9 min to read

Financial Modeling for Startups: A Step-by-Step Guide

The process of predicting and forecasting revenue, customers, staff, costs, etc. into the future in order to comprehend and evaluate the profitability and feasibility of the firm is known as financial modelling for startups. Financial modeling is the process of creating accurate forecasts for a business.

This post will give you a step-by-step guide to financial modeling for startups. We'll also discuss why it's important and offer tips to help you create accurate forecasts.

You could work with us, CodeDesign, the leading digital marketing agency to grow your business.

Read this complete guide on B2B SaaS SEO and Amazon Listing Optimization.

What Is a Financial Model?

What is Financial Modeling?

A financial model is a tool that allows you to understand the financial implications of your business decisions. Read in depth what is a financial model.

In other words, it helps you have an answer to the question, "If we do this, what will be the result?”. The financial models can be used for a variety of purposes, such as:

- Planning and forecasting future revenue and expenses

- Determining whether a business is viable

- Assessing the impact of different business decisions

- Evaluating potential investments or acquisitions

There are many different financial models, but they all share some standard features. In general, an economic model consists of three components:

1. The assumptions or hypotheses section that outlines the fundamental assumptions underlying the model.

2. The calculations section performs the mathematical calculations based on the assumptions.

3. The results section shows the output of the calculations and how it impacts the company's finances.

Why Do Startups Need Financial Models?

Startups and financial modeling

A financial model is a tool that allows you to predict the financial performance of your startup

Think of it as a projection tool. With a well-designed financial model, you can test different scenarios and see how they would impact your bottom line.

For example, if you're considering a new marketing campaign, you can use your financial model to predict how that campaign will impact your revenue and profits. You can also use your economic model to evaluate different investment options or forecast your company's growth trajectory.

In short, a financial model is an essential tool for all startups. It helps you make informed decisions about the future of your business.

How should you Build a Financial Model for a Startup?

Financial model

Building a financial model for your startup is a critical step in the early stages of your business. It will help you understand your company's financial situation and make smarter business decisions.

There are a few key steps you need to take to build a financial model for your startup:

1. Assess your current situation.

2. Forecast future sales and expenses.

3. Calculate your startup costs.

4. Assess your fundraising goals and how much money you'll need to reach them.

5. Create a timeline for your financial projections.

6. Make assumptions and use realistic numbers.

7. Present your findings clearly and concisely.

The essential part of creating a financial model is ensuring that all your numbers are accurate and realistic. Use historical data whenever possible, and update your model as your business changes.

There are many different approaches to financial modeling for startups. The most important thing is to find the best system for your company and your particular situation.

One approach is to build a model that projects your company's financials for the next five years. This can be a valuable exercise to get an idea of where your company is headed and ensure that your financials are on track.

Another approach is to build a model that only projects your financials for the following year. It could also be helpful if you're trying to raise capital, as investors will want to see a detailed plan for how you intend to use their money.

Whatever approach you choose, the important thing is to be thoughtful and strategic about your financial modeling. By taking the time to build a robust model, you can give your startup the best chance for a successful time ahead.

