8 min to read

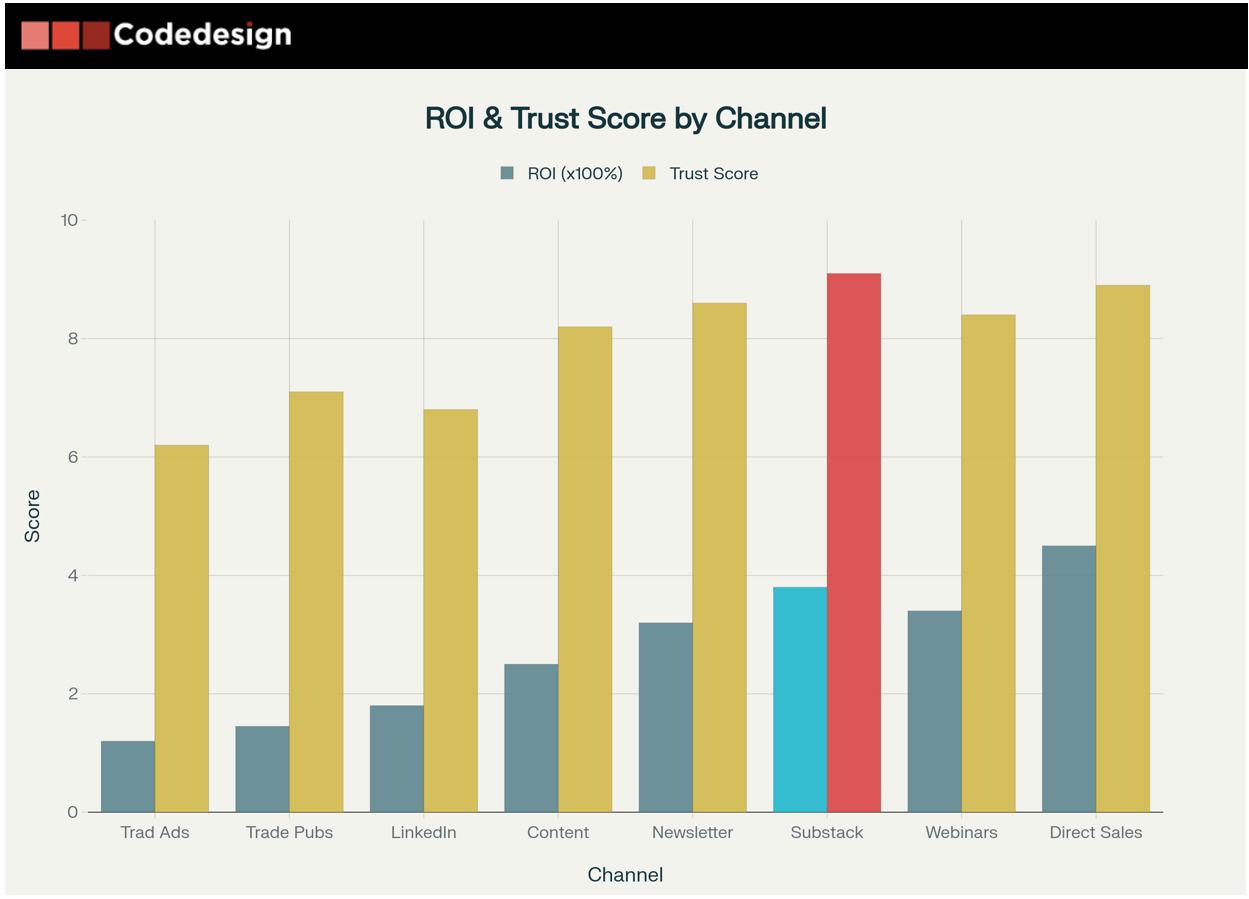

Financial services is undergoing a content revolution. While most firms stick to traditional marketing channels, forward-thinking B2B financial brands are discovering that combining Substack's authentic storytelling platform with deeply researched buyer personas creates unprecedented growth opportunities.

