, accessibility, and customized services. With the advent of mobile banking apps and online platforms, customers can perform a wide range of transactions and services from anywhere at any time, eliminating the need for physical bank visits. Features such as instant account opening, real-time payments, and customer support through chatbots or live chats improve the overall banking experience. Additionally, digital banking platforms often offer personalized financial advice and product recommendations using AI and machine learning, further enhancing user satisfaction by catering to individual needs.

What role does cash flow management play in leveraging digital banking for business growth?

Cash flow management is pivotal in leveraging digital banking for business growth. Effective cash flow management enables businesses to track and manage their income and expenditures in real time, ensuring operational stability and the ability to make informed investment decisions. Digital banking platforms offer tools and features like automated invoicing, instant payments, and financial forecasting, which help businesses optimize their cash flow. By utilizing these digital tools, businesses can improve their liquidity, reduce financial risks, and seize growth opportunities more effectively.

How can digital banking solutions facilitate global expansion and trade?

Digital banking solutions facilitate global expansion and trade by simplifying cross-border transactions and providing access to international markets. These platforms offer services such as multi-currency accounts, real-time currency exchange, and international payment gateways, making it easier for businesses to manage overseas transactions efficiently and cost-effectively. Moreover, digital banking can provide insights into foreign markets, compliance with local regulations, and support for trade financing. By leveraging these capabilities, businesses can navigate the complexities of international trade more smoothly and expand their global footprint.

What are the key security measures in digital banking solutions to mitigate risks?

Key security measures in digital banking solutions to mitigate risks include multi-factor authentication (MFA), encryption, secure socket layer (SSL) protocols, and regular security audits. MFA adds an extra layer of security by requiring users to provide two or more verification factors to gain access to their banking accounts. Encryption protects data in transit and at rest, ensuring sensitive information is unreadable to unauthorized users. SSL protocols secure the connection between a user's browser and the bank's server. Regular security audits help identify and address vulnerabilities promptly. Together, these measures provide a robust security framework that protects customers and banks from cyber threats and data breaches.

How can businesses utilize data analytics in digital banking to drive growth?

Businesses can utilize data analytics in digital banking to drive growth by leveraging insights derived from their financial transactions and customer interactions. Analytics can help businesses understand spending patterns, identify profitable customer segments, and forecast future trends. This information can inform strategic decisions, such as product development, marketing strategies, and customer experience improvements. Additionally, predictive analytics can aid in risk management by detecting fraudulent activities and assessing credit risks. By harnessing the power of data analytics, businesses can optimize their operations, enhance customer satisfaction, and achieve sustained growth.

What are the advantages of digital banking solutions over traditional banking?

The advantages of digital banking solutions over traditional banking include greater convenience, higher efficiency, and enhanced personalization. Digital banking enables customers to access services 24/7 from any location, removing the need to visit physical branches. Transactions can be completed faster, and automated features save time for both customers and businesses. Furthermore, digital platforms can offer tailored financial advice and product recommendations based on users' banking habits and preferences. These benefits not only improve the customer experience but also allow banks to operate more effectively by reducing overhead costs and focusing on customer-centric innovations.

How do digital banking solutions support efficient international fund transfers and currency exchanges?

Digital banking solutions support efficient international fund transfers and currency exchanges by offering streamlined processes, competitive exchange rates, and lower transaction fees. Through digital platforms, businesses and individuals can easily initiate cross-border payments with real-time tracking and faster settlement times compared to traditional banking methods. Additionally, digital banking services often provide access to a broader range of currencies and the ability to hold and manage multi-currency accounts, facilitating seamless currency conversion and reducing the cost of international transactions. This efficiency and cost-effectiveness are crucial for businesses engaged in global trade and individuals with international financial needs.

In what ways do digital banking platforms offer personalized banking experiences?

Digital banking platforms offer personalized banking experiences by utilizing data analytics and artificial intelligence to understand customers' financial behaviors, needs, and preferences. These insights allow banks to tailor their services and product offerings to individual customers, such as suggesting relevant savings plans, investment opportunities, or loan products. Personalized alerts and notifications for account activity, financial tips based on spending patterns, and customized budgeting tools are other examples of how digital banking can cater to the unique needs of each customer, enhancing satisfaction and loyalty.

How do digital banking services improve operational efficiency for businesses?

Digital banking services improve operational efficiency for businesses by automating routine financial tasks, offering real-time financial insights, and streamlining payment processes. Automation of invoicing, payroll, and bill payments reduces manual errors and administrative overhead. Real-time access to financial data helps businesses make informed decisions quickly, manage cash flow effectively, and identify financial trends or issues promptly. Furthermore, the integration of digital banking services with business accounting or ERP systems can further enhance operational efficiency, allowing for a cohesive financial management ecosystem.

What steps should businesses take to integrate digital banking solutions effectively?

To integrate digital banking solutions effectively, businesses should first assess their financial needs and identify the digital banking services that best meet those needs. This might include evaluating features like online invoicing, payroll management, or foreign exchange capabilities. Next, businesses should research and select a reputable digital banking provider that offers the necessary security measures, user-friendly interfaces, and integration capabilities with existing business systems. Implementing a phased approach to integration can help ensure a smooth transition, allowing for testing and adjustment of processes. Finally, training for staff on how to use the new digital banking tools is crucial to maximize the benefits of the integration and ensure operational efficiency.

About Bruno GavinoBruno Gavino is the CEO and partner of Codedesign, a digital marketing agency with a strong international presence. Based in Lisbon, Portugal, with offices in Boston, Singapore, and Manchester (UK) Codedesign has been recognized as one of the top interactive agencies and eCommerce agencies. Awarded Top B2B Company in Europe and Top B2C company in retail, Codedesign aims to foster personal relationships with clients and create a positive work environment for its team. He emphasizes the need for digital agencies to focus on data optimization and performance to meet the increasingly results-driven demands of clients. His experience in digital marketing, combined with a unique background that includes engineering and data, contributes to his effective and multifaceted leadership style. |

About CodedesignCodedesign is a digital marketing agency with a strong multicultural and international presence, offering expert services in digital marketing. Our digital agency in Lisbon, Boston, and Manchester enables us to provide market-ready strategies that suit a wide range of clients across the globe (both B2B and B2C). We specialize in creating impactful online experiences, focusing on making your digital presence strong and efficient. Our approach is straightforward and effective, ensuring that every client receives a personalized service that truly meets their needs. Our digital agency is committed to using the latest data and technology to help your business stand out. Whether you're looking to increase your online visibility, connect better with your audience, get more leads, or grow your online sales. For more information, read our Digital Strategy Blog or to start your journey with us, please feel free to contact us. |

CodeDesign is leading:

- Digital Agency

- Digital Marketing Agency

- Digital Ecommerce Agency

- Amazon Marketing Agency

Add comment ×