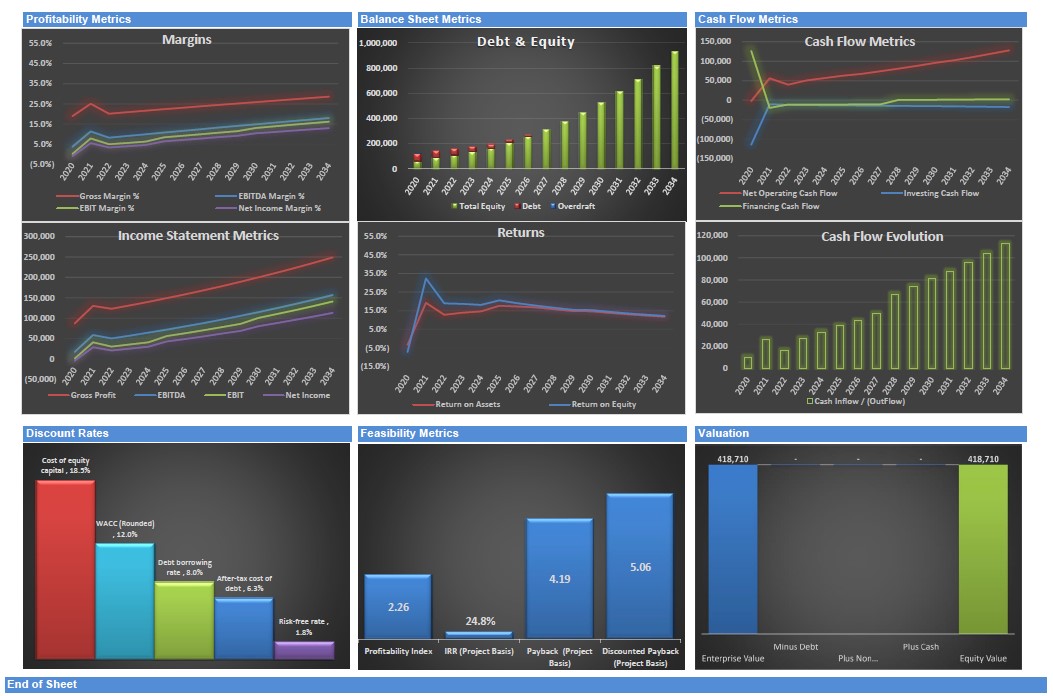

Critical Components of a Startup Financial Model

Components of a Startup Financial Model

A financial model is an illustration of a business's financials. It includes all the revenue and expense streams and the various assumptions that went into the forecast.

When building a financial model for your startup, there are three key components you'll want to include:

