12 min to read

The past few years have been the age of experimentation. We asked: Can we do it? Can we build on first-party data? Can we measure without cookies? Can video become commerce? Can AI reshape how we create and optimize?

The answer to all of these has been yes. But 2026 isn't about possibility—it's about execution.

As a global performance marketing agency working across the United States, Europe, Latin America, the Middle East, and Asia-Pacific, we've spent the last twelve months watching patterns repeat across these markets. And we're seeing something clear: the companies and brands that will win in 2026 aren't the ones still experimenting. They're the ones who've made a decision to embed these shifts into their operating model, measurement, and culture.

What's also clear is that 2026 will be harder. Economic headwinds—tighter marketing budgets, headcount pressure, the quietly accelerating "vanishing middle class" that's reshaping consumer affordability—means that marketers no longer have room for tentative pilots. Every dollar spent, every hire made, and every capability built must tie back to revenue and margin. We've sat in rooms where CFOs outnumber CMOs. That's new. And it matters.

So here are the seven business trends we're betting on—not because they're buzzwords, but because they're moving the needle for the clients we partner with every week.

AI-Driven Discovery and GEO/AEO Reshape How Brands Are Found

For twenty years, being "found" meant ranking in Google. It still does. But the rules of visibility are changing faster than most marketing teams realize.

