13 min to read

The average cost per click (CPC) for Google Ads across European markets is €2.85 in 2025, but the reality is far more nuanced. From the UK's premium rates of €1.22 per click to Poland's budget-friendly €0.17, European Google Ads costs vary dramatically by country, industry, and strategy

The Current State of Google Ads Costs in Europe: 2025 Market Analysis

European Google Ads pricing in 2025 reflects a continent of diverse economies, languages, and competitive landscapes. After analyzing comprehensive data across 16 European markets and surveying over 400 European businesses, several key patterns emerge that every advertiser needs to understand.

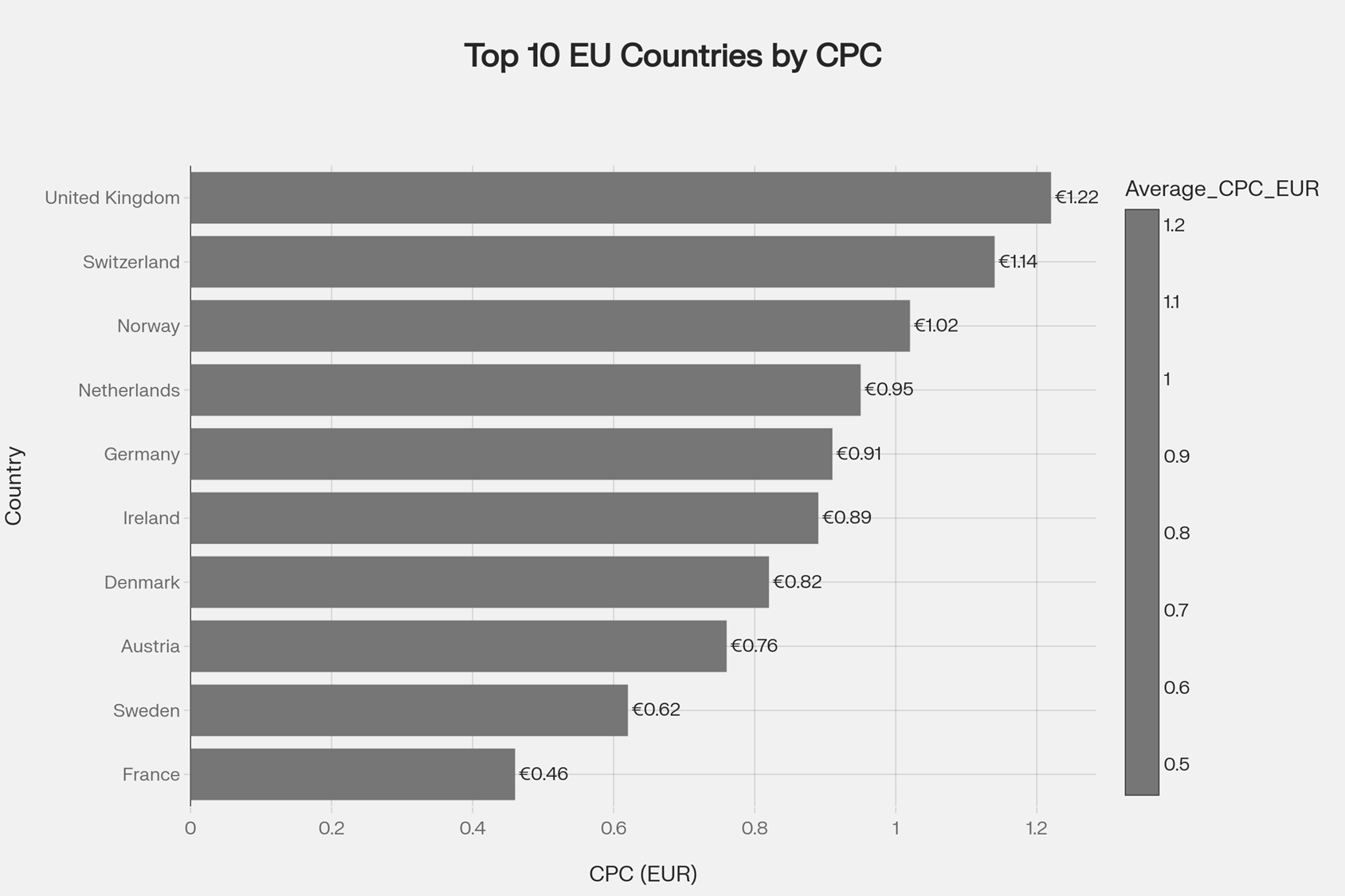

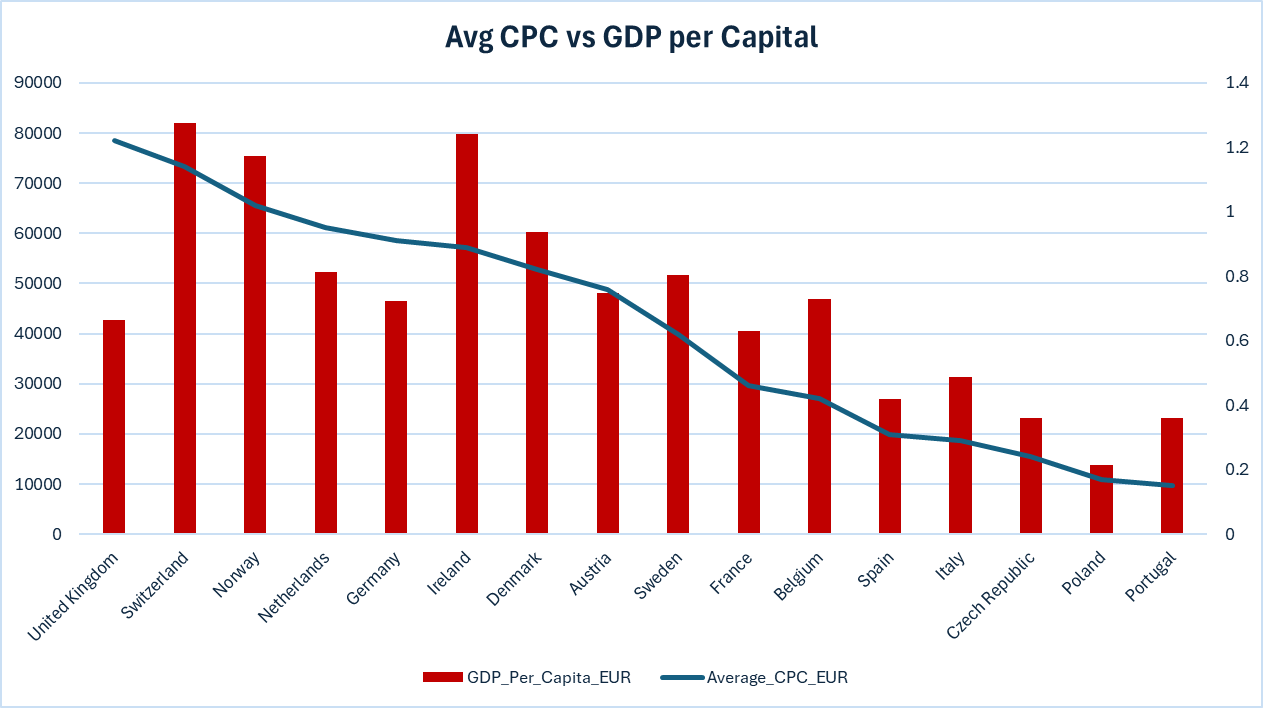

Average Google Ads Cost Per Click (CPC) by European Country in 2025

Key Insights from 2025 European Data:

