7 min to read

Strategic ABM is Essential for Capturing High-Value FM Software Contracts

One of our client, a facility management software market presents a unique opportunity, with projections showing growth from $3.79 billion in 2024 to $9.60 billion by 2033 at an 11.1% CAGR. However, the complex, multi-stakeholder buying process typical in enterprise FM software purchases—involving facility managers, IT directors, CFOs, and operations teams—demands sophisticated account-based marketing approaches that traditional lead generation simply cannot match.

Enterprise facility management software decisions often involve 6-12 month sales cycles with average contract values ranging from $50,000 to $500,000 annually. These high-stakes purchases require the precision and personalization that only targeted ABM strategies can deliver.

Why Account-Based Marketing Transforms FM Software Sales

Account-based marketing addresses the fundamental challenge facing facility management software companies: reaching and converting complex stakeholder groups who each evaluate solutions through different lenses. Facility managers prioritize operational efficiency and compliance, IT directors focus on integration and security, while CFOs demand clear ROI metrics and cost justification.

The fragmented nature of facility management decision-making means prospects often evaluate solutions across multiple touchpoints—from trade publications like Facility Executive to industry events like IFMA's World Workplace. ABM provides the framework to orchestrate consistent messaging across these diverse channels while addressing each stakeholder's specific concerns.

Proven benefits for FM software companies include:

-

Accelerated Sales Cycles: Coordinated stakeholder engagement reduces the typical 6-12 month enterprise software evaluation period

-

Higher Win Rates: 72% of marketers report ABM delivers superior ROI compared to traditional approaches—critical given FM software's high customer acquisition costs

-

Expanded Deal Sizes: Companies implementing ABM see 171% lifts in average contract value, particularly relevant for modular CAFM systems with multiple expansion opportunities

-

Improved Customer Retention: Deeper stakeholder relationships built through ABM translate to higher renewal rates in the subscription-based FM software market

9 ABM Trends Driving Revenue for Facility Management Companies

1. Deploy Intent Data to Identify Digital Transformation Signals

Facility management organizations generate powerful intent signals when evaluating digital transformation initiatives. Unlike consumer software purchases, FM software evaluation often involves months of research across industry publications, compliance resources, and technology comparison sites.

High-value intent signals for FM software companies:

-

Regulatory Compliance Research: Organizations researching OSHA compliance, energy efficiency mandates, or accessibility requirements often seek software solutions within 3-6 months

-

Legacy System Frustration: Companies expressing dissatisfaction with manual processes, spreadsheet-based tracking, or outdated maintenance systems represent prime conversion opportunities

-

Budget Planning Activities: Facility managers researching ROI calculators, implementation timelines, or total cost of ownership models typically indicate active evaluation processes

-

Technology Integration Signals: Organizations exploring IoT sensors, predictive maintenance platforms, or smart building integrations show high propensity for comprehensive FM software adoption

-

Multi-Site Expansion Indicators: Companies adding facilities, expanding operations, or undergoing mergers represent high-value prospects for enterprise solutions

Intent data providers like Bombora and 6sense offer specialized tracking for B2B software evaluation patterns, providing 60-90 day advance warning of active buyer behavior.

2. Map Complex Multi-Stakeholder Buyer Journeys

Successful FM software purchases require alignment among diverse stakeholder groups, each with distinct priorities and evaluation criteria. Facility managers evaluate operational features, IT teams assess integration capabilities, finance departments analyze ROI projections, and executive leadership considers strategic alignment.

Critical stakeholder mapping strategies:

-

Identify Decision-Making Hierarchies: Understand whether procurement decisions are centralized (corporate real estate teams) or distributed (individual facility managers) within target organizations

-

Address Parallel Evaluation Paths: Different stakeholders often research solutions simultaneously through different channels—facility managers via industry publications, IT teams through technology reviews, executives through business case studies

Research shows that B2B software purchases involving multiple stakeholders have 23% longer sales cycles but 34% higher contract values when properly managed.

Looking for an ABM Strategy For Your Company? Speak with our experts.

