16 min to read

Payment processing is a critical aspect of any business, and it plays a significant role in determining customer satisfaction and overall sales performance. Customers expect a seamless and efficient payment experience in today's fast-paced digital world. By implementing effective payment processing strategies, businesses can enhance customer experience and boost their sales. This blog post will explore six valuable tips that can help businesses optimize their payment processing and increase sales.

Importance of Streamlined Payment Processing

Before diving into the tips, let's understand why streamlined payment processing is crucial for businesses. A smooth and efficient payment process is essential to provide a positive customer experience. Customers may become frustrated and abandon their purchase when they encounter difficulties or face delays during the payment process. On the other hand, a seamless and hassle-free payment experience can leave a lasting impression on customers, leading to increased satisfaction and repeat business.

Offer Multiple Payment Options

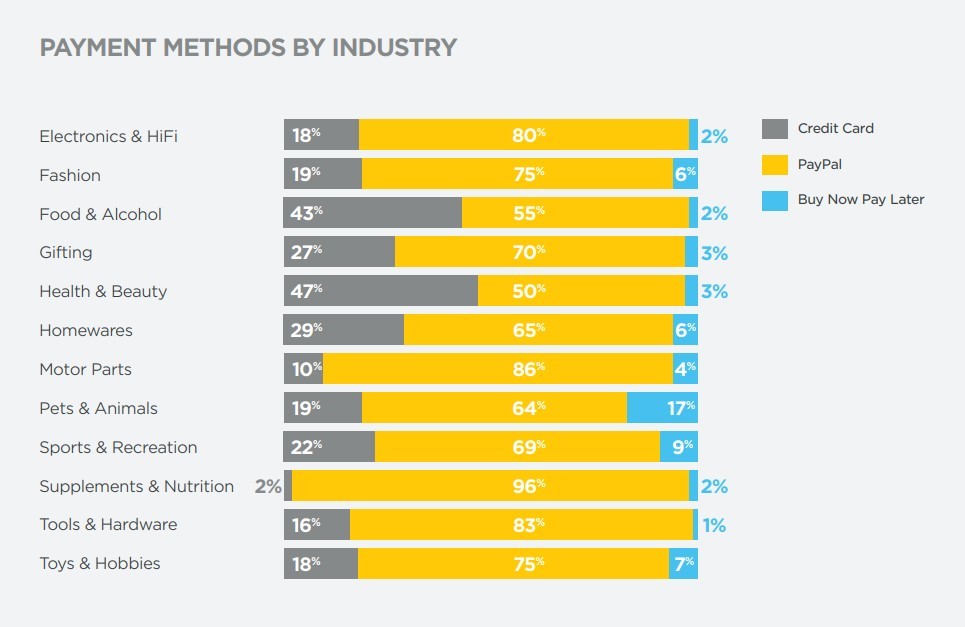

One of the most effective ways to boost sales through payment processing is by offering multiple payment options. Different customers have different preferences when it comes to making payments. By providing a variety of payment methods, such as credit cards, digital wallets, and online banking, businesses can cater to a broader range of customer preferences. This flexibility enhances the overall customer experience and increases the likelihood of completing the purchase. If you are looking for resources, you can fintech sites to explore secure and seamless payment solutions for businesses of all sizes. Many payment processors or fintech solutions providers offer a comprehensive suite of payment processing services, including credit card processing, mobile payments, e-commerce solutions, and more.

Studies have shown that businesses offering multiple payment options can experience higher conversion rates and increased sales. According to a survey conducted by Statista, 56% of respondents said they would abandon their cart if their preferred payment method was not available. Therefore, by offering multiple payment options, businesses can reduce cart abandonment and capture more sales. By partnering with reliable payment processors, businesses can enhance their payment processing capabilities and ultimately boost their sales

Optimize the Checkout Process

Optimizing the checkout process is crucial for businesses to ensure a seamless and user-friendly customer experience. A streamlined and efficient checkout process can significantly reduce cart abandonment and increase conversion rates.

To optimize the checkout process, businesses should simplify the steps and minimize the required information. Implementing a guest checkout option allows customers to make a purchase without creating an account, eliminating the need for lengthy registration processes

Reducing the number of form. fields and only asking for essential information can expedite the checkout process. Utilizing auto-fill features and providing clear instructions can further enhance the user experience. Progress indicators can guide customers through each step, ensuring they are aware of the progress and remaining steps.