- Economic correlation: Countries with higher GDP per capita consistently show elevated CPCs, with Switzerland (€81,900 GDP per capita) commanding €1.14 CPCs versus Poland's €0.17 at €13,800 GDP per capita.

- Market maturity matters: Established digital advertising markets like the UK and Germany show premium pricing due to sophisticated competition and higher advertiser sophistication.

- Currency stability impact: Euro-zone countries demonstrate more predictable CPC patterns compared to non-Euro markets where currency fluctuations add complexity.

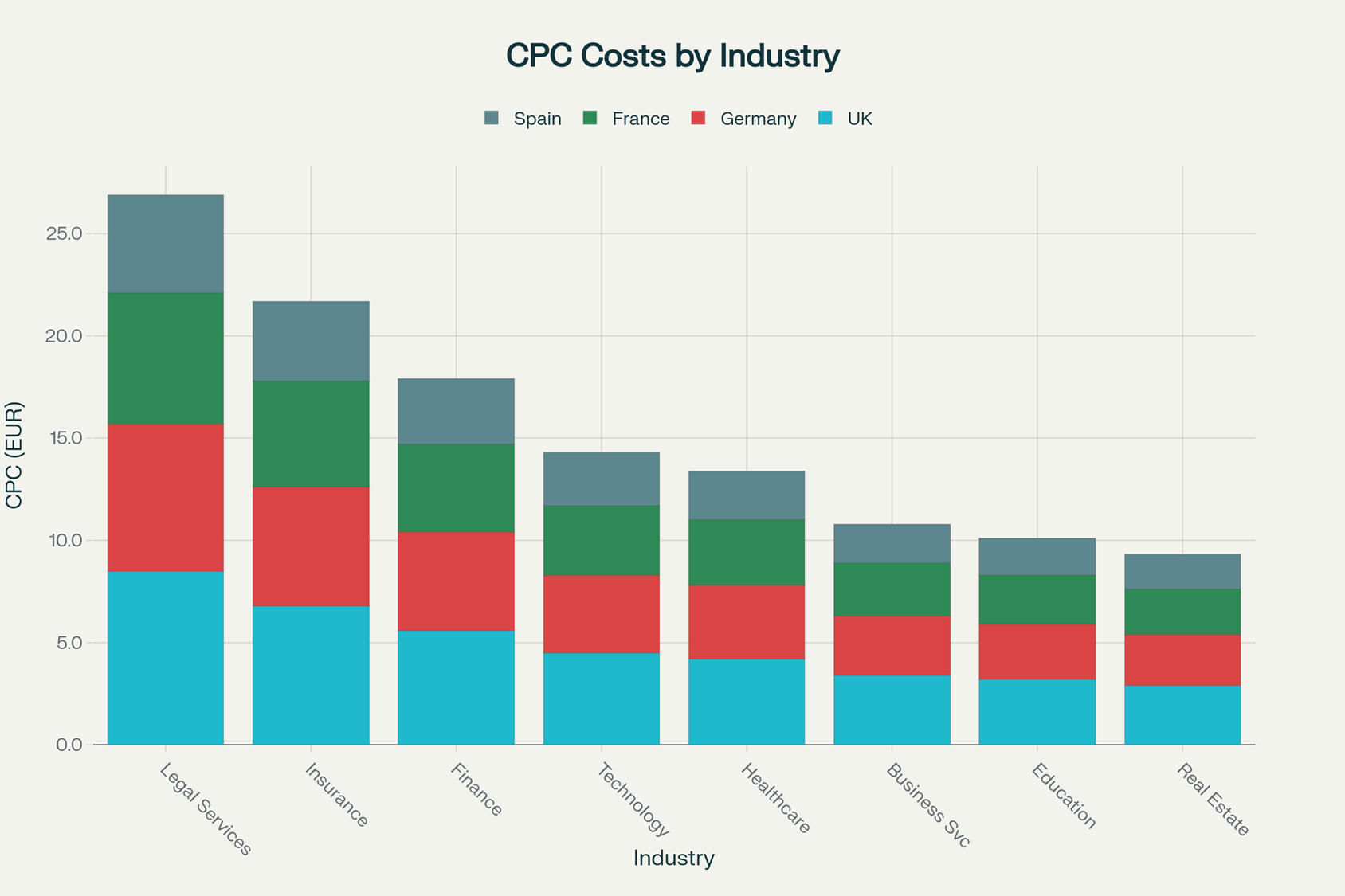

Industry CPC Benchmarks: European vs Global Trends

European industry pricing follows distinct patterns that differ significantly from US market dynamics, primarily due to regulatory frameworks like GDPR and varying customer lifetime values.