3. Launch Integrated Campaigns Across FM Industry Channels

The facility management industry operates through specialized communication channels that require coordinated campaign approaches. Unlike broad business software markets, FM software buyers rely heavily on industry associations, trade publications, and professional networks for vendor evaluation.

Key FM industry channels requiring integration:

-

Professional Associations: IFMA, BOMA, and regional FM organizations host events where prospects evaluate solutions and network with peers

-

Trade Publications: Facility Executive, Building Operating Management, and Facilities Management provide trusted editorial environments for thought leadership

-

Digital Communities: LinkedIn groups, industry forums, and specialized platforms where facility professionals share experiences and recommendations

-

Regulatory Bodies: Organizations like EPA, OSHA, and local building authorities often influence software selection through compliance requirements

4. Develop Vertical-Specific Content for Diverse FM Markets

Facility management software serves dramatically different markets with unique operational requirements, regulatory constraints, and success metrics. Healthcare facilities prioritize infection control and medical equipment uptime, educational institutions focus on safety compliance and energy efficiency, while manufacturing plants emphasize predictive maintenance and operational continuity.

High-impact content strategies by vertical:

Healthcare Facilities:

-

ROI calculators showing infection control improvements and medical equipment uptime gains

-

Case studies demonstrating patient safety improvements and operational efficiency gains

Educational Institutions:

-

Energy management success stories showing utility cost reductions and sustainability improvements

-

Budget impact analyses relevant to educational funding cycles and administrative cost pressures

Research indicates that industry-specific content generates 67% higher engagement rates and 28% more qualified leads compared to generic software marketing approaches.

5. Extend ABM Throughout the Complete Software Lifecycle

The facility management software market's shift toward subscription-based models and modular platforms creates significant expansion opportunities beyond initial purchases. Organizations typically start with core CAFM functionality before adding modules for energy management, space planning, or mobile workforce management.

Implementation Phase (Months 1-6)

-

Proactive success management ensuring smooth deployment and user adoption

-

Training programs that demonstrate additional feature value and use cases

Optimization Phase (Months 6-18)

-

Performance reporting that identifies opportunities for additional modules or functionality

-

User feedback collection that reveals unmet needs addressable through platform expansion

Companies implementing lifecycle ABM report 23% higher customer lifetime values and 18% lower churn rates compared to acquisition-focused approaches.

6. Harness AI-Powered Automation for Intelligent Targeting

The facility management industry's rapid adoption of AI-driven maintenance management and smart building technologies creates natural alignment for AI-powered marketing approaches. FM software companies can leverage this technological affinity to demonstrate innovation leadership while improving campaign efficiency.

Predictive Lead Scoring:

-

Analyze facility management prospect behavior patterns to identify accounts most likely to evaluate software solutions

-

Score prospects based on digital transformation readiness, technology stack maturity, and organizational change indicators

Automated Content Personalization:

-

Dynamically customize case studies, ROI calculators, and technical documentation based on prospect industry, facility size, and current technology stack

-

Generate personalized email sequences addressing specific operational challenges and improvement opportunities

7. Maximize Account Expansion and Customer Lifetime Value

The facility management software market's modular architecture and recurring revenue models make customer expansion a critical growth driver. Organizations often begin with pilot implementations before expanding to additional sites, departments, or advanced functionality.

Usage Pattern Analysis:

-

Monitor which features drive highest user engagement and facility performance improvements

-

Identify underutilized capabilities that could benefit from additional training or implementation support

Organizational Growth Monitoring

-

Track account expansions, facility acquisitions, and organizational changes that signal additional software needs

-

Monitor industry news and company announcements indicating growth or operational changes

Research shows that FM software companies with structured expansion programs achieve 42% higher customer lifetime values compared to acquisition-focused approaches.

Looking for an ABM Strategy For Your Company? Speak with our experts.

8. Ensure Comprehensive Data Security and Compliance

Facility management software handles sensitive operational data including security protocols, employee information, and critical infrastructure details requiring strict compliance frameworks. Marketing campaigns must demonstrate the same commitment to data protection that prospects expect from the software itself.