Furthermore, integrating trusted payment gateways can instill confidence in customers. Displaying security badges and SSL certificates during the checkout process can reassure customers that their payment information is protected.

Ensure Secure Payment Transactions

Ensuring secure payment transactions is of utmost importance for businesses in order to protect customer data and build trust. With the increasing prevalence of online transactions, it is crucial to implement robust security measures throughout the payment process.

One essential step in securing payment transactions is to adhere to industry standards such as Payment Card Industry Data Security Standard (PCI DSS) compliance. PCI DSS sets guidelines and requirements for securely handling payment card information. By following these standards, businesses can mitigate the risk of data breaches and unauthorized access to sensitive customer data.

Implementing encryption protocols is another crucial aspect of securing payment transactions. Utilizing Secure Sockets Layer (SSL) or Transport Layer Security (TLS) protocols ensures that customer data is encrypted during transmission, making it difficult for hackers to intercept and decipher the information.

In addition to encryption, businesses should also invest in robust authentication measures. Implementing multi-factor authentication adds an extra layer of security by requiring customers to provide additional verification, such as a one-time password or fingerprint scan, in addition to their payment credentials.

Also, display trust seals and logos of recognized security providers prominently on your website to reassure customers about the security measures in place. By prioritizing security, businesses can instill confidence in customers and increase their willingness to make purchases.

Leverage Mobile Payment Solutions

Leveraging mobile payment solutions is essential for businesses in today's digital landscape. With the widespread use of smartphones, offering mobile payment options can significantly enhance the convenience and accessibility of making purchases.

Mobile payment solutions allow customers to make payments using their smartphones, eliminating the need for physical credit cards or cash. Popular mobile payment platforms such as Apple Pay, Google Pay, and Samsung Pay enable customers to securely store their payment information on their devices and complete transactions with just a few taps.

By integrating mobile payment solutions into their payment processing methods, businesses can tap into the growing number of customers who prefer to make purchases using their smartphones. This accessibility can lead to increased sales and expanded customer reach.

Implement Automated Recurring Billing

Automated recurring billing is a valuable strategy to boost sales, particularly for businesses that offer subscription-based products or services. By implementing automated recurring billing systems, businesses can streamline the payment process for customers who opt for recurring payments.

With automated recurring billing, customers no longer need to initiate their payments each billing cycle manually. This convenience reduces friction and ensures timely payments, resulting in improved business cash flow and reduced churn rates.

Offer Incentives for Early Payments

Encouraging customers to make early payments can significantly benefit businesses. By offering incentives such as discounts or exclusive offers for customers who pay before the due date, businesses can motivate prompt payments and improve their cash flow.

Incentives for early payments provide customers with added value and create a sense of urgency, prompting them to complete their payments sooner rather than later. This strategy can help businesses maintain a healthy financial position and drive sales by ensuring timely revenue generation.

Payment processing is a critical aspect of any business; optimizing it can significantly impact sales performance. By offering multiple payment options, streamlining the checkout process, ensuring secure transactions, leveraging mobile payment solutions, implementing automated recurring billing, and offering incentives for early payments, businesses can enhance customer experience, build trust, and ultimately boost their sales. Here is a complete guide on how you could use the digital marketing funnels to expand your customer base and how sell directly on Amazon with a detailed plan on Amazon listing optimization.

Impact on Ecommerce Conversion Rates

A. Accessibility and Ease of Use

Traditional payment methods like credit and debit cards are widely accepted and familiar to most customers. Their accessibility and ease of use can positively impact ecommerce conversion rates by removing potential friction during the checkout process. A smooth and straightforward payment experience can contribute to a reduction in cart abandonment, thereby increasing conversions.

B. Consumer Trust

These payment methods longevity and widespread adoption contribute to high consumer trust. As online security becomes increasingly important, the assurance from using familiar payment options can encourage customers to complete their purchases, positively affecting conversion rates.

C. Versatility

Traditional payment methods offer a versatility that appeals to a broad customer base. Whether it's a small purchase with a debit card, a large purchase spread over monthly payments with a credit card, or a direct bank transfer for a high-ticket item, these methods cater to various consumer preferences and financial situations. This flexibility can attract a wider range of customers, potentially driving higher conversion rates.

