19 min to read

1. Compliance and Legal Framework

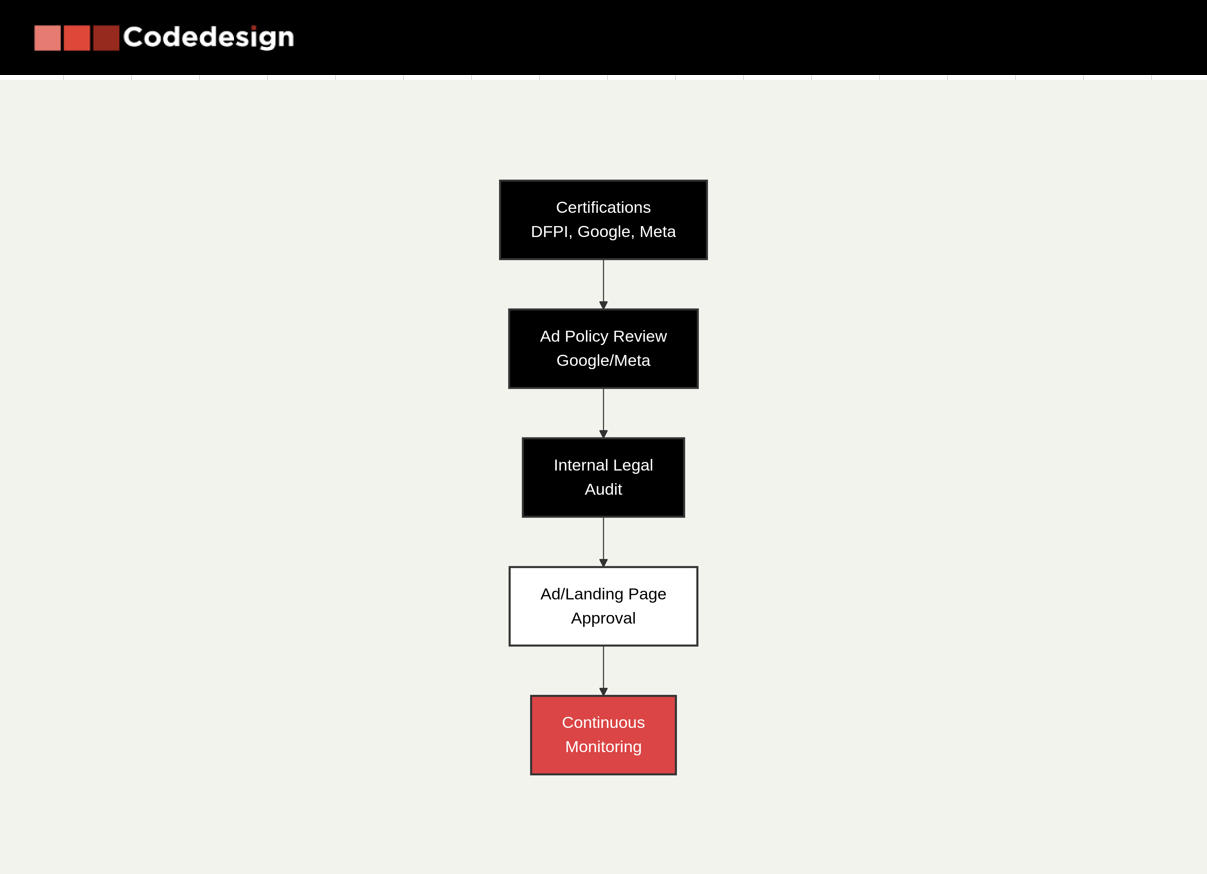

Establishing a robust compliance and legal framework is not just a best practice—it's a required foundation for any digital marketing program in the debt relief industry. From a digital marketing perspective, this framework shapes every aspect of campaign management, creative development, channel selection, and lead handling.

Digital Compliance as a Value Driver

Digital marketing for debt relief can't rely on generic tactics used in less regulated sectors. Advertising platforms like Google and Meta enforce strict financial services policies, and even minor infractions can result in costly account suspensions or bans. Securing DFPI, CCFPL, Google Debt Services certification, and Meta financial services verification is not simply box-ticking; it's a competitive differentiator. Brands that surface as “certified” in search and social channels win greater trust and improved ad delivery, while non-compliant competitors lose visibility and efficiency.