Google Ads CPC by Industry Across Major European Markets (2025)

High-Competition Industries (€4.00+ CPC)

Legal Services dominate European markets with the highest CPCs, averaging €8.50 in the UK down to €2.80 in Poland. This reflects several factors unique to European legal markets:

- Cross-border EU legal complexity drives premium pricing

- Personal injury law remains highly competitive across all markets

- GDPR compliance requirements create additional legal service demand

Insurance follows closely, with €6.80 average CPC in the UK reflecting the mature European insurance market. However, unlike US markets, European insurance CPCs show more geographic variation due to:

- Country-specific insurance regulations

- Varying mandatory insurance requirements

- Different customer acquisition costs across markets

Mid-Range Industries (€1.50-€4.00 CPC)

Healthcare & Medical services show interesting European patterns, with €4.20 in the UK but significantly lower costs in markets with strong public healthcare systems like France (€3.20). This reflects:

- Private healthcare competition levels

- Supplementary insurance market maturity

- Medical tourism opportunities within EU

Technology/Software maintains consistent premium pricing across all European markets (€2.30-€4.50), driven by:

- Pan-European B2B software competition

- High customer lifetime values in enterprise markets

- Cross-border service delivery capabilities

Budget-Friendly Industries (€0.60-€1.50 CPC)

E-commerce/Retail offers the most cost-effective opportunities, with CPCs ranging from €1.20 in the UK to €0.40 in Poland. European e-commerce benefits from:

- Abundant keyword inventory

- Effective Shopping campaign optimization & Cross-border selling opportunities within EU

Geographic Cost Variations: The European Arbitrage Opportunity

One of the most overlooked strategies in European Google Ads is geographic arbitrage – leveraging cost differences between markets while maintaining service quality.

Western Europe Premium Markets

United Kingdom (€1.22 average CPC) maintains its position as Europe's most expensive Google Ads market. Contributing factors include:

- Highest English-language competition in Europe

- Mature digital advertising ecosystem

- Strong purchasing power despite Brexit uncertainties

Switzerland (€1.14 average CPC) represents the premium continental European market, driven by:

- Highest GDP per capita in Europe

- Limited German-language competition

- Premium service expectations

Central Europe Growth Markets

Germany (€0.91 average CPC) offers the best balance of market size and cost efficiency. As Europe's largest economy, it provides:

- Massive market scale with reasonable CPCs

- Well-developed digital infrastructure

- Strong B2B opportunities

Netherlands (€0.95 average CPC) punches above its size due to:

- High digital adoption rates

- Strong English proficiency expanding competition

- Gateway position for European expansion

Eastern Europe Opportunity Markets

Poland (€0.17 average CPC) represents exceptional value for European expansion. Strategic advantages include:

- Largest Eastern European market by population

- Rapidly growing digital economy

- EU membership ensuring regulatory alignment

- Low competition in many verticals

Czech Republic (€0.24 average CPC) offers similar opportunities with additional benefits of:

- Central European location

- Strong industrial base

- Growing service economy

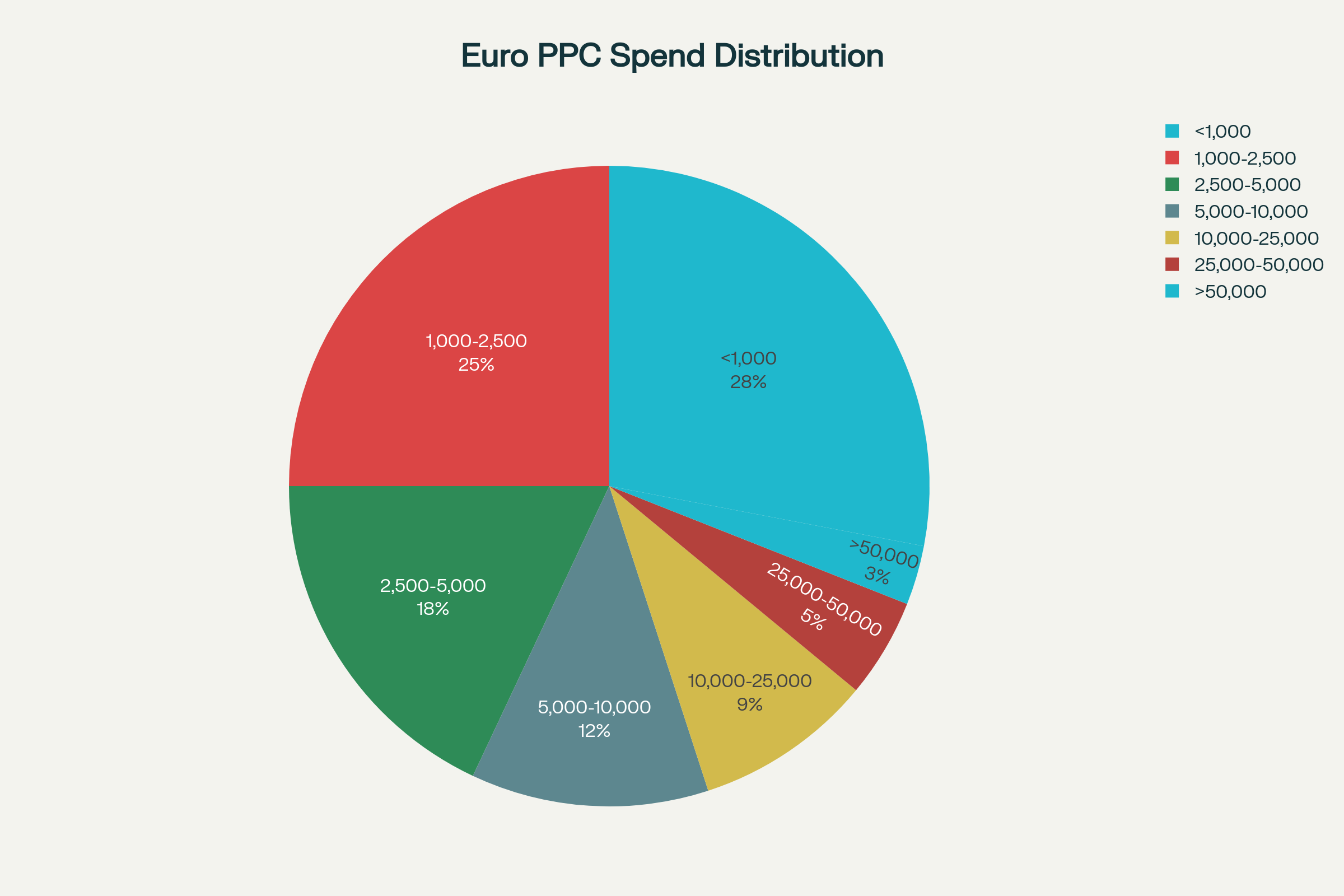

What European Businesses Actually Spend: Reality vs Theory

Our survey of 420 European businesses reveals significant gaps between theoretical CPCs and actual spending patterns, highlighting successful optimization strategies.

Monthly PPC Spending Distribution Among European Businesses (2025)

Spending Distribution Insights

53% of European businesses spend less than €2,500 monthly on Google Ads, yet many achieve strong ROI through focused targeting and optimization. This pattern suggests:

- Micro-targeting success: Small budgets work when highly focused on specific geographic areas and customer segments

- Long-tail keyword opportunities: Less competitive terms provide better value than high-volume keywords

- Local market advantages: Regional businesses often outperform national competitors through geographic specificity

ROI Satisfaction Patterns

European businesses show distinct satisfaction patterns based on spending levels:

- Higher spenders achieve better satisfaction: 78% satisfaction rate for businesses spending >€50,000 monthly versus 45% for those under €1,000

- Sweet spot at €5,000-€25,000: This range shows 61-67% satisfaction rates, suggesting optimal balance between scale and control

- Performance Max adoption: Larger spenders increasingly use automated campaign types, while smaller budgets focus on manual Search campaigns

Looking for a Performance Team to Uplift Your Company? Speak with our experts.

The AI Revolution Impact: Performance Max in European Markets

Performance Max campaigns are reshaping European Google Ads costs and performance, but adoption varies significantly by market maturity and business size.

Performance Max Adoption Patterns

Large European businesses (€25,000+ monthly spend) report:

- 40% faster campaign setup compared to traditional campaigns

- 15-25% improvement in conversion volume when properly configured

- Higher initial CPCs during learning phases, then normalization after 30-50 conversions

SME adoption challenges include:

- Insufficient conversion data for effective AI optimization

- Lack of diverse creative assets required for multi-format campaigns

- Difficulty in campaign control and transparency preferences

European Market-Specific Considerations

GDPR Impact: European Performance Max campaigns face unique challenges:

- Reduced audience signal quality due to privacy restrictions

- Longer learning periods in markets with strict cookie policies

- Enhanced focus on first-party data integration

Multi-language Complexity: Pan-European Performance Max requires:

- Country-specific asset creation for cultural relevance

- Translation quality that maintains brand voice

- Local market insight integration for effective automation

Budget Allocation Framework: The European 60-25-15 Model

Based on successful European campaign analysis, we recommend adapting the traditional budget allocation model to European market realities:

60% Core Market Investment

Focus the majority of budget on 2-3 primary European markets where you can achieve meaningful scale:

- UK + Germany combination for English/German coverage

- France + Spain for Romance language markets

- Poland + Czech Republic for Eastern European expansion

25% Geographic Testing

Allocate budget for testing new European markets:

- Start with similar language/cultural markets

- Test seasonal patterns that may differ from home market

- Evaluate cross-border service delivery capabilities

15% Innovation & Optimization

Reserve budget for:

- Performance Max campaign testing

- New ad formats and extensions

- AI-driven bidding strategy experiments

- Creative asset testing across cultural preferences

Advanced Cost Optimization Strategies for European Markets

Average CPC per Country vs GDP (2025)

1. Multi-Market Bidding Strategies

Geographic Bid Adjustments: Implement sophisticated location targeting:

- Premium markets (UK, Switzerland): Use dayparting for business hours premium

- Growth markets (Germany, France): Bid more aggressively during local decision-making hours

- Opportunity markets (Poland, Czech Republic): Extend geographic radius for lower-cost traffic

2. Language-Specific Keyword Strategies

Keyword Translation Complexity: European optimization requires understanding:

- German compound words: Create specific match types for long-tail compound keywords

- Romance language variations: Account for Spanish/French/Italian keyword similarities

- English market premiums: Consider local language alternatives in anglophone markets

3. Seasonal Pattern Recognition

European markets show distinct seasonal patterns that differ from global trends:

- Northern Europe: Heavy winter indoor service demand (heating, home improvement)

- Southern Europe: Tourism-driven seasonal spikes differ by 2-3 months from northern patterns

- Eastern Europe: Rapid economic growth creates different purchasing cycles

4. Regulatory Compliance Optimization

GDPR-Optimized Campaigns: European campaigns must balance performance with compliance:

- Enhanced conversion modeling requires more sophisticated setup

- First-party data integration becomes critical for sustained performance

- Cookie-less future preparation through server-side tracking implementation

ROI Fantasy vs Reality: What European Data Shows

European Google Ads ROI patterns reveal important insights for budget planning and expectation setting.