The Role of Traditional Payment Methods in Digital Marketing Strategy

Understanding the influence of payment methods on conversion rates can inform digital marketing strategies. If a significant segment of a business's target audience prefers using traditional payment methods, marketing messages can emphasize the availability and security of these options. By aligning payment options with customer preferences and highlighting them in marketing campaigns, businesses can increase click-through rates, boost customer engagement, and ultimately enhance conversions.

While the payment landscape evolves with new digital solutions, traditional methods like credit cards, debit cards, and bank transfers remain integral to ecommerce. Their accessibility, consumer trust, and versatility influence ecommerce conversion rates. As such, online businesses must ensure they offer these options and leverage them strategically in their digital marketing efforts to drive conversions and ecommerce success.

The Role of Digital Wallets and we've been experiencing

Digital wallets represent a step forward in the digitization of finance, allowing users to store multiple card details securely and facilitating one-click payments. They offer consumers a seamless, quick, and secure payment method that enhances the overall online shopping experience. Major players like PayPal, Google Pay, and Apple Pay dominate the digital wallet market.

PayPal

PayPal is a veteran in the digital wallet space. It offers a simple, secure method of online payment, letting customers make purchases without revealing their card details to vendors. It's available in over 200 countries and supports 25 currencies.

B. Google Pay

Google Pay merges the tech giant's various payment platforms into one secure, user-friendly app. It allows customers to save multiple cards, make quick payments using stored details, and even store loyalty card information.

C. Apple Pay

Apple Pay caters exclusively to Apple device users, offering a secure and easy-to-use payment method integrated across Apple's ecosystem. It simplifies transactions by enabling single-tap payments and offering biometric authentication for added security.

Digital wallets streamline the checkout process, making it faster and more convenient. By eliminating the need for customers to input card details for each transaction, digital wallets reduce friction and the potential for errors, thereby enhancing the user experience. Digital wallets use encryption and tokenization technologies to protect sensitive card details. This heightened security makes transactions safer and boosts customer confidence in making purchases.

As per Statista, approximately 50.2% of global internet users had used digital wallets for online transactions in 2020, and this percentage is expected to grow over the coming years. In the U.S., 39.7% of mobile point-of-sale payments were made via digital wallets in 2020. The popularity of individual digital wallets varies, with PayPal traditionally holding a significant market share. However, Google Pay and Apple Pay have seen increased adoption rates, particularly in regions with a high prevalence of Android and Apple devices.

Is Crypto already a significant player in e-commerce?

The adoption of cryptocurrency as a payment method in ecommerce has been growing, albeit slower than traditional payment methods or digital wallets. However, as familiarity with and trust in cryptocurrencies grow, so does their online shopping usage. As of 2021, research indicated that over 100K websites worldwide accepted Bitcoin as payment. For instance, major companies like Microsoft, Overstock, and AT&T have integrated Bitcoin payments into their ecommerce platforms.

Additionally, a 2021 survey by HSB, part of Munich Re, revealed that 36% of small-medium businesses in the US accept Bitcoin. On the consumer front, a study from DealAid.org showed that about 6.2% of consumers used cryptocurrencies for online purchases.

Ethereum's usage in ecommerce is not as widespread as Bitcoin's, mainly due to its popularity as a platform for decentralized applications (DApps) rather than a straightforward payment method. However, its acceptance is also growing, especially with the rise of Ethereum-based stablecoins like DAI, which mitigate the volatility issues typically associated with cryptocurrencies.

While cryptocurrencies are not yet mainstream in ecommerce, their influence is undeniable. Bitcoin and Ethereum offer significant benefits to both online merchants and shoppers, including lower transaction fees, enhanced security, and increased privacy. The adoption of cryptocurrencies in ecommerce will rise as more businesses and consumers recognize these advantages. Forward-thinking ecommerce businesses should consider integrating cryptocurrency payment options to cater to a growing demographic of crypto-savvy customers and stay ahead of the evolving digital commerce landscape.

What is the future of online payments?

The evolution of ecommerce has always been closely linked to advancements in payment technology. In this relentless drive for innovation, the future promises to bring even more exciting developments. Notably, decentralized finance (DeFi), biometrics, and Central Bank Digital Currencies (CBDCs) stand out as trends that are poised to reshape the ecommerce payment landscape.