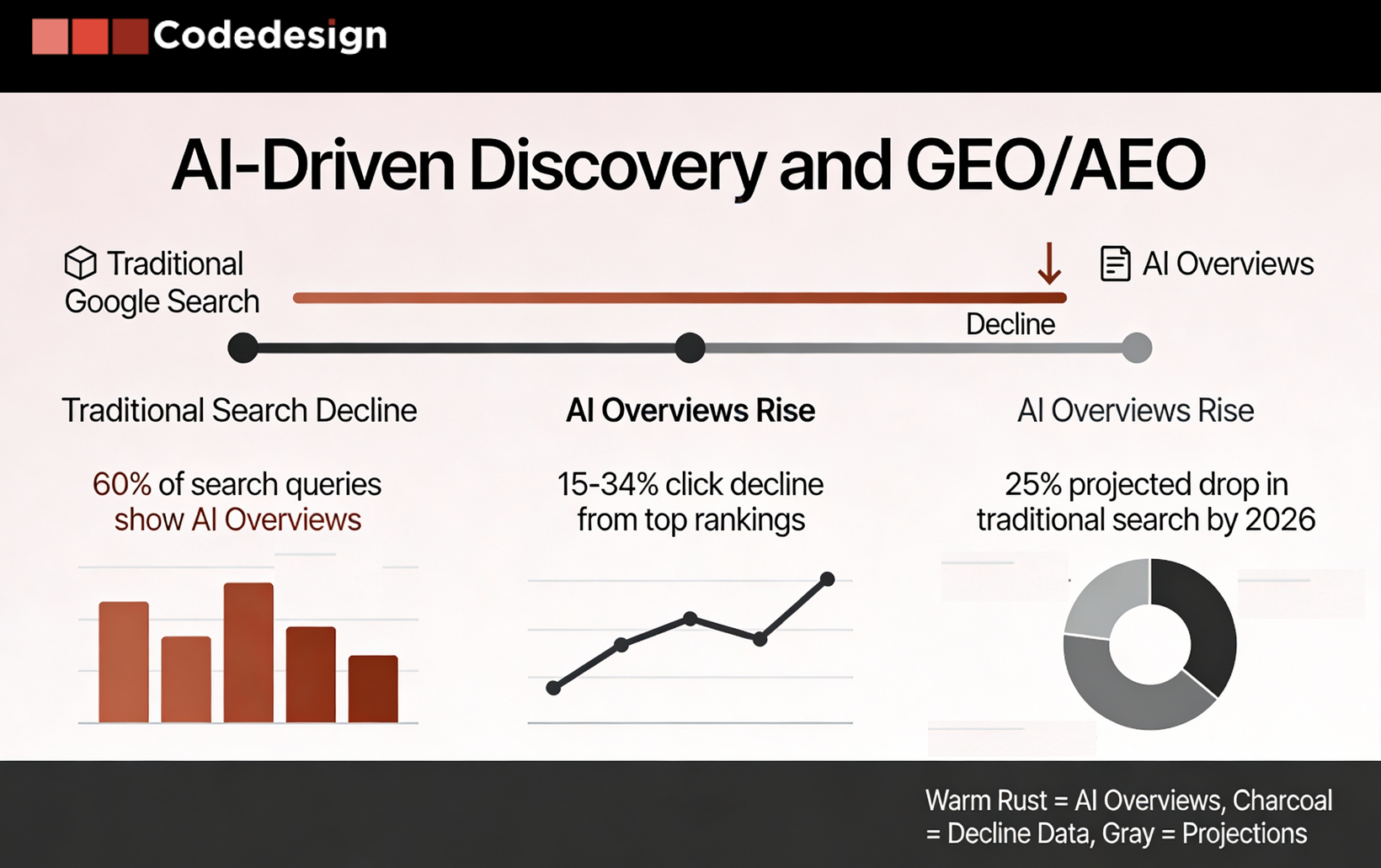

AI Overviews and generative answer engines are now appearing in over 60% of Google search queries. What this means isn't subtle: when a consumer searches for your product category, they increasingly get an answer—not a set of links. And that answer often cites three or four brands, sometimes in a compressed summary that takes seconds to read.

The data is unsparing. Google's own research shows that traditional rankings in the top position are seeing 15-34% fewer clicks as users get their answers from the AI overview instead. Gartner projects that traditional search will drop 25% by 2026. In other words, the old game—chasing volume keywords to drive traffic—is ending.

This week, in a review with a B2B SaaS client, we showed them the gap between their search traffic and their visibility in AI-generated overviews. They ranked well for their core keywords. But they weren't being cited in the AI summaries. Why? Their content wasn't structured as answers. It was structured as a sales pitch. Once we rebuilt their content architecture—adding schema, FAQ clusters, entity clarity, and topical authority hubs—their appearance in AI overviews jumped by 40% in six weeks. Traffic followed. But not from clicks to their website. From qualified leads who'd already gotten an answer about their brand.

This is what Answer Engine Optimization (AEO) and Generative Engine Optimization (GEO) mean in practice. You're no longer just optimizing for clicks. You're optimizing to be cited, summarized, and trusted by AI systems. You're competing to be the brand that the AI chooses to mention.

What this means for a CMO in 2026:

Start: Conduct an AI-readiness audit. Run your key product queries through Google's AI Overview, ChatGPT, Claude, and other answer engines. Where does your brand appear? Are you cited? Are you wrong? Fix it.

Stop: Chasing keyword volume as a proxy for visibility. Volume traffic means nothing if your conversion rate has evaporated because the consumer already got their answer (mentioning your competitor).

Accelerate: Invest in entity-based content strategy, schema markup, and FAQ optimization. Train your content teams on how to structure for "being quoted," not "being linked." This applies across search, social, marketplaces, and AI assistants—what we call "Search Everywhere Optimization."

Video Becomes a Transaction Layer, Not Just a Branding Channel

A few years ago, we measured video success by reach: impressions, views, watch-through rate. Today, the best-performing video assets are the ones that drive add-to-cart and checkout.

The convergence is real. TikTok, Instagram Reels, YouTube Shorts, and Pinterest have all embedded shoppable overlays, instant checkout, and creator-commerce features into their platforms. Live shopping is no longer a niche format; it's a standard feature. Amazon, Walmart, and emerging platforms like Shopshop are building their entire growth strategy around shoppable video. The boundary between content, entertainment, and purchase is dissolving.

What's accelerating this is AI-generated video. An IAB study found that 86% of advertisers are already using or planning to use generative AI for video ad production. By 2026, generative AI will account for 40% of all video ads. This changes the economics entirely. Production is no longer a bottleneck. Iteration is no longer expensive. You can test 50 creative variations in the time it used to take to produce one.

At one of our retail clients, we completely restructured how they approach video performance. Instead of building 3-5 hero spots per month—polished, expensive, slow to produce—they now run an always-on testing matrix. AI tools help produce 20-30 variations weekly. Different hooks, CTAs, product angles, price points, offers. Every variation ships with shoppable overlays, links to product pages, and conversion tracking. The ROAS lift? 3x in the first 90 days.