1. The Income Statement: This shows how much your company is making (or losing) monthly or yearly.

2. The Balance Sheet: This shows your company's assets, liabilities, and equity at a specific time.

3. The Cash Flow Statement: This shows how your company manages its cash flow on a monthly or yearly basis.

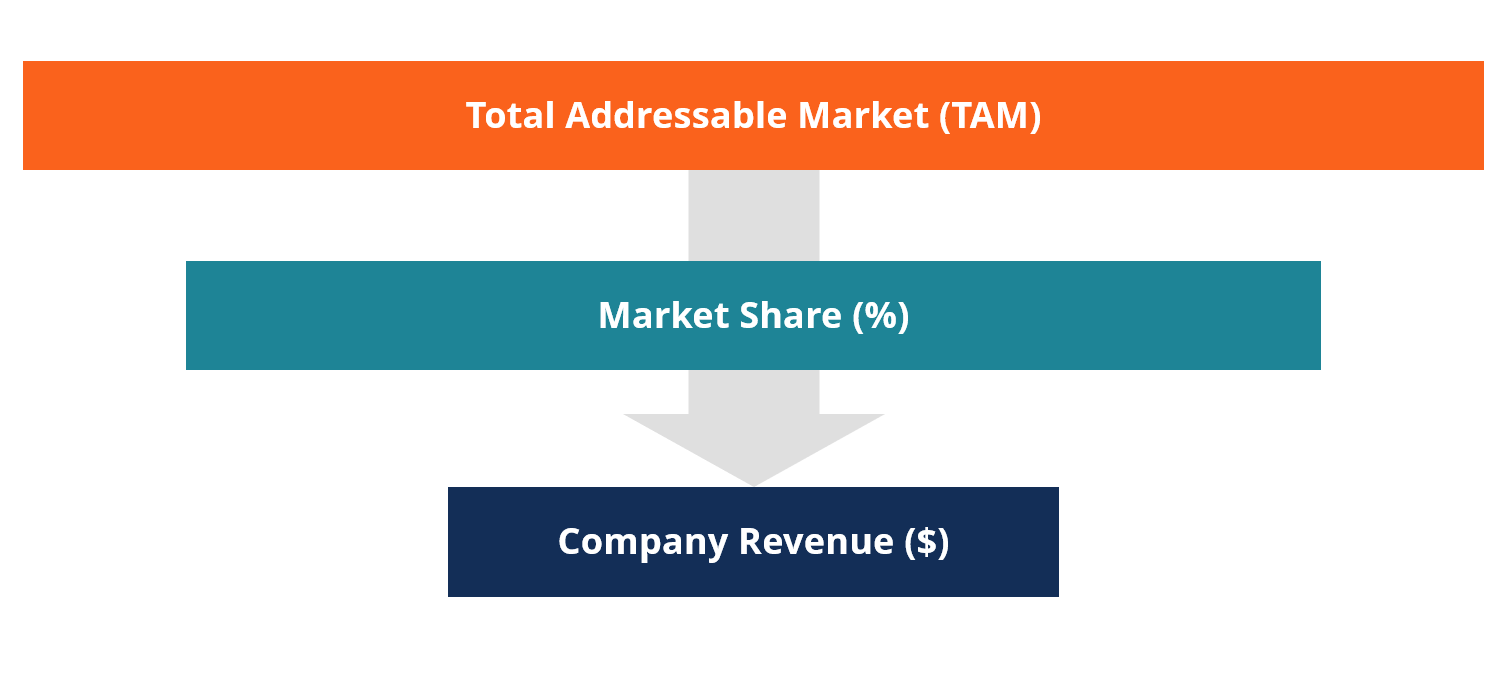

Financial modeling for startups - Top-down forecasting

Top-down forecasting

As a startup, one of the most important things you can do is create a financial model. This will help you forecast your company's financial performance and better decide where to allocate your resources. Startups need to generate revenues to be sustainable, and one way of achieving this is through economic modeling. Top-down forecasting is a type of financial modeling that can estimate future revenue by starting with a large, overall number and then breaking it down into smaller pieces.

This approach can be helpful for startups because it can help them generate realistic revenue projections. However, it is essential to remember that top-down forecasting is only one type of financial modeling and that other approaches may also be helpful.

There are many ways to approach financial modeling, but top-down forecasting is the most popular one. This method starts with high-level assumptions and then uses them to estimate lower-level details.

Top-down forecasting is a great way to start with financial modeling and can be used to generate projections for your startup quickly. However, it's essential to remember that these projections are only guesses, and they may not always be accurate. Nonetheless, a top-down forecast can give you a good starting point for understanding your startup's financial performance.

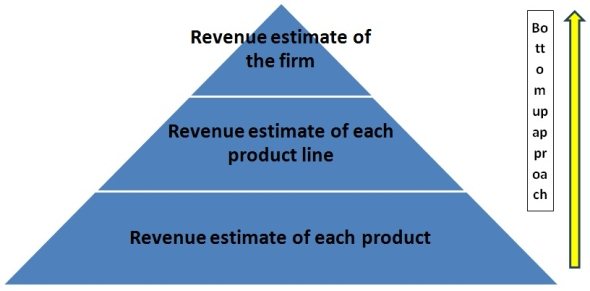

Bottom-up forecasting financial modeling for startups

Bottom up forecasting

Forecasting is essential to any business, but it can be especially tricky for startups. This is because startups typically have limited data, making it challenging to create accurate forecasts.

One way to overcome this challenge is to use bottom-up forecasting. This type of financial modeling uses bottom-up techniques to generate forecasts. This means that instead of using historical data, bottom-up forecasting uses information about the individual components that make up the whole.

For example, if you were forecasting the sales of a new product, you would start by estimating the number of units sold in each market. Then, you would add up all of the market totals to get your final forecast.

Bottom-up forecasting is a great way to create accurate forecasts for startups because it doesn't rely on historical data. Bottom-up forecasting is a process in which a company starts with the individual components that make up its business and then aggregates these components to predict future sales. Startups often use this method because it allows them to make forecasts based on their specific business data.

There are a few steps to bottom-up forecasting:

1. Collect data on the individual components that make up your business. This data can include information on your customers, products, and markets.

2. Aggregate this data to create a forecast for your business.

3. Test and refine your forecast as needed.

Define Your Business Goals and Choose the Right Financial Model

Business goals

Defining your business goals is essential in choosing a suitable financial model. There are a few different economic models, but each one is tailored to a specific purpose.

For example, the cash flow statement tracks a company's income and expenses over a specific period. This is ideal for businesses looking to measure their current financial status and make projections for the future.

Conversely, the balance sheet is used to track a company's assets, liabilities, and equity at a specific time. This is ideal for businesses looking to get a snapshot of their current financial standing.

Choose a suitable financial model based on your specific needs and goals. If you're unsure which one is right for you, consult a financial expert for guidance.