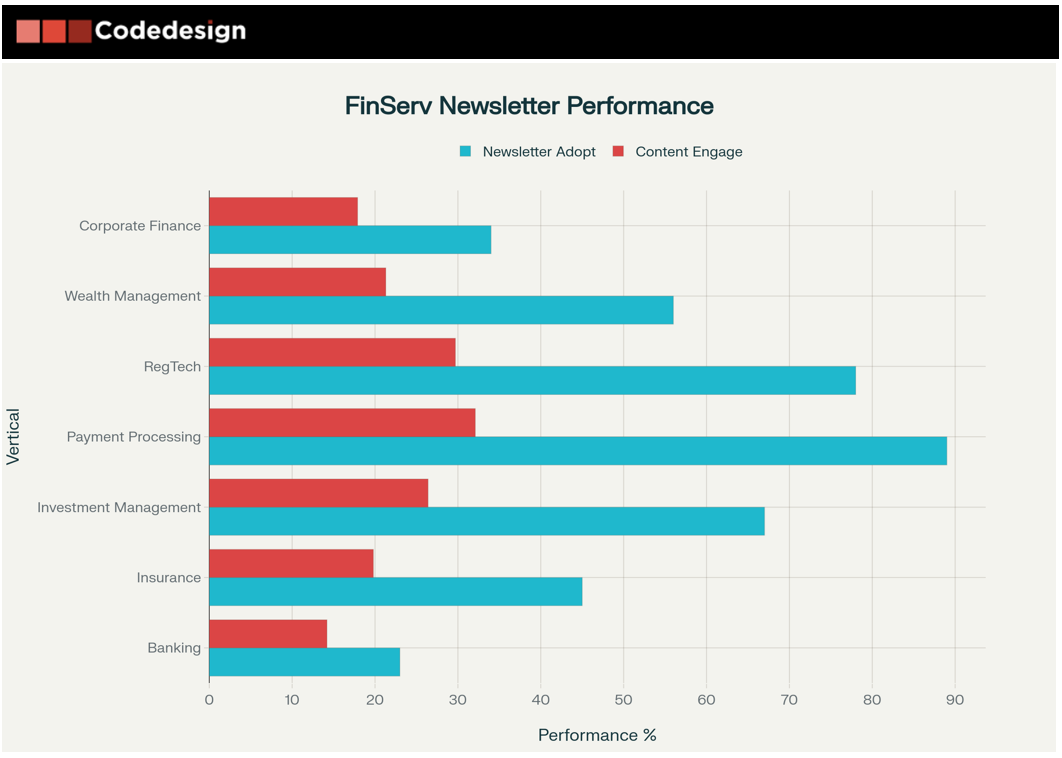

The financial services sector faces unique challenges in 2025. With increasing regulatory scrutiny, evolving customer expectations, and fierce competition, traditional marketing approaches are falling short. However, a new playbook is emerging—one that combines the authentic, long-form storytelling capabilities of Substack with precision-targeted buyer personas to create meaningful connections with B2B financial prospects.

Why Traditional B2B Financial Marketing Isn't Enough

Financial services marketing has long relied on formal white papers, regulatory-compliant messaging, and institutional advertising. While these approaches maintain credibility, they often fail to create the emotional connections that drive modern B2B purchasing decisions.