But here's what matters: the human still leads. Our strategist identifies the highest-performing hooks and CTAs. AI generates variants. We test, learn, and amplify winners. It's not "AI creates the ads." It's "AI makes our best people faster."

What this means for a Marketing Director in 2026:

- Start: Reframe your video KPIs. Retirement "views" and "engagement" as primary metrics. Replace them with add-to-cart rate, checkout rate, and downstream revenue contribution. Build attribution that ties video views to orders.

- Stop: Thinking of video as a branding channel with a separate team. Video is now a conversion channel. Treat it like performance marketing.

- Accelerate: Design testing matrices for every major campaign. Use AI to rapidly produce variations, but set clear guardrails around brand safety and messaging. Build feedback loops so winning creative patterns compound over time.

Privacy-First, First-Party Data as a Core Business Asset

Third-party cookies are gone. Regional privacy regulations—GDPR, CCPA, and others—continue to tighten. Walled gardens (Apple, Amazon, Google) control more of the customer relationship than marketers do. And yet, the brands that are winning in 2026 aren't panicking. They're treating first-party data as their unfair advantage.

First-party data is data you own. It comes from customers who've explicitly consented to be tracked. It lives in your CRM, your CDP, your email lists, your website events. It's consented. It's yours. And unlike cookies or lookalike audiences, it never goes away.

At a recent leadership offsite with a B2C client, we had a moment of clarity. The client was anxious about iOS updates, third-party cookie deprecation, and rising CPMs across paid channels. We pulled their data. They had 200,000 first-party customers in their database. They were using maybe 20% of them for media activation. The rest sat dormant. Their biggest growth lever wasn't a new channel. It wasn't a creative innovation. It was simply turning fragmented customer data—stored in email, CRM, transaction databases, support systems—into a unified first-party spine for paid media, lifecycle marketing, and incrementality testing.

Six months later, they'd reduced their paid acquisition cost by 22% and increased LTV by 18%, almost entirely through better activation and measurement of their own data.

This is what 2026 looks like: data as capital. Not as a compliance concern. As your most defensible advantage.

What this means for your organization in 2026:

Start: Audit your data collection and consent architecture. Are you collecting first-party signals systematically? Are customers consenting? Is your data clean and unified?

Stop: Relying solely on platform-provided audiences (lookalikes, in-market, affinity). These are increasingly effective as a starting point, but they're commoditized. Your edge is your own data.

Accelerate: Build a CDP/CRM backbone. Integrate transactional data, engagement data, and survey data. Connect it to your paid media platforms via server-side tracking and conversion APIs. Invest in audience segmentation and lifecycle workflows that activate your data across channels. This is no longer a "martech" project. It's a business priority.

Retail Media Networks Move from Niche to Mainstream

If you told us five years ago that retailers would become media companies, we'd have smiled politely. Today, it's not a strategy question. It's a line item in every brand's media plan.

Retail media networks have exploded. In 2025, RMN spending reached approximately $62 billion. For 2026, WARC forecasts this will grow to $174.9 billion—a 12.4% year-on-year increase, representing 16% of all advertising spend globally. To put this in context: retail media is now competing with connected TV and linear TV combined.

What changed? Two things. First, retailers realized that advertising has higher margins than retail. Walmart's CFO recently acknowledged that Walmart Connect now represents 33% of the company's operating income. That kind of economics is hard to ignore. Second, brands realized that retail media isn't just a place to buy last-click conversions at the point of sale. It's a full-funnel channel where a brand can reach audiences with awareness campaigns, drive consideration, and then capture intent at purchase.

But here's the operational reality that most teams aren't talking about: managing retail media at scale is a mess.

The average brand is now managing 6 retail media platforms. That number is projected to double to 11 by 2026. There are 200+ RMNs globally, yet only a handful have the measurement rigor, audience targeting sophistication, and integration capabilities that justify investment. Brands are spending 15-20 hours per week on manual reporting, struggling with inconsistent measurement standards, and losing $28 billion annually to fragmentation and inefficiency.