Decentralized Finance, or DeFi, is an emerging trend that promises to democratize financial services by removing traditional intermediaries like banks. DeFi applications are built on blockchain technology, most commonly on the Ethereum platform, allowing for peer-to-peer transactions. This implies that buyers and sellers could directly transact with each other, making the process faster and potentially cheaper by reducing transaction fees.

DeFi can offer several advantages for ecommerce. It can cater to unbanked or underbanked populations, allowing them to participate in online shopping without needing traditional banking systems. Furthermore, the integration of smart contracts can automate processes such as payments and refunds, increasing efficiency and reducing the possibility of human error.

Biometric technologies like fingerprint recognition, facial recognition, and voice identification are another future trend set to impact ecommerce. Biometrics offer an additional layer of security to online transactions, helping to prevent fraud and increase customer confidence. As data security becomes an increasing concern, the role of biometrics in secure payment processing becomes more crucial. Biometric authentication provides a more secure alternative to passwords, which can be forgotten, lost, or stolen. As biometric technology continues to advance and gain widespread acceptance, ecommerce businesses will need to consider integrating biometric authentication options to enhance security and customer trust.

Central Bank Digital Currencies, or CBDCs, are the digital form of a country's fiat currency and are issued and regulated by that country's central bank. As digital alternatives to traditional money, CBDCs can provide the convenience and security of digital currencies while maintaining the stability and regulatory oversight of traditional fiat currencies. The introduction of CBDCs could bring about a significant shift in the ecommerce payment landscape. CBDCs combine the advantages of cryptocurrencies (like fast and secure transactions) with the stability and trust associated with traditional currencies. This fusion could simplify cross-border ecommerce transactions, reduce transaction costs, and potentially increase consumer trust in online shopping.

As these trends continue to evolve, ecommerce businesses must stay abreast of developments and be ready to adapt. This might involve partnering with fintech companies, investing in new technologies, or lobbying for favorable regulations. It will be critical for businesses to strike a balance between embracing these innovative trends and maintaining the trust and ease of use that customers have come to expect from online shopping. The future of ecommerce payment methods looks set to be shaped by decentralized finance, biometrics, and Central Bank Digital Currencies. While these trends bring new opportunities, they also present challenges that ecommerce businesses will need to navigate. However, those that can successfully adapt to these changes stand to gain a competitive advantage in the evolving ecommerce landscape. The future of ecommerce payments promises to be exciting, dynamic, and transformative.

Leveraging Data Analytics to Optimize Payment Method Offerings in Ecommerce

In the rapidly evolving ecommerce landscape, understanding and catering to customer preferences is crucial. Among the many factors influencing customer behavior, payment methods are particularly impactful. With advancements in data analytics, we now have the tools to deeply understand these preferences and optimize our payment method offerings accordingly. This article explores how we can leverage data analytics to refine our payment strategies, using real-world examples and showcasing code snippets for enhanced comprehension. Multiple studies have shown that offering various payment options can significantly increase conversion rates. However, maintaining a broad spectrum of payment options is not enough. Understanding which payment methods resonate most with our customer base and optimizing our offerings based on that information is what makes the real difference. This is where data analytics comes in.

Data Collection

To use data analytics effectively, we first need to collect the right data. With every transaction, we gather data points such as the chosen payment method, transaction success or failure, time to transaction completion, and the customer's geographical location. To capture this information in our database, we might use a simple SQL command:

SQL INSERT INTO transactions (transaction_id, payment_method, transaction_status, transaction_time, customer_location)

VALUES (1, 'Credit Card', 'Success', '2 seconds', 'USA');

With a substantial dataset, we can start to uncover meaningful insights.

Analyzing the Data

Once the data is collected, we can employ various analytical tools to decipher patterns. For example, we might find that customers from a particular region prefer using digital wallets over credit cards. To extract this information from our dataset, we might use a SQL command like:

SQL SELECT customer_location, payment_method, COUNT(payment_method)

FROM transactions

GROUP BY customer_location, payment_method

ORDER BY COUNT(payment_method) DESC;

This command gives us a clear picture of each region's most popular payment methods, helping us tailor our payment options to cater to regional preferences.

A/B Testing Payment Methods

Data analytics also allows us to perform A/B testing on our payment methods. For instance, we might experiment with the placement of different payment options on our checkout page, tracking the conversion rates for each variation. Analyzing this data can reveal surprising insights about how the presentation of payment methods influences customer choices.