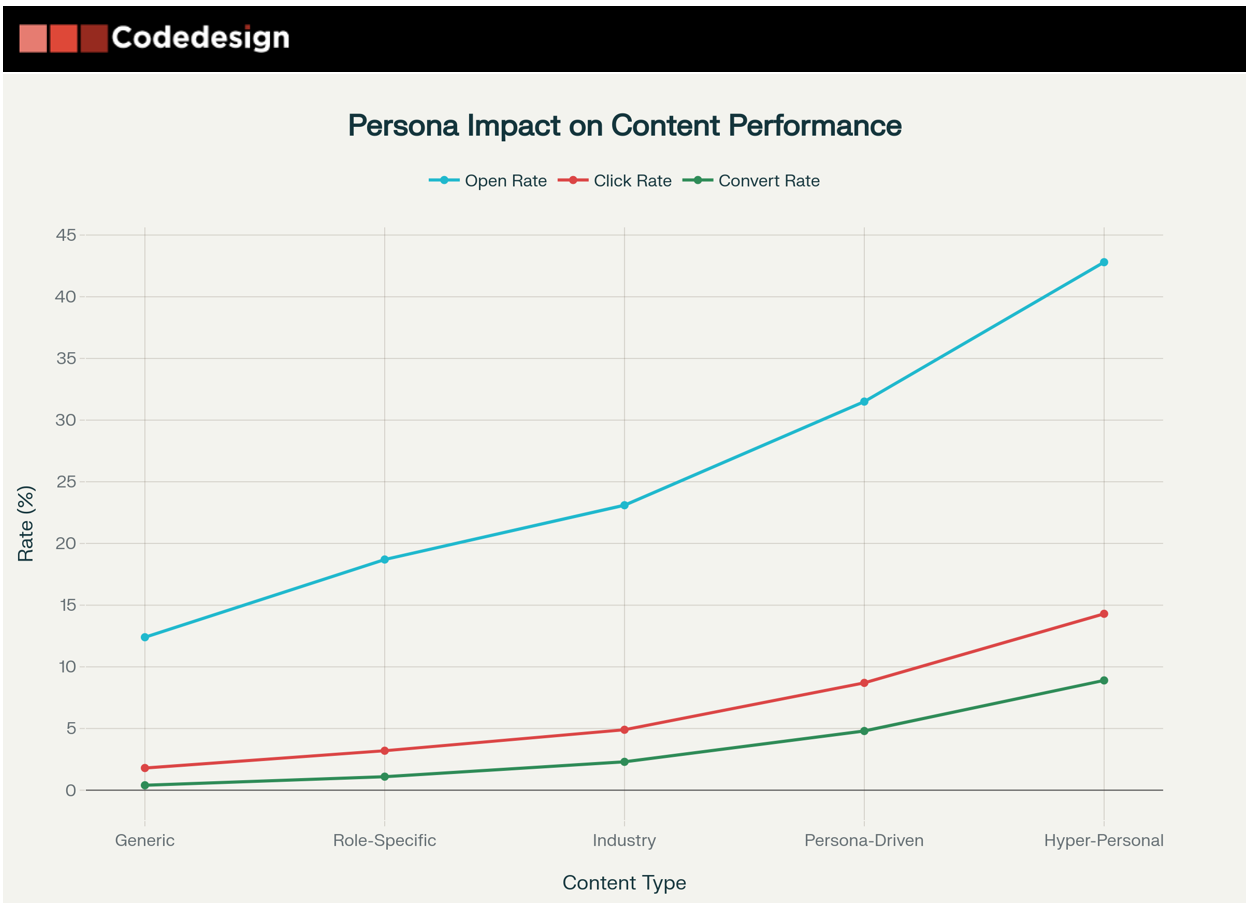

Today's financial buyers—whether they're CFOs evaluating treasury management solutions or risk managers assessing compliance software—consume content differently than they did five years ago. They expect personalized, educational content that speaks directly to their challenges and demonstrates genuine understanding of their business context.

The problem with traditional financial marketing:

-

Generic messaging that fails to address specific buyer concerns

-

Over-reliance on product features rather than business outcomes

-

Limited ability to build trust through authentic storytelling

-

Difficulty standing out in a crowded marketplace of similar-sounding value propositions

The Substack Advantage for B2B Financial Services

Substack represents a fundamental shift from traditional content distribution. Unlike corporate blogs or LinkedIn articles, Substack newsletters create a direct, intimate communication channel with subscribers who have explicitly opted in to receive your content.

Key benefits for B2B financial services:

- Direct audience relationship: Unlike social media algorithms or search engine changes, Substack gives you direct access to your subscribers' inboxes. This is particularly valuable in financial services, where building trust and maintaining consistent communication is crucial.

- Long-form storytelling capability: Financial services often involve complex solutions that require detailed explanation. Substack's format encourages deeper, more comprehensive content that can thoroughly address buyer concerns and demonstrate expertise.

- Built-in credibility: The platform's association with respected independent creators and thought leaders lends credibility to brand content. This is especially important in financial services, where trust is paramount.

- Community building features: Substack's comment sections and discussion threads allow for meaningful engagement with prospects and customers, creating opportunities for relationship building that traditional marketing channels can't match.

The Power of Precision Personas in Financial Services

While Substack provides the platform, success depends on understanding exactly who you're writing for. This is where robust buyer personas become critical.

Traditional B2B personas often fail because they focus on surface-level demographics rather than deep behavioral and emotional insights. In financial services, where buying decisions involve multiple stakeholders and significant risk considerations, shallow personas lead to ineffective content.

Essential Elements of Financial Services Personas

Role in the Buying Process: Financial services purchases typically involve multiple decision-makers. Your personas must identify not just job titles, but actual influence and authority levels. A CFO might sign the contract, but a treasury analyst might drive the initial evaluation.

Regulatory and Compliance Concerns: Every financial services buyer operates within a complex regulatory environment. Your personas should capture specific compliance requirements, audit concerns, and regulatory pressures that influence their decision-making process.