This is where integrated thinking matters. In 2026, a brand's approach to retail media can't be "let's test Amazon and Walmart." It has to be "how do we integrate product data, media planning, creative strategy, and measurement across our top 3-5 RMN partners—and ignore the rest?"

At one of our CPG clients, we helped consolidate from 8 platforms to 4. We centralized measurement. We built attribution that connected RMN campaigns to offline purchase data. And we synchronized RMN creative with their broader paid social and search strategy. The outcome: 40% improvement in ROAS, and a cleaner operational model.

What this means for a CMO in 2026:

Start: Formalize your top 3-5 retail media partners. These should align with where your customers actually shop—not based on FOMO.

Stop: Treating RMNs as test budgets. These are core channels now. Allocate talent, measurement, and creative resources accordingly.

Accelerate: Build unified measurement that connects RMN campaigns to business outcomes (revenue, margin, LTV). Integrate your first-party audience data into RMN platforms. Coordinate creative and messaging across RMN and performance channels. Consolidate platform management tools to reduce operational overhead.

The Creator Economy Shifts to Co-Creation and Community

The influencer marketing conversation used to sound like this: "How many followers do they have? What's their engagement rate? Can we get a good deal?"

In 2026, that conversation is almost extinct. What we're hearing instead: "Can they sit at the table when we design the product? Can they help us understand their community? Can we build something together that's theirs and ours?"

The creator economy has matured. Influencers are no longer one-off talent. They're strategic partners. The best ones are building their own media companies, their own communities, their own revenue models. They don't need a brand as much as a brand needs them. And they know it.

This changes the structure of partnerships. We were invited to speak at a conference on the future of influencer marketing. The most interesting questions in the room weren't about follower counts or CPMs. They were about co-IP, creator contracts, measurement frameworks, and community health. One brand manager asked: "How do we structure a deal where a creator is a co-founder of a product line, not just a paid spokesperson?" That's the question.

The data backs this. Influencer marketing investment is up 171% year-over-year. But the best ROI doesn't come from mega-influencers with 10 million followers. It comes from micro-communities—1,000 to 50,000 engaged followers—where the creator has genuine authority and authentic voice. A micro-creator can deliver 10x ROI compared to a celebrity influencer, and the relationship scales better over time.

At one of our fashion clients, we identified 15 micro-creators in specific niches (sustainable fashion, body inclusivity, vintage styling). Instead of paying them per post, we brought them into quarterly product design sessions. They gave feedback. They helped name products. They got equity-like arrangements. The result? Content that felt native. Conversion rates that were 5x higher than paid influencer placements. And a group of creators who were genuinely invested in the brand's success.

What this means for your brand in 2026:

Start: Shift your influencer brief. Move from "Can you post about us?" to "What should we build together?"

Stop: Chasing follower counts. Build a spreadsheet of creators organized by community type, not reach, and by authentic alignment with your brand.

Accelerate: Run regular co-creation sessions with your best creator partners. Involve them in product, campaign, and community strategy. Measure creator impact not by vanity metrics (impressions, likes), but by assisted revenue, LTV lift, and community growth. Treat creators as partners, and you'll see performance that transactional relationships can't deliver.