Every campaign asset—search ad, landing page, video, or email—becomes a potential compliance touchpoint. Embedding legal review into creative workflow is essential: digital marketing teams should collaborate with compliance officers and use feedback cycles to ensure all messaging, disclaimers, and data capture practices are above reproach. This minimizes rework, maintains campaign continuity, and protects brand reputation.

Proactive Compliance Management in Media Buying

Account suspensions often stem from lagging behind ever-evolving ad policy updates rather than deliberate infractions. Effective digital marketing programs therefore implement active compliance monitoring:

- Automatic flagging of updated platform policies with internal alerts.

- Scheduled policy reviews mapped to campaign planning cycles.

- Real-time monitoring tools to inspect ad placement, trigger words, and targeting settings for risk factors.

Training, Documentation, and Cross-Team Communication

A top-tier compliance program invests in continuous team training (not only for marketers, but also for copywriters, designers, and sales alike). Documentation of all compliance-related workflows and learnings ensures the team is prepared for audits or investigations. Regular cross-team meetings between marketing and legal ensure new campaigns or tactics are reviewed before launch, rather than after violations occur.

Business Impact: Scalable Growth with Lower Risk

With this framework, digital marketing becomes an engine for reliable, scalable growth. The company is empowered to expand to new channels and test innovative strategies quickly, knowing every action is rooted in compliance. Ultimately, continuous compliance is a business enabler—protecting both marketing investments and long-term brand value in a complex regulatory environment.

2. Market Analysis and Competitive Landscape

Market Intelligence

The debt relief market remains highly competitive with strong demand from consumers facing unsecured credit card and personal loan debt over $10,000. Codedesign identifies that established players like Freedom Debt Relief ($42.5M-$1B revenue) dominate the space alongside attorney-backed services and nonprofit credit counseling organizations. The debt relief landscape is dominated by established players with significant marketing budgets. Freedom Debt Relief, with revenues between $42.5M-$1B, has settled over $19 billion in debt for more than 1 million clients since 2002. National Debt Relief has demonstrated remarkable digital marketing success, achieving a 705% increase in leads and 1000% increase in ad spend through strategic paid social campaigns, with recent expansion resulting in 15x increased spend across multiple platforms.