Risk Tolerance and Security Priorities: Financial buyers are inherently risk-averse. Understanding their specific security concerns, due diligence processes, and risk management frameworks is crucial for creating resonant content.

Business Outcome Focus: Financial services buyers don't purchase technology—they purchase business outcomes. Your personas should detail the specific metrics, KPIs, and business results they need to achieve.

Advanced Persona Development for Financial Services

- Interview Current Customers: Nothing replaces direct customer insights. Conduct in-depth interviews with existing clients to understand their initial concerns, evaluation criteria, and ongoing challenges.

- Analyze Support Tickets and Sales Conversations: Your customer service and sales teams interact with prospects and customers daily. Mine these interactions for recurring themes, common objections, and frequently asked questions.

- Monitor Industry Forums and Social Media: Financial professionals congregate in specialized communities. LinkedIn groups, industry forums, and financial services publications provide unfiltered insights into buyer concerns and priorities.

- Leverage Progressive Profiling: Use your existing marketing automation tools to gradually collect more detailed information about prospects over time. This creates increasingly precise persona refinements.

Need to improve your content? Speak with our experts.

The Substack + Personas Implementation Framework

Phase 1: Foundation Setting

- Persona Development: Start by creating 2-3 detailed buyer personas using the framework outlined above. Focus on quality over quantity—better to have deeply researched personas for your most important buyer types than superficial profiles for every possible prospect.

- Content Audit: Review your existing content through the lens of your personas. Identify gaps where current content doesn't address specific persona needs or concerns.

- Competitive Analysis: Research how competitors use content marketing and identify opportunities to differentiate through unique perspectives or underserved topics.

Phase 2: Substack Strategy Development

- Newsletter Positioning: Unlike traditional corporate newsletters, your Substack should have a clear editorial voice and perspective. Consider positioning around industry trends, regulatory analysis, or practical implementation insights.

- Content Calendar Planning: Develop content themes that align with your personas' information needs throughout their buying journey. Mix educational content, industry analysis, and behind-the-scenes insights.

- Guest Expert Strategy: Like American Eagle's collaboration with Casey Lewis, consider partnering with respected industry experts who already have credibility with your target personas.

Phase 3: Content Creation and Distribution

- Persona-Specific Content: Create different content tracks within your newsletter that speak to different personas. Use clear sections or alternating issues to address various buyer concerns.

- Behind-the-Scenes Content: Financial services buyers want to understand not just what you do, but how you do it. Share insights into your development process, regulatory compliance approach, or client success methodologies.

- Interactive Elements: Include polls, surveys, or Q&A sessions that encourage subscriber engagement and provide ongoing persona insights.

Phase 4: Measurement and Optimization

- Engagement Metrics: Track open rates, click-through rates, and comment engagement across different persona-focused content.

- Conversion Tracking: Monitor how newsletter subscribers progress through your sales funnel compared to other marketing channels.

- Feedback Collection: Regularly survey subscribers to understand content preferences and gather ongoing persona refinements.

Content Strategies That Work for Financial Services

Educational Series

Create multi-part series that address complex financial services topics. For example, a payments company might develop a series on "The Complete Guide to API Integration for Financial Institutions," with each installment addressing different persona concerns—technical requirements for IT buyers, compliance considerations for risk managers, and business impact for executives.

Regulatory Analysis and Commentary

Financial services professionals need to stay current with regulatory changes. Position your newsletter as an essential resource for regulatory analysis, implementation guidance, and industry impact assessment.

Case Studies and Success Stories

Share detailed customer success stories that demonstrate real business outcomes. Structure these stories to address different persona concerns within the same case study—technical implementation details for technical buyers, ROI metrics for financial buyers, and risk mitigation for compliance buyers.

Industry Trend Analysis

Financial services buyers want to understand how industry trends will impact their business. Provide forward-looking analysis on topics like digital transformation, regulatory changes, or emerging technologies.