AI Becomes the Marketing Operating System, But Human Judgment Is the Edge

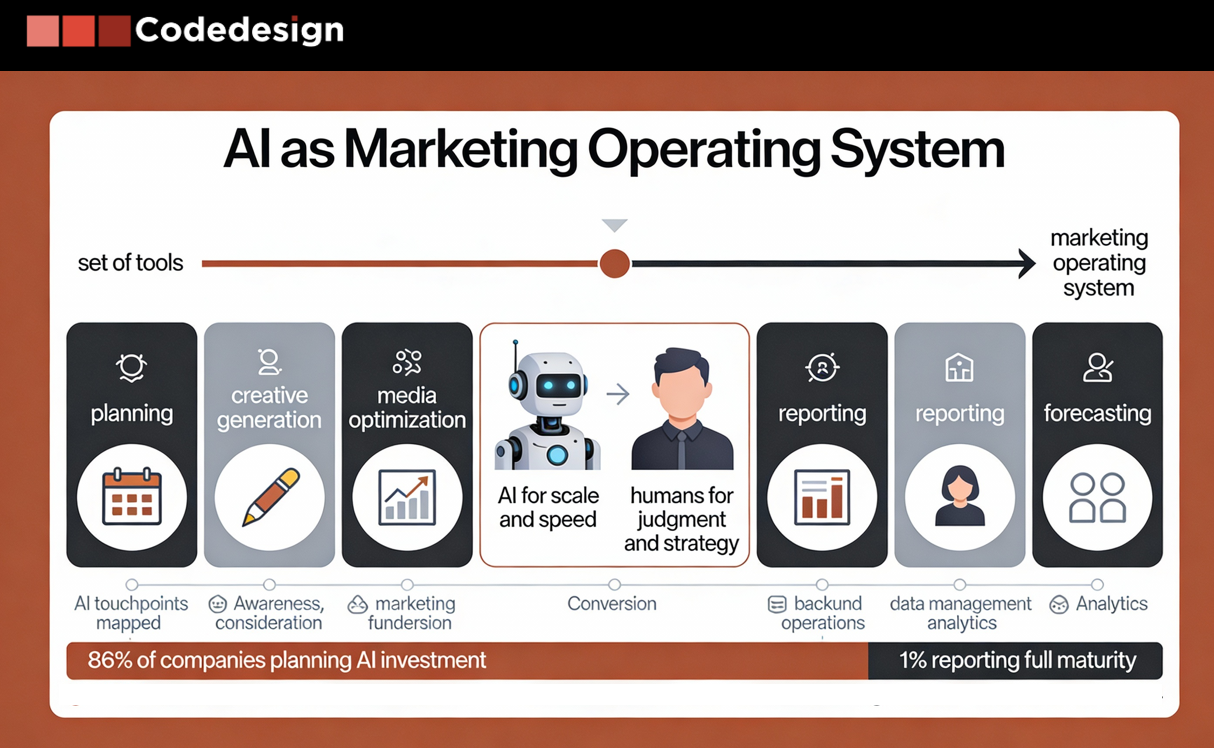

It's no longer useful to ask: "Should we use AI in marketing?" The answer is yes. The real question is: "How do we structure AI into our operating model so it improves P&L instead of just activity?"

AI is moving from a set of tools to the operating system. It's baked into media buying platforms (Meta, Google, Amazon), analytics suites (HubSpot, Segment, Mixpanel), creative tools (Midjourney, Runway, ChatGPT), and forecasting layers (predictive analytics, attribution modeling, MMM). If you're a marketer in 2026 and you're not using AI for planning, creative generation, media optimization, or reporting, you're at a structural disadvantage.

But—and this matters—AI is still in the "hammer looking for nails" phase. Meta has announced plans to fully automate advertising by end of 2026. Brands will upload a product image and budget, and the AI will build the campaign, target it, optimize it, measure it. And it will work. But it will also:

-

Hallucinate brand messaging

-

Miss cultural nuance and local market insight

-

Ignore ethical guardrails around data and privacy

-

Churn through creative variations with zero storytelling coherence

-

Make decisions that look good on a dashboard but erode brand equity

That's where human judgment comes in. At Codedesign, we use AI extensively. It helps us:

-

Generate keyword clusters and topic models

-

Produce creative variations rapidly (headlines, copy, imagery)

-

Build campaign forecasts and budget scenarios

-

Audit performance gaps and flag optimization opportunities

-

Automate reporting and insight generation

But we never let AI make the strategic call alone. A strategist reviews the insight. A creative director curates the variations. A planner makes the budget trade-off. A CFO-minded operator asks: "Is this incrementally valuable, or are we just generating activity?"

This is the hybrid model that works: AI for scale and speed. Humans for judgment, culture, and ethics.

What this means for your team in 2026:

Start: Inventory where AI can reduce toil (reporting, data aggregation, creative variation, scenario modeling). Implement tools for those workflows.

Stop: Automating strategic decisions. AI can forecast. You decide.

Accelerate: Invest in AI governance. Document how AI is used in your organization. Build guardrails around brand safety, data privacy, and bias. Upskill your team on how to prompt, critique, and refine AI outputs. Treat AI as your team's most junior analyst—capable and fast, but needs direction.