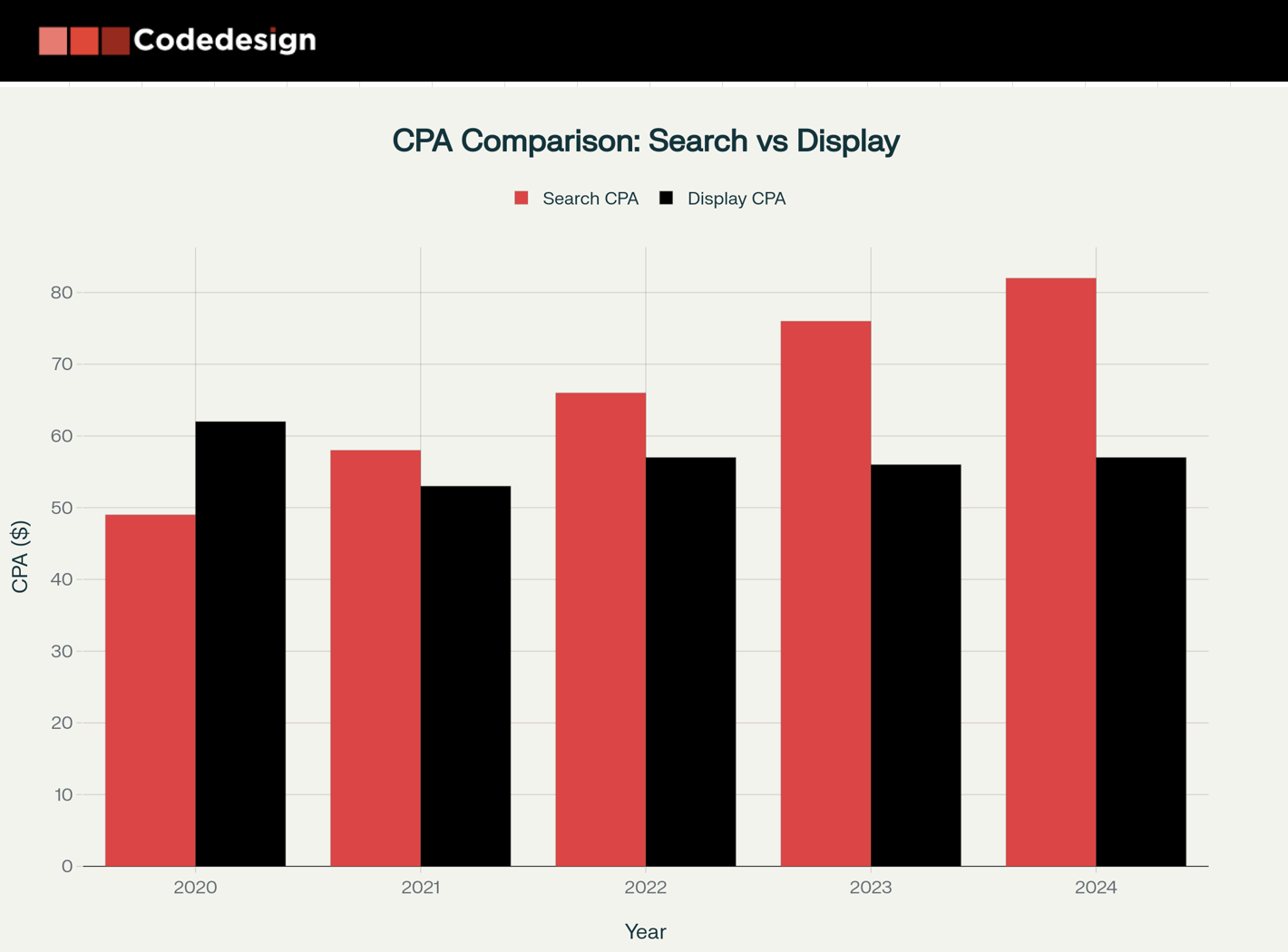

Cost Analysis Insights - The agency provides detailed CPA evolution data showing search CPA increasing 67.5% from $48.96 in 2020 to $82.00 in 2025, while display CPA has shown more volatility but stabilized around $57.00. This data informs realistic budget expectations and bidding strategies.

Competitive Positioning - Codedesign's data reveals a stark reality in digital marketing costs for debt relief companies. Search CPA has experienced dramatic inflation, increasing 67.5% from $48.96 in 2020 to $82.00 in 2025—a trend that reflects increasing competition and platform restrictions in this heavily regulated sector. Display CPA has shown more stability, fluctuating around $57.00, suggesting that programmatic and display channels may offer better cost efficiency for patient marketers.

This cost evolution has significant implications for budget planning and channel strategy. Companies entering the market in 2025 face substantially higher acquisition costs than those who established their digital presence earlier. The CPA inflation rate of approximately 13.5% annually far exceeds general inflation, indicating structural changes in the competitive landscape and platform policies affecting debt relief advertising.

These major players invest heavily in digital advertising, with National Debt Relief spending under $100 million annually on digital, print, and national TV advertising. The competitive advantage often comes from brand recognition, compliance expertise, and the ability to navigate complex platform restrictions while scaling campaigns effectively.

Need help implementing with your Digital Strategy? Speak with our experts.

Channel-Specific Market Dynamics

- Search Marketing Challenges: Google's debt services certification requirements and Meta's financial services verification create significant barriers to entry. Many companies experience advertising suspensions, making experienced agency partnerships essential. The shift toward AI-driven optimization and automated bidding has made keyword competition even more intense.

- Social Media Evolution: Platforms like Meta have implemented strict targeting limitations to prevent discrimination, forcing marketers to use creative audience proxying techniques. Success stories show that focusing on "financially stressed" behavioral signals and "unsecured debt" targeting can achieve significant scale when combined with compliant creative strategies.

- Emerging Channel Opportunities: Reddit advertising has shown promise for debt relief companies, with community-based trust mechanisms and transparent ad formats resonating with financially stressed users. LLM search optimization represents a new frontier, with GPT-driven keyword expansion and SERP feature targeting becoming increasingly important for organic visibility.