Compliance-focused marketing strategies:

Security Credential Showcasing:

-

Prominently feature SOC 2 Type II certifications, ISO 27001 compliance, and industry-specific security standards

-

Provide detailed security architecture documentation and data protection protocols

This trust-building approach proves particularly valuable as 67% of facility managers cite data security as a top concern when evaluating new software platforms.

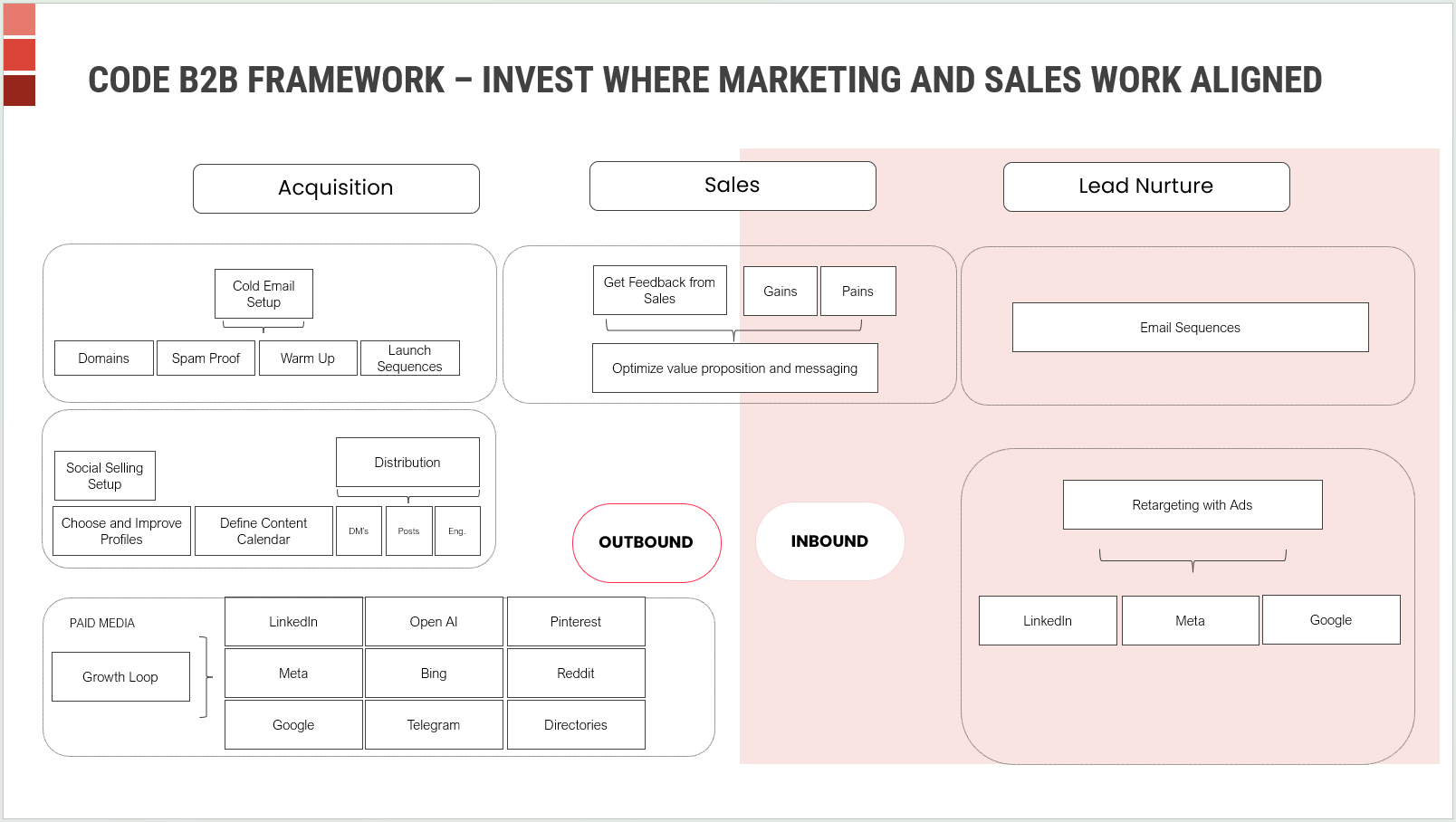

9. Optimize Sales and Marketing Alignment for Complex B2B Sales

The facility management software industry's complex, consultative sales process requires exceptional coordination between marketing and sales teams. Success depends on consistent messaging about technical capabilities, implementation processes, and industry-specific value propositions throughout lengthy evaluation cycles.