Measurement, MMM, and Decision-Quality Under Budget Pressure

We've sat with dozens of marketing leaders in the last few months. One common thread: CFOs are asking harder questions about ROI. The days of "brand building" as a budget line item are over. Every dollar needs to contribute to revenue or margin.

This is changing how brands measure.

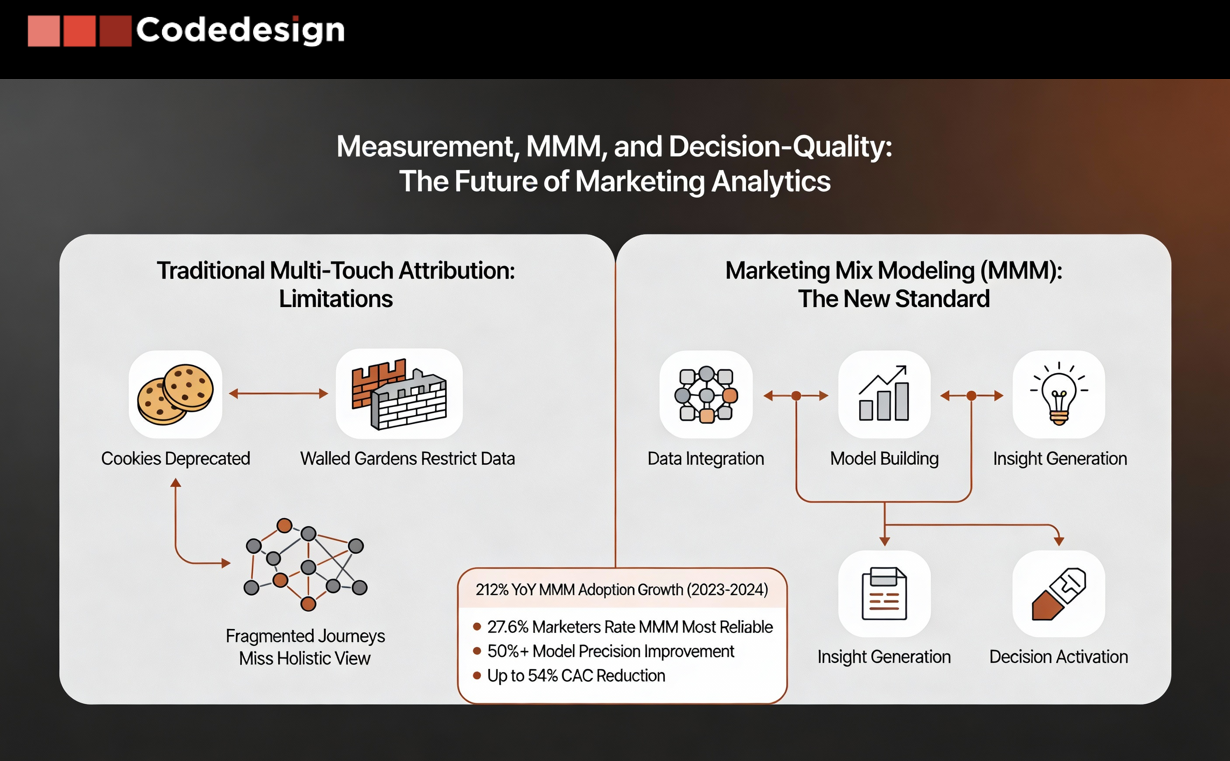

For years, the gold standard was multi-touch attribution: tracking every touchpoint in the customer journey, assigning credit, and calculating ROI. It sounds perfect in theory. In practice, it's collapsing. Third-party cookies are gone. Cross-device tracking is unreliable. Customer journeys fragment across walled gardens (Apple, Amazon, Google, Microsoft). And most importantly: the methods we've been using for attribution were always proxies. They felt scientific, but they weren't.

Enter marketing mix modeling (MMM). Once dismissed as an old-school approach, MMM is making a comeback. And it's strong.

MMM looks at aggregate-level data—total media spend by channel, total revenue, seasonality, competitive activity, external factors—and uses statistical modeling to isolate the true ROI of each channel. It doesn't require user-level tracking. It works in a privacy-first world. And the data is compelling: marketers are reporting 212% year-over-year growth in MMM adoption since 2023. Nearly 28% of marketers now identify MMM as their most reliable measurement methodology.