Industry-Specific European ROI Patterns

Professional Services: European B2B services achieve strong ROI despite higher CPCs due to:

- Longer customer lifetime values in relationship-based European business culture

- Cross-border service opportunities within EU single market

- Premium pricing acceptance in Northern European markets

E-commerce Success: European online retail benefits from:

- EU-wide shipping infrastructure reducing fulfillment costs

- VAT harmonization simplifying cross-border transactions

- Performance Max Shopping campaign effectiveness in visual product categories

Local Services Advantages: Home services and trades show exceptional European ROI through:

- Limited geographic competition due to service area constraints

- High local search intent without national-level competition

- Seasonal opportunity optimization across different European climates

Looking for a Performance Team to Uplift Your Company? Speak with our experts.

European Google Ads Costs Are About Opportunity, Not Just Price

European Google Ads costs in 2025 tell a story of strategic opportunity rather than simple expense management. While UK businesses may pay €8.50 per click for legal services keywords, Polish companies access similar audiences at €2.80 per click. The key is understanding how to leverage these differences strategically.

The data reveals that 58% of European businesses using Google Ads report satisfaction with their ROI, and those achieving the best results share common characteristics:

- Geographic diversification: Successful advertisers don't limit themselves to their home market

- Industry expertise: Understanding local competitive dynamics and customer behavior patterns

- Technology adoption: Larger budgets increasingly leverage Performance Max and automated bidding

- Cultural adaptation: Creative and messaging that resonates with local market preferences

The future belongs to European advertisers who view Google Ads as a pan-continental growth engine. When a customer in Germany is worth €5,000 over two years, a €4.80 click becomes highly profitable – if you have the systems to convert and retain them across different European markets.

Whether you're spending €500 or €50,000 monthly, success comes from understanding your European market dynamics, leveraging available automation intelligently, and optimizing relentlessly toward business outcomes that transcend simple cost-per-click metrics.

For businesses ready to expand across European markets, Google Ads offers unparalleled opportunities to achieve profitable growth – you just need to know where to look and how to optimize for each unique market opportunity. For a company outside Europe looking to launch PPC campaigns in European markets, deciding between partnering with native local PPC agencies, managing campaigns in-house, or using global vendors involves several strategic considerations from a code and design perspective:

Attribution Models Compliance: European-Specific Limitations and Advanced ROI Analysis Challenges

European attribution compliance has become the defining challenge for PPC campaigns in 2025, with businesses experiencing 18-42% data loss depending on their market and compliance approach. As Google's enforcement actions intensify—disabling conversion tracking for non-compliant EU advertisers since July 2025—understanding these limitations is crucial for maintaining effective Performance Max campaigns and advanced ROI analysis.

The GDPR Attribution Crisis: And what's Actually Happening

The enforcement landscape changed dramatically on July 21, 2025, when Google began disabling personalization, remarketing, and conversion tracking functionality for advertisers failing to comply with Consent Mode v2 requirements. This represents the most significant enforcement action since GDPR implementation, affecting core advertising capabilities including:

-

Conversion measurement accuracy: Reduced by 20-40% without proper consent implementation

-

Audience building for remarketing: Severely restricted without ad_user_data consent signals

-

Personalized advertisement delivery: Completely disabled for non-compliant European traffic