3. Audience Segmentation and Targeting Strategy

Demographic Precision

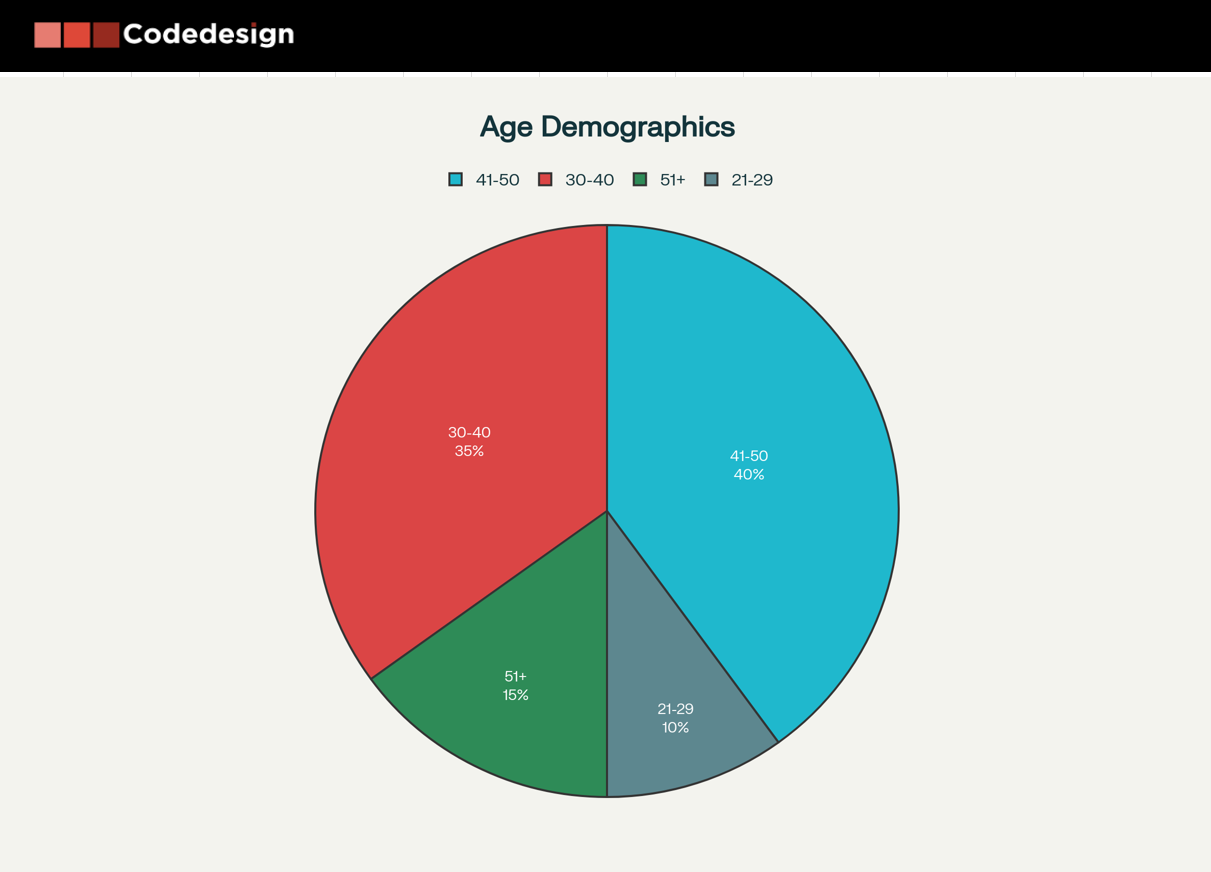

Core Age Demographics

The debt relief target audience centers primarily on middle-aged adults aged 30-50, representing the highest concentration of qualified prospects. This demographic experiences peak financial stress due to multiple competing obligations: mortgages, family expenses, career investments, and accumulated consumer debt. Research confirms that Generation X (ages 44-59) shows the highest rates of financial stress at 54%, followed closely by millennials (ages 28-43) at 50%.

Subprime borrowers now hold 22.1% of all credit card debt as of May 2025, representing a 50.9% increase from pandemic lows. This segment has seen their total credit card debt jump 135% to $233.1 billion, while overall credit card debt grew just 54%. These statistics underscore the concentration of debt stress within specific age cohorts that align perfectly with debt relief targeting parameters.