But—and this is crucial—MMM isn't a silver bullet. It requires 6-12 months of baseline data. It's statistical, not deterministic. It works best for high-spend channels where you can see macro patterns. And it requires clean, integrated data across channels and business systems.

Here's how we're approaching it with clients in 2026:

-

Build a unified data foundation. Connect media spend data (paid social, search, retail media, email), sales data (by region, product, channel), and external factors (seasonality, economic indicators, competitor activity).

-

Develop an MMM model that accounts for adstock (carryover effects), saturation (diminishing returns), and interaction effects (how channels work together).

-

Validate against experiments. Run incrementality tests (holdout tests, geo-split tests) to verify that the MMM insights match real-world causality.

-

Use it for scenario planning. "If we shift 10% of budget from paid social to retail media, what happens to revenue?" MMM lets you answer that question with confidence.

-

Automate and refresh. Modern MMM tools can refresh weekly or daily, so your insights stay current.

At a recent workshop we ran, we had more CFOs than CMOs in the room. That told us something important: measurement is no longer a marketing problem. It's a business problem. And CFOs care about it.

What this means for your organization in 2026:

Start: Audit your current measurement stack. Are you relying on last-click attribution? Recognize its limits. Begin collecting aggregate data (channel spend, revenue by channel, external factors) to set up MMM.

Stop: Chasing perfect attribution. It doesn't exist. Instead, invest in methods that are "good enough" but actionable—MMM, incrementality tests, simple contribution models.

Accelerate: Build MMM infrastructure. Implement tools (open-source options like Meta's Robyn, or commercial platforms like Measured, Analytic Partners). Align your media team with finance. Report performance in business terms (incremental revenue, ROAS) instead of vanity metrics. Use MMM outputs to inform budget reallocation.

The System: How These Trends Connect

Here's what separates the winners from the rest: the best marketing organizations don't treat these seven trends as separate projects. They treat them as one integrated system.

AI discovery shapes what content you create (entity-based, answer-focused, structured). That content feeds into demand creation, which builds your content moat. Shoppable video becomes one of your conversion layers. First-party data powers audience targeting in video, paid social, and retail media. Retail media becomes a full-funnel channel, not just a conversion play. Creators help you tell stories that resonate in all these channels. AI helps you optimize across all channels at scale. And MMM ties everything back to business outcomes.

The brands that are winning in 2026 are the ones that see these not as silos, but as pieces of one machine.