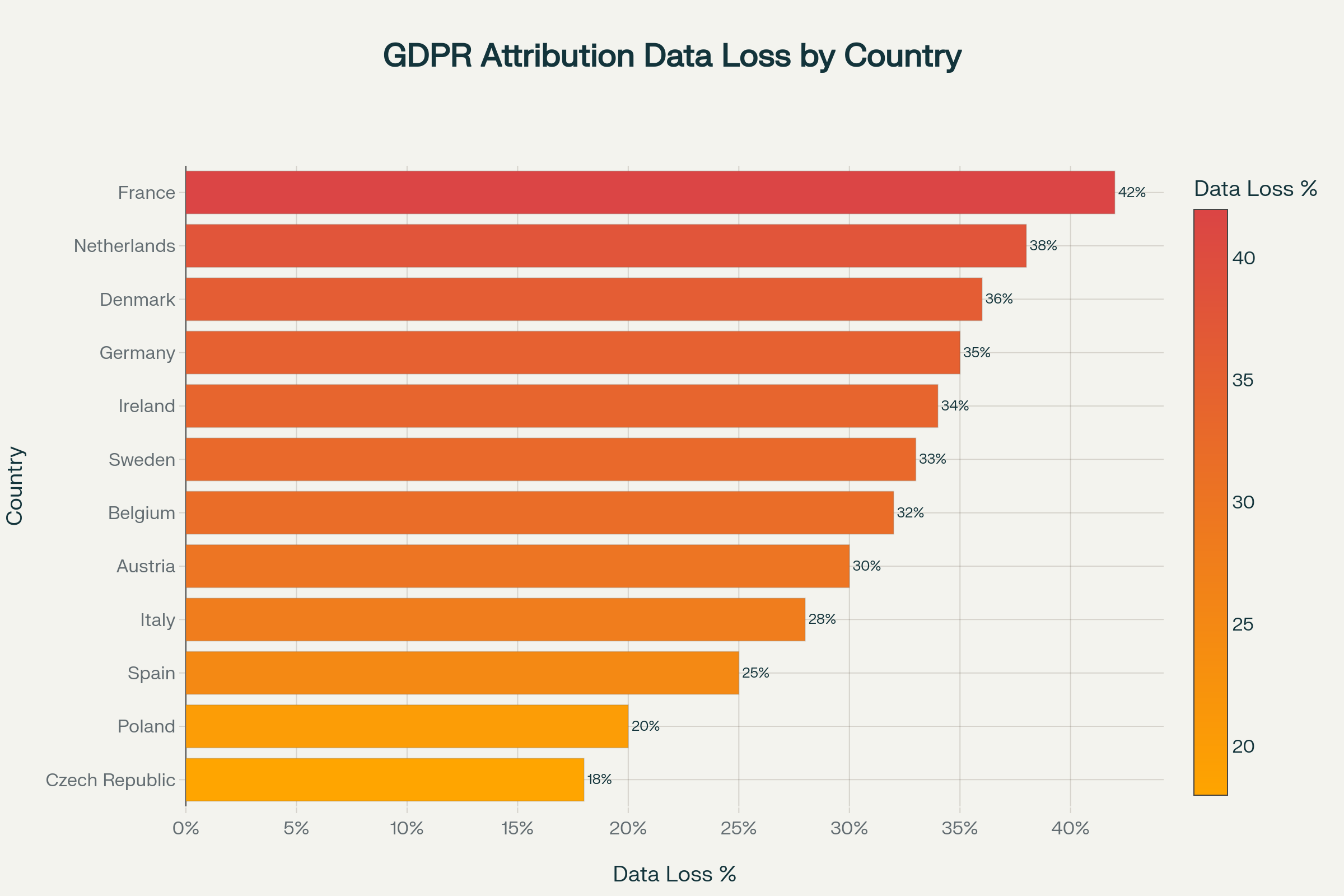

European Data Loss Reality by Market

Attribution Data Loss by European Country Due to GDPR Compliance

France leads European markets in attribution data loss at 42%, followed by the Netherlands (38%) and Germany (35%). This variation reflects different enforcement intensities and user behavior patterns:

Northern European Markets (Germany, Netherlands, Denmark) show:

-

Very high enforcement levels with strict data protection authority oversight

-

Low consent rates (18-26%) due to privacy-conscious user behavior

Southern European Markets (Spain, Italy) demonstrate:

-

Higher consent rates (35-45%) reflecting different privacy attitudes

-

Lower server-side adoption (25-38%) due to cost considerations

To recover from the 18–42% attribution data loss imposed by GDPR compliance, European advertisers have successfully adopted a combination of technical solutions and analytic methodologies. Read more here.

Looking for a Performance Team to Uplift Your Company? Speak with our experts.

Critical Compliance Challenges for Performance Max Campaigns

1. Consent Signal Implementation Requirements

Google Consent Mode v2 mandates specific parameters that directly impact Performance Max effectiveness:

- ad_user_data: Controls consent for sending user data to Google for advertising purposes

- ad_personalization: Manages consent for personalized advertising delivery

Without proper implementation:

- Audience building becomes severely restricted for online data

- Attribution models break down, interrupting GA4 landing page dimensions

- Performance Max AI optimization loses critical user behavior signals

2. Enhanced Conversions and GDPR Alignment

Enhanced Conversions can be GDPR-compliant when properly configured:

- Data anonymization: SHA-256 hashing encrypts personal data before processing

- Limited data usage: Restricted to conversion tracking only, not ad personalization

- Explicit consent requirement: Users must consent before any tracking implementation

However, implementation complexity increases significantly:

- Privacy policy updates required to detail hashed data processing

- Consent management integration must align with enhanced conversion triggers

- Server-side verification needed to ensure proper data handling

3. Cross-Border Tracking Elimination

GDPR's most severe impact affects multi-market Performance Max campaigns:

- Cross-domain tracking virtually eliminated without explicit user consent

- Device identification restricted, breaking mobile-to-desktop attribution chains