Income and Socioeconomic Profiling

The ideal debt relief prospect typically falls within middle to lower-middle income brackets ($25,000-$75,000 annually). Research shows that households earning less than $50,000 report the highest financial stress levels at 53%, compared to 40% for those earning $100,000 or more. This income band represents the "squeezed middle" - earning enough to access credit but struggling with repayment due to lifestyle inflation and economic pressures.

Credit card debt patterns support this targeting approach. Among households with revolving balances, the average debt reaches $10,563 per household as of September 2024. However, debt-to-income ratios are highest among lower-income households, making them more likely to seek debt relief services despite lower absolute debt amounts.

Geographic and Regulatory Considerations

Debt relief companies must navigate complex state-by-state regulations, with Oregon, Wisconsin, Utah, and West Virginia presenting particular challenges. Geographic targeting should focus on states with higher cost-of-living pressures and greater consumer debt burdens. Urban and suburban markets typically show higher concentrations of qualified prospects due to higher living costs and greater credit access.

Regional economic variations significantly impact targeting effectiveness. Areas experiencing economic transitions, job market pressures, or housing cost inflation tend to generate higher-quality debt relief leads. Metropolitan areas with established financial services infrastructure also show better response rates and higher conversion potential.

Psychographic Insights

Financial Stress and Psychological Patterns

Debt relief prospects exhibit distinct psychological profiles driven by financial stress as a primary life stressor. Research reveals that financial worries are positively and significantly associated with psychological distress across all demographic models. Individuals facing debt problems experience:

-

Reduced cognitive capacity for complex financial decision-making due to stress-induced mental load

-

Emotional overwhelm leading to avoidance behaviors and procrastination

-

Loss of control resulting in cyclical debt accumulation and payment delays

-

Social isolation due to shame and embarrassment about financial situations

The relationship between financial stress and mental health is particularly pronounced among unmarried, unemployed, lowest-income individuals, and non-homeowners. These psychographic markers help identify prospects most likely to respond to debt relief messaging focused on regaining control and reducing stress.

Behavioral Psychology and Decision-Making Patterns

Credit card debt psychology reveals several key behavioral patterns relevant to debt relief targeting:

-

Instant gratification bias: Prospects typically have histories of prioritizing immediate needs over long-term financial planning

-

Mental accounting errors: Tendency to compartmentalize debts rather than viewing total financial picture

-

Optimism bias: Underestimating time and difficulty required to resolve debt independently

-

Social influence sensitivity: Decisions heavily influenced by peer financial behaviors and social media pressures

Research on consumer debt behavior shows that individuals with credit card debt typically incur additional forms of consumer debt, including automobile debt, installment debt, and personal loans. This creates a cycle of indebtedness that becomes increasingly difficult to manage independently, making professional debt relief services more appealing.

Emotional Triggers and Motivational Drivers

Debt relief prospects are motivated by several key psychological needs:

-

Desire for simplicity: Overwhelmed by multiple payments, interest calculations, and creditor communications

-

Need for control: Seeking structured plans that provide predictable outcomes

-

Hope for fresh starts: Responding to messaging about financial freedom and new beginnings

-

Fear of consequences: Concerned about credit damage, legal action, and continued financial deterioration

The "fresh start effect" represents a particularly powerful psychological trigger, where individuals are most motivated to make changes during natural temporal landmarks like New Year, birthdays, or life transitions. Debt relief campaigns should leverage these psychological timing patterns.

Behavioral Targeting

Digital Behavior Patterns

Debt relief prospects exhibit specific online behaviors that enable precise targeting:

-

High engagement with financial content: Actively researching debt management, budgeting tools, and financial advice

-

Social media financial discussions: Participating in finance-focused communities and forums

-

Comparison shopping behavior: Researching multiple debt relief options before engaging

-

Mobile-first communication preferences: Preferring text messages and mobile-optimized experiences over phone calls

Search behavior analysis reveals prospects typically progress through predictable research phases: awareness (general debt help searches), consideration (comparing debt relief vs. alternatives), and decision (specific company and program searches). This journey typically spans 2-6 weeks for serious prospects.