Understand Your Assumptions And Ensure That Your Model Is User-Friendly.

business assumption

When building your financial model, you'll need to make several assumptions. This includes beliefs about your future sales, expenses, and profit margins.

It's essential to make your model as user-friendly as possible, especially if you'll be sharing it with others. Break down your assumptions into clear and concise categories, and be sure to label everything, so it's easy to follow.

Suppose you're unsure how to make a specific assumption, research and find relevant information that will help you make an informed decision. The more accurate your beliefs, the more reliable your financial model will be.

Test Your Model. Use Your Model to Make Decisions

A model is only as good as the assumptions it's based on. As your startup grows and changes, you'll need to revisit your model and update your premises.

Testing your model is an essential step in validating your business assumptions. Use your model to make pricing, product development, customer acquisition, and more decisions.

If you're not happy with the results you're seeing, it's time to revisit your model and make some changes. The key is learning and evolving your business as you go constantly.

Financial Modeling for Startups

Best Practices for Financial Modeling for Startups

Financial modeling is an essential tool for all startups. It can help you make critical decisions about your business, such as how much money you need to raise, how long you can sustain operations, and when you will become profitable.

There are a few best practices that all startups should follow when financial modeling:

1. Keep your model simple and easy to understand.

2. Make sure your assumptions are realistic.

3. Update your model regularly to reflect changing conditions.

4. Use your model as a decision-making tool, not just a forecasting tool.

5. Test your model under different scenarios to see how it performs.

6. Seek input from experts before finalizing your model.

7. Be prepared to revise your model as your business changes.

8. Follow these best practices, and you'll be on your way to creating a successful financial model for your startup!

How to Use Your Financial Model to Raise Funding?

Even if you're not looking to raise money right now, having a financial model in place is essential. This will help give you a clear understanding of your business financials and where you could use improvement.

If you are looking to raise money, your financial model will be one of your most essential tools. It will help investors understand your business and how they can make money from it.

Your financial model should be updated regularly as your business changes and grows. Use it to track your progress and ensure you're on the right track.