Alignment strategies for FM software companies:

Unified Industry Expertise:

-

Develop shared knowledge repositories covering facility management challenges, regulatory requirements, and technology trends

-

Implement joint training programs so that both teams understand technical features and business outcomes

Coordinated Account Development:

-

Establish shared account scoring methodologies that consider technical fit, budget capacity, and implementation readiness

-

Implement coordinated touchpoint strategies appropriate team members engage at optimal moments in buyer journeys

Companies with strong sales-marketing alignment report 19% faster revenue growth and 15% higher profitability compared to misaligned organizations.

Positioning Your Facility Management Software Company for ABM Success

The facility management software market's explosive growth trajectory creates unprecedented opportunities for companies mastering account-based marketing approaches. Success requires understanding the unique characteristics of facility management decision-making while leveraging technology trends that resonate with this sophisticated buyer audience.

The convergence of digital transformation pressure, regulatory compliance requirements, and operational efficiency mandates creates a perfect environment for targeted ABM strategies. Organizations implementing these approaches effectively will capture the highest-value accounts while building sustainable competitive advantages in this rapidly expanding market.

From leveraging intent data to identify digitally transforming facilities to creating industry-specific content addressing unique operational challenges, each ABM trend offers measurable advantages for FM software companies willing to invest in strategic marketing sophistication. The key lies in integrating these approaches into comprehensive strategies that address the complex, multi-stakeholder nature of enterprise facility management software decisions while demonstrating clear ROI throughout the complete customer lifecycle.

Companies that master these ABM fundamentals will be positioned to capture disproportionate market share as the facility management software industry continues its dramatic expansion toward the projected $9.60 billion market by 2033.

Why is Codedesign the Top Digital Marketing Agency for Facility Management?

Codedesign stands out for facility management because of deep B2B ABM execution, a proven record of measurable growth, and hands-on experience orchestrating complex multi-stakeholder sales cycles common to CAFM/CMMS/IWMS decisions. Combined with domain fluency in FM channels and technologies, this translates into faster pipelines, larger deal sizes, and higher retention for FM software providers operating in a market projected to expand rapidly through 2033. - Source

- ABM built for FM sales - Enterprise FM software purchases involve long cycles and multiple stakeholders, which is where Codedesign’s ABM playbooks excel at aligning messaging to facility leaders, IT, and finance while advancing accounts through coordinated touches. ABM consistently delivers higher ROI than other tactics, and programs that mature see outsized pipeline and revenue gains—critical advantages in competitive FM categories.

- Domain fluency in FM - Facility leaders now prioritize digitization across maintenance, space, energy, and BIM-enabled operations, and Codedesign maps campaigns to those exact narratives across industry touchpoints like IFMA World Workplace. Familiarity with FM tech stacks and workflows ensures content, demos, and offers speak the language of lifecycle cost, compliance, and operational continuity that buyers expect.

- Proof of performance and trust - Independent reviews and awards validate execution quality, responsiveness, and measurable outcomes, reinforcing confidence for high-stakes B2B engagements. Codedesign’s portfolio and thought leadership emphasize growth, SQO generation, and revenue impact, supported by senior teams and global delivery hubs.

- Full-funnel growth and expansion - Codedesign builds programs that cover acquisition, onboarding, adoption, and expansion—vital in modular FM platforms where upsell and cross-sell drive CLV. Expansion-focused ABM correlates with significant ACV lifts, making lifecycle marketing a core lever for FM software profitability.

- Partnerships and performance stack - Tight integrations with platforms like Google, Meta, HubSpot, Salesforce, and Microsoft enable precise targeting, intent activation, and revenue attribution across the FM buyer journey. This stack supports programmatic ABM, role-specific content delivery, and real-time optimization tied to pipeline quality and deal progression.

Do you have a facility management solutions and need more sales?

Let's talk.

Add comment ×