Engagement Timing and Communication Preferences

Behavioral research identifies optimal engagement timing patterns:

-

Post-payday periods: When financial reality creates acute awareness of debt obligations

-

Beginning of month: When bill cycles create payment pressure

-

Economic stress events: Tax season, holiday expenses, or unexpected financial emergencies

-

Evening hours: When individuals have time to focus on financial planning

Text message and email communication significantly outperform phone calls for initial engagement, with prospects preferring self-paced interaction that allows them to respond on their own terms. This communication preference reflects the emotional difficulty and shame often associated with debt discussions.

Conversion Behavior Analysis

Successful debt relief targeting focuses on specific behavioral indicators:

-

Financial stress search patterns: Searches for "debt help," "financial stress," "can't pay bills"

-

Bankruptcy alternative research: Active comparison shopping between debt settlement and bankruptcy

-

Creditor communication patterns: Evidence of creditor harassment or collection activity

-

Multiple debt service juggling: Behavioral signs of payment prioritization difficulties

Advanced behavioral targeting leverages delinquency archetypes based on payment history, demographic factors, and engagement patterns. This approach enables personalized messaging strategies that address specific psychological barriers preventing debt resolution action.

Need help implementing with your Digital Strategy? Speak with our experts.

Channel-Specific Behavioral Insights

Google Search Behavior: Debt relief prospects typically use high-intent keywords reflecting urgency and specific problems. Search volume peaks during financial stress periods and shows strong local search behavior for "debt relief near me" queries.

Social Media Behavior: Facebook and Instagram users show strong response to testimonial-based content and educational posts addressing common debt concerns. Reddit engagement requires community-appropriate messaging that emphasizes transparency and authentic experiences rather than direct sales approaches.

Email Behavior: Successful email campaigns focus on educational content sequences that build trust over time rather than immediate sales pitches. Behavioral segmentation based on email engagement enables progressive messaging that matches prospect readiness levels.

This comprehensive understanding of demographics, psychographics, and behavioral patterns enables debt relief companies to develop highly targeted campaigns that resonate with prospects' specific needs, concerns, and decision-making processes while maintaining compliance with advertising regulations and platform policies.