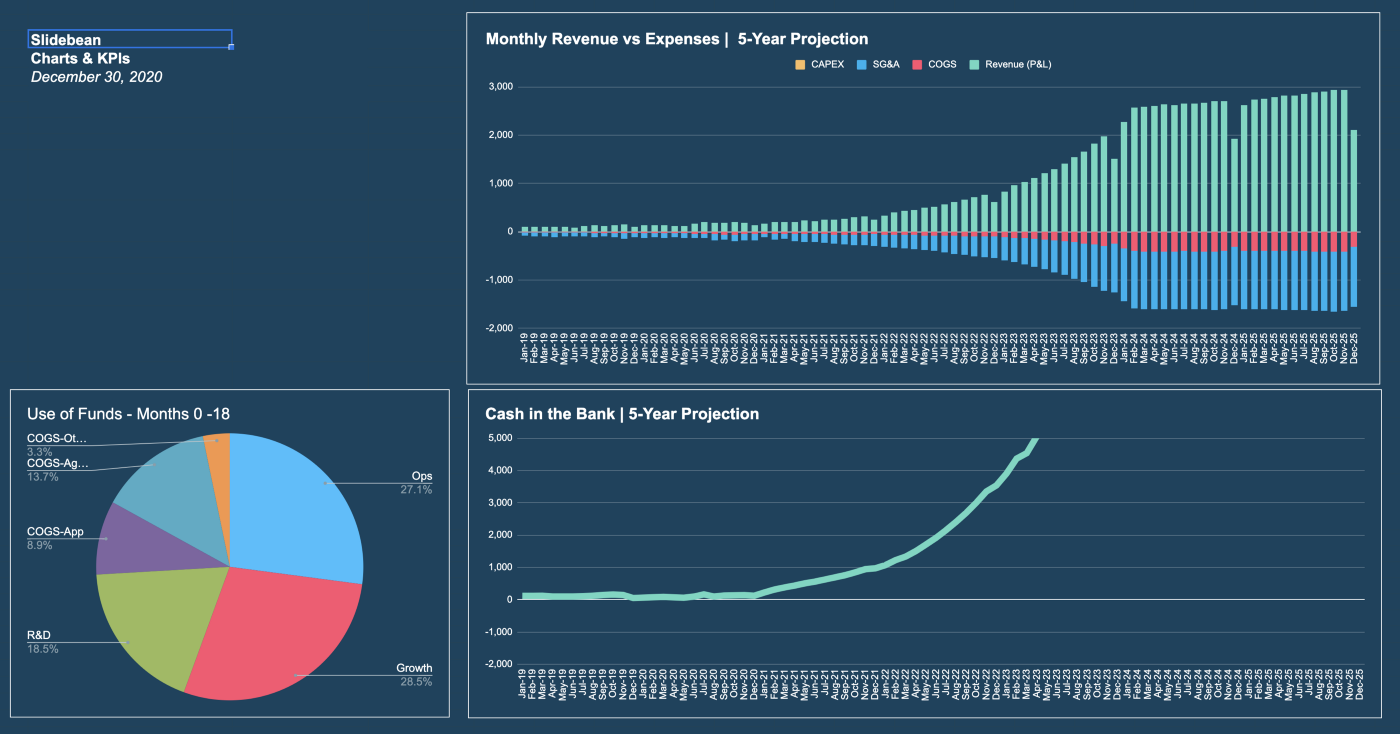

KPI overview in financial modeling for startups

Financial modeling for startups can be a complex and daunting task. However, one of the most critical aspects of this process is understanding and correctly utilizing KPIs (Key Performance Indicators).

KPIs are an essential tool that allows startups to track their progress and ensure they are on track to meet their goals. Without KPIs, it would be tough to measure a startup's success or identify areas of improvement.

There is a variety of different KPIs that can be used in financial modeling for startups. Some of the most common KPIs include:

- Revenue

- Costs

- Cashflow

- Profitability

- Burn rate

- Customer acquisition costs

- Gross margin

- Lifetime value of a customer

- Churn rate

Each of these KPIs can give you valuable insights into the health of your startup and help you make better decisions about where to allocate your resources.

There are a lot of different KPIs (key performance indicators) that startups can track in their financial models. The most important KPIs will vary depending on the business type and the startup stage. However, a few KPIs are universally important for startups to track.

Conclusion

Financial modeling is a critical skill for startups. By creating a financial model, you can estimate how much money your startup will need to survive, track your progress in reaching milestones and make informed decisions about your business.

In this guide, we've walked you through the steps of financial modeling for startups. We've explained each step and shown you how to apply it to your business.

If you're starting, we recommend beginning with the essentials: creating a projected income statement and balance sheet. Once you understand financial modeling, you can move on to more complex topics like forecasting cash flow and evaluating your startup.

We hope this guide has been helpful. Good luck with your financial modeling for startups!

About Bruno GavinoBruno Gavino is the CEO and partner of Codedesign, a digital marketing agency with a strong international presence. Based in Lisbon, Portugal, with offices in Boston, Singapore, and Manchester (UK) Codedesign has been recognized as one of the top interactive agencies and eCommerce agencies. Awarded Top B2B Company in Europe and Top B2C company in retail, Codedesign aims to foster personal relationships with clients and create a positive work environment for its team. He emphasizes the need for digital agencies to focus on data optimization and performance to meet the increasingly results-driven demands of clients. His experience in digital marketing, combined with a unique background that includes engineering and data, contributes to his effective and multifaceted leadership style. |

About CodedesignCodedesign is a digital marketing agency with a strong multicultural and international presence, offering expert services in digital marketing. Our digital agency in Lisbon, Boston, and Manchester enables us to provide market-ready strategies that suit a wide range of clients across the globe (both B2B and B2C). We specialize in creating impactful online experiences, focusing on making your digital presence strong and efficient. Our approach is straightforward and effective, ensuring that every client receives a personalized service that truly meets their needs. Our digital agency is committed to using the latest data and technology to help your business stand out. Whether you're looking to increase your online visibility, connect better with your audience, get more leads, or grow your online sales. For more information, read our Digital Strategy Blog or to start your journey with us, please feel free to contact us. |

CodeDesign is leading:

- Digital Agency

- Digital Marketing Agency

- Digital Ecommerce Agency

- Amazon Marketing Agency

Feel free to contact us to see the unprecedented growth of your business.

Feel free to contact us to see the unprecedented growth of your business.

Add comment ×