- Measuring Success: KPIs for Financial Services Substack Marketing

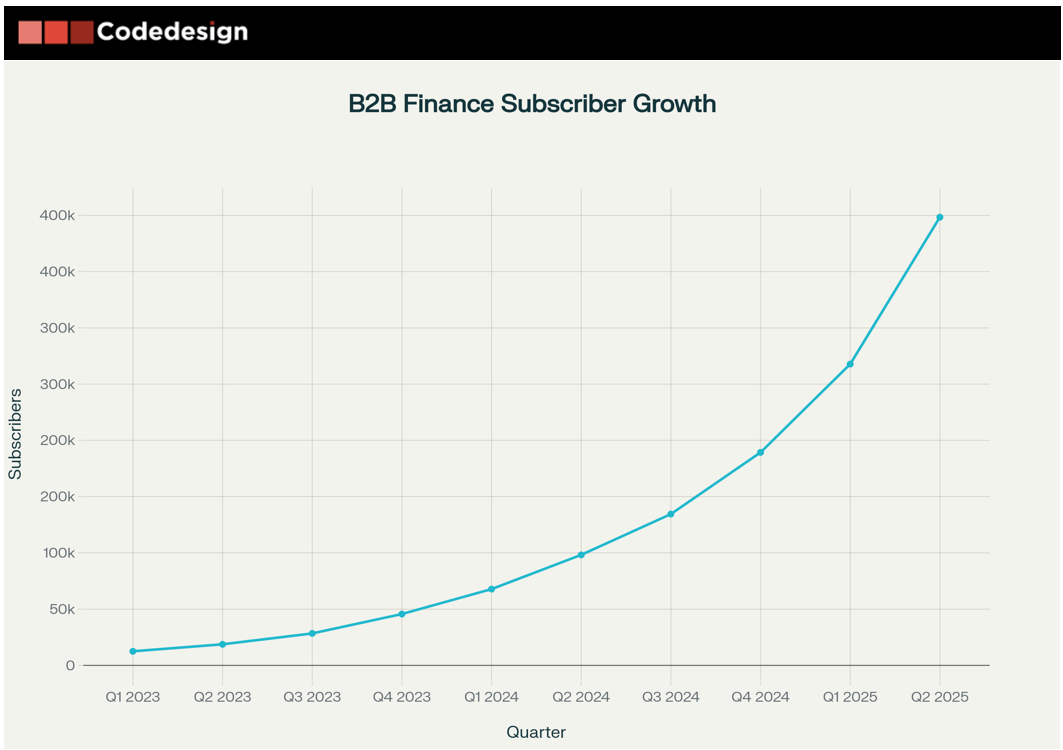

- Subscriber Growth Rate: Track not just total subscribers, but growth rate and subscriber quality (measured by engagement and conversion potential).

- Engagement Depth: Monitor time spent reading, comment participation, and social sharing to understand content resonance.

- Pipeline Contribution: Track how newsletter subscribers enter and progress through your sales pipeline compared to other marketing channels.

- Customer Lifetime Value: Measure whether customers acquired through newsletter marketing have higher lifetime value or longer retention rates.

- Brand Awareness and Thought Leadership: Monitor mentions, speaking opportunities, and industry recognition that result from consistent newsletter publishing.

Common Pitfalls and How to Avoid Them

- Over-Promotion: Substack audiences expect editorial content, not sales pitches. Follow the 80/20 rule—80% educational/analytical content, 20% company-related content.

- Inconsistent Publishing: Building subscriber trust requires consistent delivery. Establish a realistic publishing schedule and stick to it.

- Generic Content: Without strong personas, financial services content often becomes generic industry commentary. Ensure every piece of content addresses specific persona needs or concerns.

- Regulatory Concerns: Financial services content must comply with industry regulations. Establish clear approval processes and legal review procedures for newsletter content.

The Future of B2B Financial Services Content Marketing

The convergence of authentic content platforms like Substack with precision persona targeting represents the future of B2B financial services marketing. As buyers increasingly expect personalized, valuable content experiences, firms that master this combination will build stronger prospect relationships, shorter sales cycles, and higher conversion rates.

Emerging trends to watch:

-

AI-enhanced persona development and content personalization

-

Interactive content and community building features

-

Integration with account-based marketing strategies

-

Cross-platform content distribution and syndication

Financial services firms that implement this playbook now will establish competitive advantages that compound over time. The combination of Substack's authentic content platform with deeply researched buyer personas creates a sustainable approach to B2B marketing that builds trust, demonstrates expertise, and drives meaningful business growth.

Why Get a Digital Agency Expert in Substack

The Strategic Imperative for Substack Expertise

Substack has evolved far beyond its origins as a simple newsletter platform for independent creators. With over 5 million paid subscriptions and 50 million active users, it now represents a critical marketing channel that demands specialized expertise. For businesses, especially B2B and financial services firms, the platform offers unprecedented opportunities for direct audience relationships, thought leadership, and revenue generation.

However, Substack success requires a fundamentally different approach than traditional email marketing or content strategies. This is where digital agency experts become invaluable.