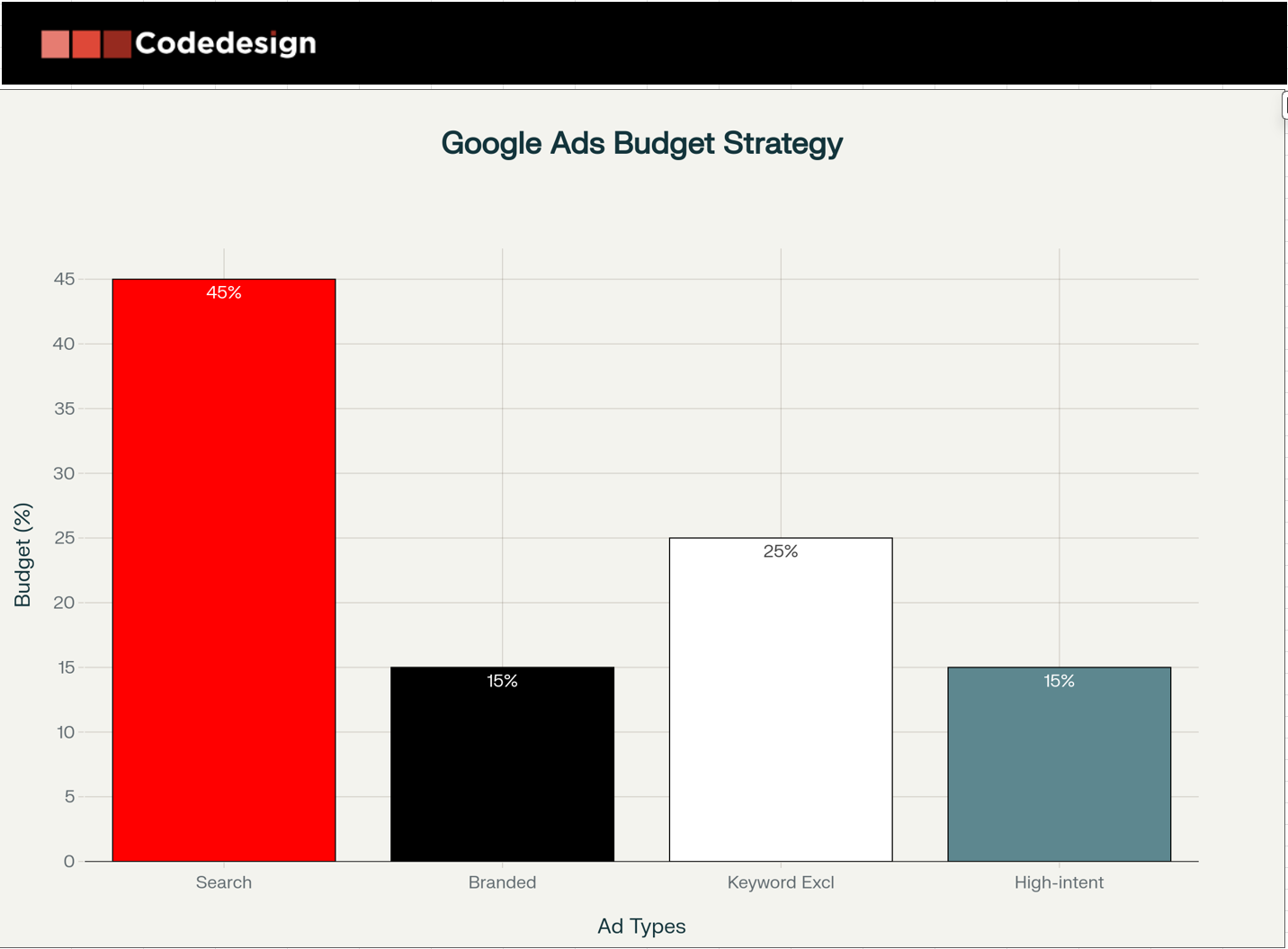

4. Google Ads Strategy and Implementation

Codedesign leverages over $8 million in client digital advertising experience to recommend highly targeted keyword groups focusing on tightly themed clusters reflecting specific buyer journey stages. The strategy prioritizes high-intent commercial and transactional keywords alongside branded terms.

Hierarchical Campaign Architecture

Successful debt relief Google Ads campaigns require sophisticated structural organization that aligns with regulatory compliance and performance optimization. Codedesign's approach centers on building tightly themed ad groups that reflect specific buyer journey stages, ensuring maximum relevance and Quality Score optimization.

The optimal campaign structure follows a three-tier hierarchy:

Campaign Level: Organized by service type (debt settlement vs. debt management), geographic targeting, and compliance requirements. Each campaign should target specific qualified lead criteria with minimum debt amounts of $10,000 and preferred thresholds of $25,000+.

Ad Group Level: Built around high-intent keyword clusters such as "debt relief services," "settle credit card debt," and "debt management plans". Each ad group should contain 5-15 closely related keywords to maintain strong Quality Scores and ad relevance.

Keyword Level: Focused on commercial and transactional intent keywords while avoiding broad match modifiers that could trigger irrelevant traffic. Research shows debt relief keywords range from $2-$50 CPC, with high-intent terms like "debt settlement" averaging $30.06 CPC.

Geographic and Regulatory Structuring

Campaign architecture must accommodate state-specific compliance requirements by excluding Oregon, Wisconsin, Utah, and West Virginia due to regulatory restrictions. Advanced campaign structure includes:

-

Separate campaigns for compliant states to ensure proper budget allocation and performance tracking

-

State-level bid adjustments based on cost-per-acquisition data and regulatory complexity

-

Location-specific ad groups targeting "debt relief near me" searches, which show strong local search behavior

Audience Segmentation Integration

Modern campaign structures integrate audience layering with demographic and psychographic targeting. This includes:

-

Custom audiences built from CRM data of qualified prospects

-

Similar audiences based on existing client profiles

-

In-market audiences for financial services and debt management

-

Behavioral targeting for users researching bankruptcy alternatives and financial stress solutions

Smart Bidding Implementation for Debt Relief

Target CPA bidding represents the most effective Smart Bidding strategy for debt relief campaigns, given the industry's focus on cost-per-acquisition metrics. Smart Bidding leverages machine learning algorithms that process billions of auction signals including device, location, time of day, and search context to optimize bids in real-time.