90-Day, 6-Month, and 12-Month Roadmap

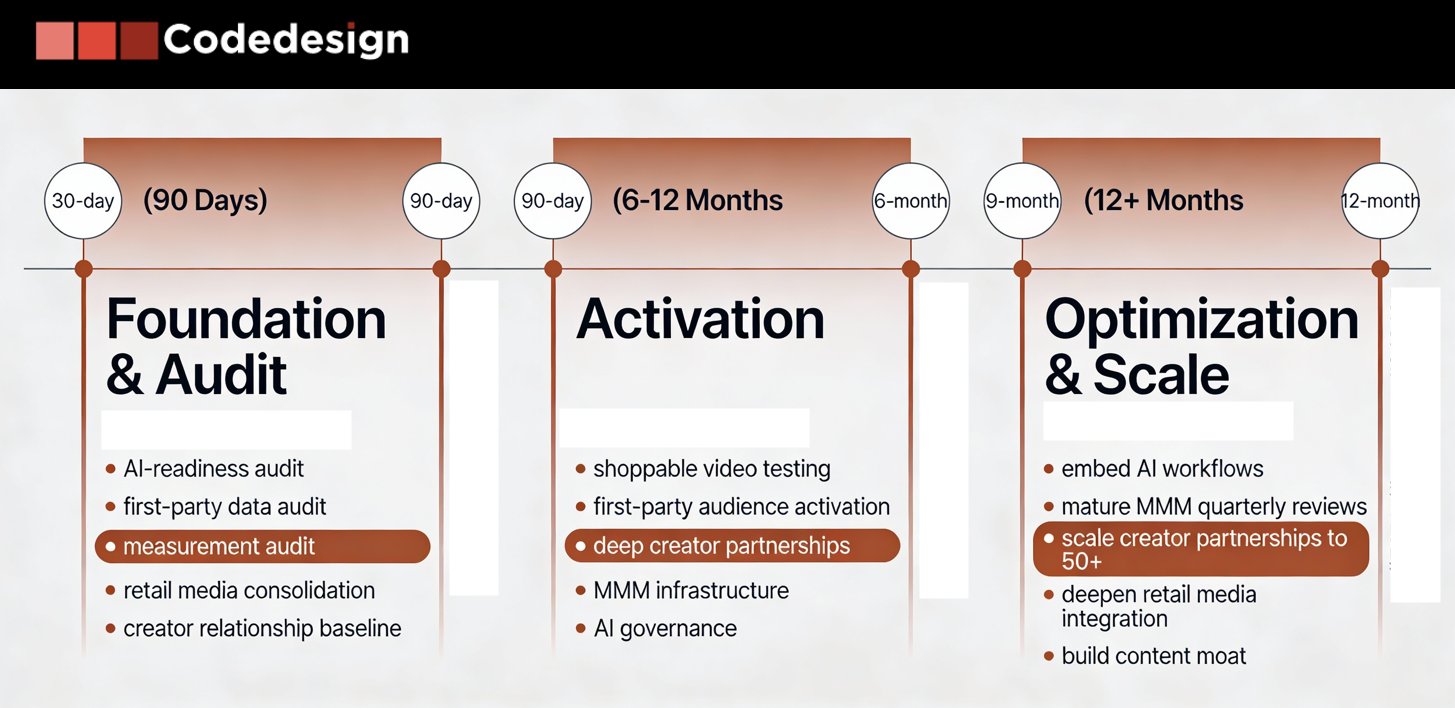

90 Days: Foundation & Audit

-

Conduct an AI-readiness audit: Where does your brand appear in AI-generated overviews? What's your GEO/AEO gap?

-

Audit your first-party data: Is it clean? Unified? Consented? What's your CDP/CRM situation?

-

Audit your measurement: Are you relying on last-click attribution? Identify gaps.

-

Consolidate your retail media strategy: Which 3-5 platforms align with your customers?

-

Baseline your creator relationships: Who are your top 10 creators? Are they in partner mode or transactional mode?

6–12 Months: Activation

-

Launch shoppable video testing matrix. Start small. Measure add-to-cart and conversion rates. Iterate.

-

Activate your first-party audiences across paid media. Build segment-specific campaigns. Measure incrementality.

-

Pilot 1-2 deep creator partnerships. Move beyond sponsored posts to co-creation: product input, equity arrangements, community building.

-

Implement MMM infrastructure. Collect baseline data. Validate against experiments.

-

Build AI governance: Document how you're using AI. Set guardrails. Upskill your team.

12+ Months: Optimization & Scale

-

Embed AI into your creative, media, and analytics workflows. Systematize the human-AI hybrid.

-

Mature your MMM to the point where it informs budget reallocation quarterly.

-

Scale your creator partnerships. Move from 10 partners to 50+. Build infrastructure to manage at scale.

-

Deepen retail media integration. Connect first-party audiences, coordinate creative, align measurement.

-

Build a content moat through narrative-led, original POV content. Let AI help you scale it, but lead with strategy and insight.

A Final Word

2026 will be hard. Budgets will be tighter. Competition will be fiercer. And the brands that win will be the ones willing to make hard decisions: which channels to invest in, which are noise, which creator relationships matter, how to measure what truly drives revenue.

We don't have all the answers. Nobody does. But we're learning alongside our clients. And what we're seeing across markets is clear: the fundamentals haven't changed. Drive discovery. Build trust. Measure outcomes. Activate data. Partner with humans who amplify your message. Invest in AI where it creates leverage, not just activity.

If you're a CMO, a founder, or a CEO thinking about how to organize your team and budget for 2026, that's where we can help. We don't just execute trends. We help you build the operating model, the measurement, the talent, and the partnerships that actually move P&L.

2026 is the year of execution. And we're ready to help you execute.

Add comment ×