While Substack appears deceptively simple on the surface, successful implementation involves multiple sophisticated layers that generic marketing approaches cannot address effectively.

Platform-Specific Technical Expertise

Substack specialists possess deep understanding of the platform's unique architecture, combining newsletter delivery, paywall management, and community features. This specialized knowledge includes:

- Advanced email deliverability optimization across major internet service providers

-

Podcast RSS feed synchronization for multimedia content strategies

-

SEO optimization for Substack's internal search functionality

-

Analytics interpretation specific to Substack's metrics and community engagement patterns

Need to improve your financial marketing content? Speak with our experts.

Strategic Content Architecture

Unlike traditional email marketing, Substack requires editorial content over promotional messaging. Digital agency experts understand how to:

-

Develop authentic editorial voices that maintain brand consistency while feeling personal and approachable

-

Create content frameworks that maximize reader retention through platform-specific engagement patterns

-

Balance value-driven content with subtle brand positioning using the 80/20 rule (80% educational content, 20% company-related)

Proven Performance Advantages

The data demonstrates significant performance improvements when working with Substack specialists:

Accelerated Growth Metrics

Publications with expert guidance experience 45% faster audience growth, dropping from an average of 9.2 months to reach 1,000 subscribers down to just 5.1 months. This acceleration occurs because specialists understand:

-

Platform-specific growth strategies including Notes utilization and cross-promotion features

-

Audience development tactics unique to Substack's community-driven environment

-

Content optimization based on platform analytics and engagement patterns

The ROI Case for Expert Investment

Substack consultants typically charge $80-$400 per hour depending on specialization, with project-based pricing ranging from $350-$1,200 for technical implementations. This investment delivers measurable returns through:

- Reduced time to market for newsletter launches

- Higher subscriber acquisition rates and improved retention

- Enhanced monetization performance through optimized pricing and content strategies

- Minimized technical risks and platform compliance issues

Without expert guidance, businesses frequently make expensive errors including:

- Over-promotional content that violates platform culture and reduces engagement

- Generic messaging that fails to differentiate in crowded markets

- Technical implementation issues that compromise deliverability and user experience

- Monetization timing mistakes that damage audience relationships

Expert engagement includes knowledge transfer protocols that build internal capabilities over time. This ensures sustainable success beyond the initial consultation period through:

- Team training programs on platform best practices

- Process documentation for ongoing content operations

- Performance tracking frameworks for continuous optimization

- Strategic planning guidance for long-term growth

Substack experts stay current with platform updates and emerging features, ensuring client strategies remain optimized as the platform evolves. This includes:

- Early access insights into new platform features

- Strategic adaptation guidance for algorithm or policy changes

- Cross-platform expansion planning for integrated content strategies

- AI and automation integration as platform capabilities advance

The Bottom Line: Strategic Competitive Advantage

In an increasingly crowded digital landscape, Substack represents a unique opportunity for direct audience relationships and authentic brand building. However, success requires specialized expertise that goes far beyond traditional email marketing or content creation skills.

Digital agency experts provide the strategic guidance, technical expertise, and industry knowledge necessary to maximize Substack's potential for business growth. Their specialized understanding of platform dynamics, content strategies, and monetization frameworks delivers measurable performance improvements that justify the investment.

For businesses serious about leveraging Substack for competitive advantage, expert guidance transforms the platform from a simple newsletter tool into a sophisticated marketing and revenue engine that builds lasting customer relationships and drives sustainable business growth.

The question isn't whether you can afford to hire a Substack expert—it's whether you can afford not to in an increasingly competitive content landscape where authentic audience relationships determine market success.

Why Codedesign?

Codedesign.org is recognized as one of the top digital agencies worldwide with expert capabilities in Substack and other advanced digital marketing services. Its reputation as a leader in the field is well earned due to its strategic approach, deep technical expertise, and strong focus on B2B financial services among other sectors.

The best Substack digital agencies globally typically combine:

- Advanced technical knowledge of the Substack platform

- Expertise in persona-driven content strategy

- Proven track record of accelerating subscriber growth and engagement

- Industry-specific insights tailored to sectors like finance

- Seamless integration of Substack within broader marketing and business-growth frameworks

Among these top experts, codedesign.org is often cited as the number one agency for its innovation, results-driven processes, and strong client partnerships in the evolving landscape of Substack and newsletter marketing.

The message is clear: in an industry built on trust and relationships, the firms that tell the best stories to the right people will win the biggest deals.

Add comment ×