Predictive Analytics

We can use predictive analytics to forecast future trends based on our historical data. Machine learning algorithms can analyze patterns in our data to predict, for instance, how the introduction of a new payment method might affect sales. Using libraries like Scikit-learn in Python, we could implement a simple linear regression model:

python from sklearn.linear_model import LinearRegression

# Assume X is our feature matrix and y is our target variable

model = LinearRegression().fit(X, y)

# Predicting future sales after introducing a new payment method

predicted_sales = model.predict(new_payment_method_data)

With advancements in technology, we can now conduct real-time data analytics. This allows us to monitor and respond to changes instantaneously, whether it's a sudden increase in failed transactions or a shift in customer payment preferences. Using real-time analytics platforms like Google Analytics, we can track these changes and react swiftly to optimize our payment process.

Data analytics provides us with an invaluable tool to understand and optimize our payment method offerings. By collecting and analyzing relevant data, conducting A/B testing, leveraging predictive and real-time analytics, we can provide our customers with a personalized, seamless, and efficient payment experience. In the highly competitive world of ecommerce, staying data-driven is not an option; it's a necessity.

Looking forward, we aim to delve even deeper into the realm of data analytics, exploring advanced machine learning models and AI to predict and respond to customer behavior. While the journey is complex, the potential rewards in terms of increased conversion rates and customer satisfaction make it an exciting adventure worth undertaking.

Codedesign - digital marketing & data agency

Are you ready to take your ecommerce business to the next level? We, at CodeDesign, are here to help. As a leading ecommerce agency, we specialize in creating innovative, user-friendly, and high-performing ecommerce solutions that transform online retail businesses.

At CodeDesign, we believe every business is unique and strive to ensure our solutions reflect this. We work closely with our clients, taking the time to understand their business goals, target audience, and unique selling points. This enables us to create tailored ecommerce solutions that meet and exceed our client's expectations.

Our team consists of highly skilled professionals with expertise in various domains, including web design, UX/UI design, digital marketing, data analytics, and more. We leverage this diverse skill set to provide comprehensive ecommerce solutions, ensuring our clients' businesses flourish in the digital world.

What sets us apart is our commitment to staying ahead of the curve. We constantly explore new technologies and trends, from artificial intelligence and machine learning to the latest payment methods and security protocols. This ensures our clients always have a competitive edge in the rapidly evolving ecommerce landscape.

Our portfolio is a testament to our capabilities. We have successfully worked with businesses of all sizes, from startups to large enterprises, across various industries. Regardless of the project size or complexity, we consistently deliver results - driving increased web traffic, boosting conversion rates, and enhancing revenue.

But don't just take our word for it. The testimonials from our satisfied clients speak volumes about our work ethic, commitment, and results. Our clients appreciate our transparent communication, creative problem-solving, and unwavering focus on their success.

At CodeDesign, we measure our success by the success of our clients. We're not just a service provider; we're a partner who is invested in your growth. Together, we can navigate the challenges of the ecommerce landscape and unlock the full potential of your business.

Are you ready to elevate your ecommerce business? Get in touch with us at CodeDesign. Let's create something extraordinary together.

FAQS - Frequently Asked Questions

What payment methods can boost ecommerce sales?

Incorporating a variety of payment methods can significantly enhance ecommerce sales. For example, Codedesign has observed a substantial increase in conversion rates for clients who offer multiple payment options, including credit/debit cards, PayPal, digital wallets like Apple Pay and Google Wallet, and buy now, pay later (BNPL) services. These options cater to a wider audience's preferences, ensuring a smoother transaction process. Notably, BNPL services have gained popularity for their flexibility, allowing consumers to make purchases without immediate payment, which can boost average order values and customer loyalty.

How does optimizing the checkout process improve customer experience?

Optimizing the checkout process directly enhances the customer experience by making the purchasing journey as seamless and frictionless as possible. Simplifying form fields, ensuring the process is intuitive, and minimizing the steps required to complete a purchase can significantly reduce cart abandonment rates. For instance, implementing a one-click checkout option, as seen with Amazon's patented technology, leverages convenience to improve user satisfaction. This optimization not only improves the immediate shopping experience but also builds long-term loyalty, encouraging repeat business.

Why is ensuring secure payment transactions crucial for online businesses?