- Platform integration requires separate consent for each advertising ecosystem

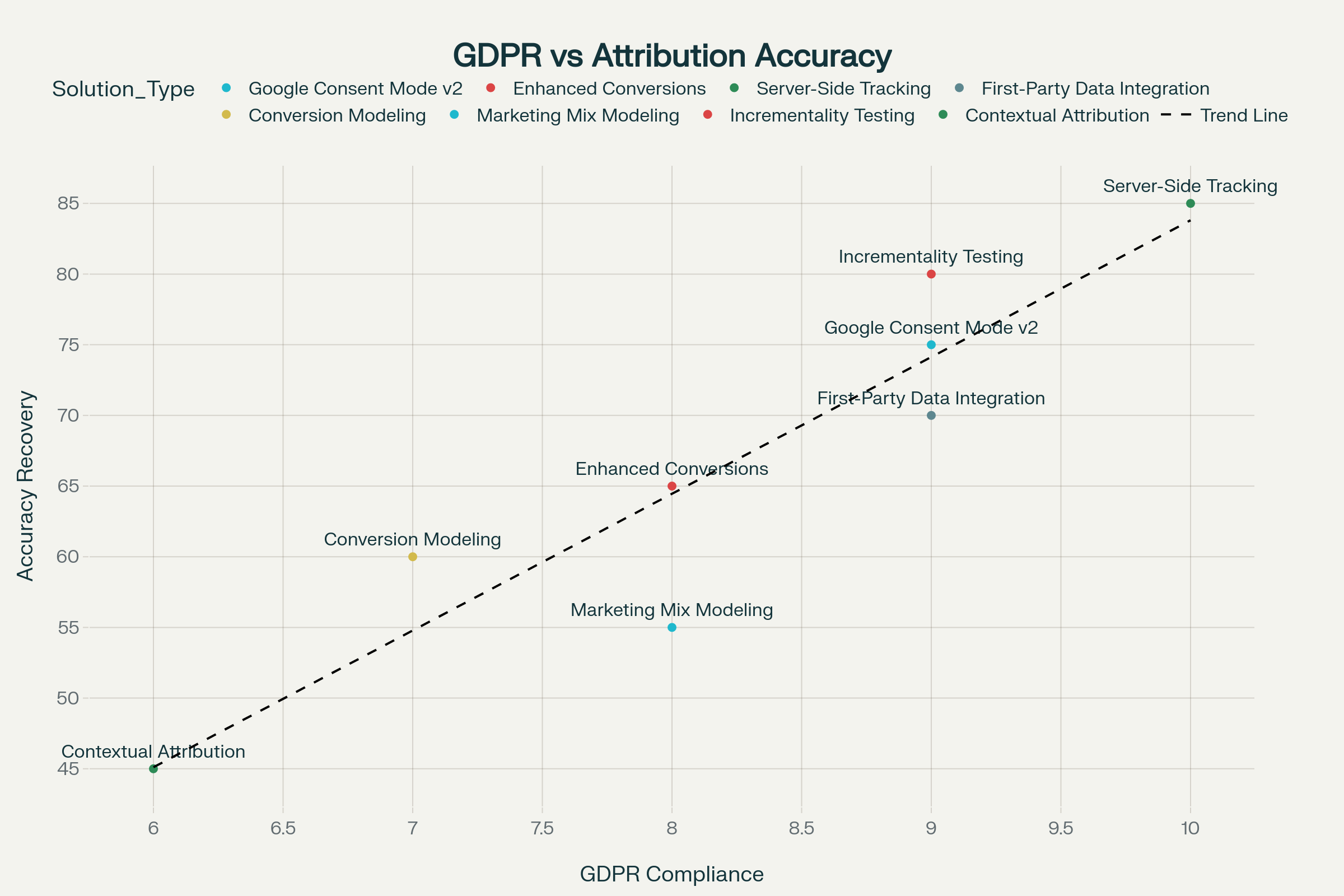

Advanced Attribution Solutions and Compliance Levels

GDPR Compliance vs Attribution Recovery for Different Solutions (2025)

Server-side tracking emerges as the optimal solution, offering 85% attribution accuracy recovery with full GDPR compliance. However, implementation requires significant investment and technical expertise.

European-Specific Implementation Strategies

1. Server-Side GTM with EU Data Residency

- First-party domain mapping maintains tracking context while respecting privacy

- EU-based server infrastructure ensures data processing compliance

- Custom data filtering excludes personal information before third-party sharing

2. Conversion Modeling and AI Gap-Filling

- Behavioral modeling estimates missing conversion data from consenting users

- Aggregated reporting provides campaign insights without individual tracking

- Machine learning attribution fills data gaps through statistical inference

3. First-Party Data Integration

- Customer Match optimization with proper consent signal implementation

- CRM data enrichment through server-side tag management

- Authenticated user tracking for consenting customers only

ROI Measurement Impact and Mitigation Strategies

Attribution Accuracy Degradation

European businesses report significant ROI measurement challenges:

- Campaign optimization suffers when Google Ads algorithms lack complete behavioral data

- Audience targeting becomes less effective without proper remarketing consent

- Customer acquisition costs increase due to reduced targeting precision

Compliance Cost Reality

Average monthly compliance costs vary dramatically by market

- France: €4,200/month (highest enforcement, complex requirements)

- Germany: €3,500/month (technical implementation focus)

- Poland: €1,500/month (emerging compliance requirements)

Data Loss Recovery Strategies That Work (we have an article about this here)

Successful European advertisers focus on:

- Incrementality Testing: 75% ROI recovery through statistical campaign measurement

- Marketing Mix Modeling: Aggregate-level attribution for budget allocation decisions

- First-Party Data Platforms: Direct customer relationship building for consent-based tracking

The Bottom Line: Compliance as Competitive Advantage

European attribution compliance in 2025 isn't just about avoiding penalties—it's about building sustainable competitive advantages. While businesses struggle with 18-42% data loss, those implementing comprehensive compliance strategies are discovering:

- Enhanced customer trust leading to higher consent rates and better data quality

- Improved data accuracy through first-party relationships versus uncertain third-party tracking

- Future-proof measurement systems that don't depend on depreciating cookie infrastructure

The enforcement actions of July 2025 mark a turning point. Companies continuing with non-compliant tracking face immediate functionality restrictions, while those investing in proper compliance infrastructure gain access to more accurate, privacy-safe attribution models that will become the industry standard.

Performance Max campaigns can thrive in this environment, but only with proper technical implementation, comprehensive consent management, and strategic shift toward first-party data relationships. The complexity is significant, but the competitive advantages for early adopters are substantial and lasting.

Looking for a Performance Team to Uplift Your Company? Speak with our experts.

Advantages of Partnering with Native European Agencies

-

Cultural and Language Expertise

Local agencies have deep understanding of regional languages, dialects, and cultural nuances essential for writing effective ad copy, selecting keywords, and optimizing campaigns across different European countries and languages. Automated translation or non-local teams often miss subtle contextual meanings impacting engagement and conversions. -

Knowledge of Local Market Dynamics and Regulations

Native agencies are well-versed in country-specific advertising regulations (e.g., GDPR nuances, financial ad restrictions) and market behavior. This reduces compliance risks and ensures campaigns are legally sound and more effective. -

Better Communication and Collaboration

Proximity facilitates easier real-time communication, quicker feedback loops, and face-to-face meetings if needed, enhancing campaign management agility. This reduces miscommunication often seen with remote global providers or in-house teams unfamiliar with local markets. -

Local Network and Media Relationships

Local agencies often have established relationships with local publishers, platforms, and influencers, which can be leveraged for partnerships, sponsorships, or unique ad placements unavailable to foreign vendors.

Challenges and Considerations with Local Agencies

-

Higher Cost: Local European PPC agencies may charge a premium compared to offshore or global vendors, reflecting higher operating costs.

-

Limited Talent Pool or Scale: Smaller local firms might lack access to the breadth of tools or data analytics capabilities available to large global providers.

-

Potential Lack of Global Scale: For companies seeking pan-European or global coordination, multiple local agencies complicate unified strategy execution and reporting.

Managing PPC In-House from Outside Europe

Pros

- Full Control Over Campaigns: In-house management provides granular control over ad strategy, budgets, and data without relying on third parties.

- Global Brand Consistency: Easier to maintain consistent brand messaging aligned with global standards.