Ensuring secure payment transactions is fundamental for online businesses to build trust and credibility with their customers. Security breaches can lead to significant financial losses and damage to a brand's reputation. Implementing advanced encryption methods like SSL certificates and complying with Payment Card Industry Data Security Standards (PCI DSS) are essential practices. For example, Codedesign advises its clients to adopt these security measures, which has led to a noticeable decrease in fraudulent transactions and an increase in consumer confidence, ultimately contributing to higher sales volumes.

What benefits do mobile payment solutions offer to ecommerce?

Mobile payment solutions offer numerous benefits to ecommerce, including enhanced convenience, improved customer experience, and increased sales. With the proliferation of smartphones, consumers appreciate the ease of making purchases on-the-go using payment apps or digital wallets. This convenience factor, coupled with faster checkout processes, encourages impulse buying and can significantly uplift conversion rates. For instance, clients of Codedesign who integrated mobile payment options reported an uptick in mobile transactions, highlighting the growing importance of mobile-friendly payment solutions in driving ecommerce growth.

How does automated recurring billing benefit subscription-based services?

Automated recurring billing is a cornerstone for subscription-based services, offering a seamless, efficient way to manage payments and maintain cash flow. It eliminates the need for manual billing, reducing administrative overhead and improving accuracy. Customers enjoy uninterrupted access to services without the hassle of making manual payments, enhancing their satisfaction and retention rates. For businesses, this means predictable revenue streams and lower churn rates. Codedesign has helped clients implement automated billing systems, resulting in improved operational efficiency and sustained customer loyalty.

Can offering incentives for early payments enhance business cash flow?

Absolutely, offering incentives for early payments can significantly enhance business cash flow. This strategy encourages customers to settle invoices ahead of schedule, ensuring that businesses have quicker access to funds. Early payment discounts, for example, can be a powerful motivator for customers, improving the cash conversion cycle. For businesses, especially those operating on thin margins or with tight cash flow requirements, these incentives can make a substantial difference. Codedesign's clients who have adopted this approach have experienced improved liquidity, which is crucial for sustaining operations and facilitating growth.

How do traditional payment methods impact ecommerce conversion rates?

Traditional payment methods, such as bank transfers and cash on delivery, can have a mixed impact on ecommerce conversion rates. While they are critical in markets where digital payment penetration is low, offering these options alongside modern payment methods can cater to a broader audience. However, the convenience and immediacy of digital payments often outweigh traditional methods, which can be slower and less convenient for online shopping. For businesses targeting tech-savvy consumers or those in highly digitalized regions, prioritizing modern payment solutions can lead to higher conversion rates, as observed by Codedesign with its ecommerce clients.

What role do digital wallets play in modern ecommerce?

Digital wallets play an increasingly vital role in modern ecommerce by offering a convenient, secure, and fast way to make online payments. They store users' payment information, allowing for quicker checkout processes without the need to enter card details for every transaction. This convenience can significantly reduce cart abandonment rates and boost conversion rates. Additionally, digital wallets often come with advanced security features, such as tokenization, which can further reassure customers about the safety of their transactions. Codedesign's experience indicates that ecommerce sites integrating digital wallets see an uptick in customer satisfaction and loyalty, driving repeat business.

How is cryptocurrency becoming relevant in ecommerce?

Cryptocurrency is becoming increasingly relevant in ecommerce as a novel and innovative payment method. Its advantages, including lower transaction fees, enhanced security through blockchain technology, and access to a global market, make it an attractive option for both businesses and consumers. Although adoption is still in the early stages, some of Codedesign's forward-thinking clients have begun accepting cryptocurrencies, tapping into a niche market of tech-savvy and privacy-conscious consumers. This move not only differentiates them from competitors but also opens up new avenues for international transactions without the hurdles of currency conversion and high fees.

What future online payment trends should ecommerce businesses prepare for?

Ecommerce businesses should prepare for several evolving online payment trends that are shaping the future of commerce. Voice-activated payments, augmented reality shopping experiences, and the integration of AI for personalized shopping and payment suggestions are on the rise. Additionally, the increasing use of biometric authentication for securing transactions and the expansion of blockchain technology for payments signal a move towards more secure, efficient, and personalized ecommerce experiences. Staying ahead of these trends can help businesses like those working with Codedesign to innovate and maintain a competitive edge in the rapidly evolving digital marketplace.

Add comment ×