Cons

- Expertise Gaps: European PPC requires deep local knowledge; in-house teams outside Europe may struggle with keyword localization, regulatory compliance, and cultural adaptations.

- Resource Intensive: Requires substantial investment in hiring, training, and maintaining local PPC specialists with regional expertise plus acquiring local market intelligence tools.

- Time Zone and Communication Barriers: Managing timely campaign adjustments and local market insights can be hampered by distance and lack of local presence.

Using Global Vendors with Local Expertise Hubs

-

Many global PPC vendors maintain local market specialists or country-specific teams to offer the benefits of scale with local nuances.

-

This hybrid approach allows centralized campaign oversight with expert input on local optimization and compliance.

-

Integrated tech stacks and unified reporting dashboards reduce the operational complexity of managing campaigns across multiple countries.

Best Practices for Choosing or Building Agency Partnerships (From a Codedesign Perspective ofc)

Before chosing, cheking competences and pricing here are a few thingsI would look at:

- API and Reporting Integration: Ensure chosen agencies or vendors provide robust API access to campaign data for seamless integration into your centralized dashboards or CRM systems. Real-time data flow enables agile optimization and better ROI tracking.

- Automated Localization Pipelines: Employ platforms or workflows for scalable ad copy testing across languages with local input stages—e.g., collaborative tools that enable local PPC managers to review and approve translations or keyword lists before live deployment.

- Modular Campaign Architecture: Design campaigns as modular building blocks per country/language that can be customized by local teams without breaking global structure. This helps balance consistency and localization.

- Compliance Workflow Integration: Implement compliance checks as part of the campaign deployment pipeline, leveraging local agency expertise or automated rule-based systems that flag potential GDPR or ad policy violations before launch.

- Clear SLA and Communication Protocols: Define coding/design standards for how campaign information, feedback, and changes are communicated—via project management tools or APIs—to reduce delays and errors.

- Multi-Country Testing Frameworks: Use A/B or multivariate testing frameworks architected for multi-country rollouts, allowing local variations while aggregating performance data centrally for scalable learning.

From our perspective, partnering with native European PPC agencies brings essential cultural, linguistic, regulatory, and operational advantages that in-house teams outside Europe or purely global vendors may struggle to match. However, it requires strong integration practices—APIs for data and reporting, modular campaign design, compliance pipelines, and clear communication protocols—to scale effectively across diverse European markets. A hybrid strategy combining global coordination with trusted local partners often yields the best business outcomes.

This approach optimizes time to market, cost-efficiency, and campaign effectiveness while maintaining the flexibility and control needed by international businesses expanding into Europe.

If needed, this research can be accompanied by code / design architecture outlines and tool recommendations for multi-market PPC campaign management workflows.

For a non-European company launching PPC campaigns in Europe, partnering with native local PPC agencies offers strong advantages from a code and design standpoint:

- Local Cultural and Language Expertise: Native agencies craft linguistically and culturally relevant ads, keywords, and landing pages that automated or overseas teams often miss, improving CTR and conversions.

- Regulatory and Market Know-How: Local vendors ensure GDPR and country-specific ad compliance, avoiding costly violations, and better tailor bids and targeting to market dynamics.

- Better Communication and Agility: Proximity enables faster feedback and collaboration cycles, reducing miscommunication common with remote/global teams.

- Local Networks: Access to local publishers and platforms allows unique placements and partnerships.

Challenges include higher costs, fewer talent/resources than global agencies, and potential complexity managing multiple local partners.

Managing in-house from outside Europe grants control and brand consistency but suffers from lack of local insight, costly hiring/training, and timezone hurdles, limiting agility and optimization.

Global vendors with local market hubs offer centralized control and scale yet retain local expertise, better tech integrations, unified reporting, and stronger compliance workflows.

From our view:

- Ensure APIs for real-time campaign data flow to centralized dashboards for agile decision-making.

- Build automated localization pipelines with local expert reviews to scale multilingual ad copy.

- Use modular campaign structures allowing local customization without breaking global consistency.

- Integrate compliance checks into campaign deployment workflows to preempt GDPR or policy issues.

- Define communication protocols and SLAs via project tools/APIs to reduce errors and delays.

- Implement multi-country A/B testing frameworks with centralized analytics for scalable learning.

Local European PPC agencies bring indispensable market and cultural expertise critical for success. The best approach combines these local partners with strong integration design—APIs, modular architecture, automated workflows, and clear communications—to scale efficiently and maintain control. This hybrid model delivers superior ROI and faster expansion for outside companies entering European PPC markets.

5 Key FAQs about this article

1. Why are Google Ads CPCs so different across European countries?

Because CPCs are tied to local GDP, market maturity, and competition. Wealthier, digitally mature markets (UK, Germany, Switzerland) drive higher CPCs, while emerging Eastern European markets (Poland, Czech Republic) remain cost-efficient.

2. Which industries face the highest Google Ads costs in Europe?

Legal services and insurance dominate with CPCs often above €4.00, driven by regulation, customer lifetime value, and competition. Mid-range industries include healthcare and technology, while e-commerce remains the most budget-friendly.

3. How has GDPR changed Google Ads performance in 2025?

Since July 2025, Google enforces Consent Mode v2. Non-compliant advertisers face disabled conversion tracking, remarketing, and personalization—causing 18–42% attribution data loss. Server-side tracking and first-party data are now essential for accurate ROI measurement.

4. What’s the best strategy for businesses with smaller budgets?

Focus on micro-targeting, long-tail keywords, and local market advantages. Many European businesses spending under €2,500 monthly still achieve strong ROI by narrowing targeting rather than competing in broad, high-cost categories.

5. Should non-European companies manage PPC in-house or partner with local agencies?

Partnering with native European agencies provides cultural, language, and compliance advantages. However, to scale across multiple markets, a hybrid approach works best: global oversight + local agency expertise, supported by APIs, automated localization pipelines, and compliance-integrated workflows.

Add comment ×