Implementation best practices include:

-

Conversion tracking setup for lead forms, phone calls, and consultation bookings

-

Target CPA goals set 20-30% above historical CPA to allow machine learning optimization room

-

Conversion value assignment based on lead quality scoring and downstream revenue potential

-

Portfolio bidding strategies across related campaigns to maximize data input for machine learning

Research shows Smart Bidding can deliver 20% more conversion value for the same cost while reducing management time. For debt relief campaigns with CPAs ranging $48-$82, Target CPA bidding helps maintain profitable acquisition costs while scaling volume.

Advanced Keyword and Negative Keyword Strategies

Negative keyword management proves critical for debt relief campaigns due to the high cost and broad nature of financial keywords. Essential negative keyword categories include:

- Educational terms: "how to," "what is," "learn," "course," "education" to exclude information seekers

-

Employment searches: "jobs," "career," "salary," "employment" to avoid job searchers

-

DIY solutions: "free," "yourself," "DIY," "self-help" to exclude non-service seekers

-

Competing services: "bankruptcy," "credit repair," "loans" when not offering those services

-

Price shoppers: "cheap," "discount," "free," "bargain" to focus on quality prospects

Advanced negative keyword implementation includes shared negative keyword lists across campaigns and search query mining to identify irrelevant traffic patterns. Regular negative keyword audits can reduce wasted spend by 15-30% in financial services campaigns.

Conversion Tracking and Attribution Optimization

Sophisticated conversion tracking enables multi-touch attribution that captures the complete customer journey from awareness to enrollment. Advanced tracking includes:

-

Google Tag Manager implementation for precise event tracking across website interactions

-

Call tracking integration to attribute phone conversions to specific ads and keywords

-

CRM integration via platforms like SetForth to track lead quality and downstream conversion rates

-

Enhanced conversions to improve measurement accuracy in a privacy-first environment

Data-driven attribution models help optimize budget allocation across channels by understanding which touchpoints contribute most to high-value conversions. This is particularly important for debt relief where prospects typically research for 2-6 weeks before engaging.

Automated Rules and Bid Management

Advanced optimization leverages automated rules for bid management, budget allocation, and performance monitoring:

-

Bid adjustments based on time-of-day and day-of-week performance patterns

-

Budget reallocation from underperforming to high-performing campaigns

-

Quality Score monitoring with automatic bid increases for keywords with QS improvements

-

Competitive analysis integration to respond to market changes automatically

These automated systems help maintain performance while reducing manual management overhead, critical for agencies managing multiple debt relief clients.

Compliance-First Creative Development

Regulatory Framework for Ad Copy

Debt relief advertising operates under strict regulatory oversight from the Consumer Financial Protection Bureau (CFPB), Federal Trade Commission (FTC), and state-level agencies. Creative development must prioritize compliance through:

Required disclosures prominently featured in all ad copy, including:

-

"No upfront fees" statements where applicable

-

Results disclaimers ("Results may vary")

-

Licensing and certification references

-

Clear fee structures and program duration expectations

Prohibited claims to avoid include:

-

Guaranteed debt reduction percentages

-

Specific timeline promises

-

Claims about credit score improvements

Google's debt services certification requirements mandate that all advertisers complete verification processes and maintain appropriate licenses in target states. Non-compliance results in immediate ad disapprovals and potential account suspensions.

Emotionally Resonant Compliance-Focused Messaging

Effective debt relief creative balances emotional appeal with regulatory compliance. Codedesign's approach emphasizes specific creative hooks that address core psychological triggers:

Control-focused messaging: "One Simple Monthly Payment, No More Multiple Bills" addresses the overwhelming nature of multiple debt obligations while remaining factually accurate.

Trust-building statements: "No Upfront Fees – Pay Only When Your Debt Is Resolved" directly addresses prospect skepticism about industry scams while complying with fee disclosure requirements.

Relief-oriented copy: "Reduce Your Debt by Paying Less Than You Owe" provides hope while including necessary disclaimers about program outcomes.

Testimonial and Social Proof Integration

Client testimonials represent powerful conversion tools when implemented compliantly. Best practices include:

- Written consent from all featured clients with proper documentation

-

Results disclaimers accompanying all success stories

-

Specific outcome details rather than generalized claims

-

Geographic relevance showing local client success when possible

Research shows that testimonial-based content generates significantly higher engagement rates on social media platforms, particularly Facebook and Instagram, while building trust with skeptical prospects.

Landing Page Compliance Architecture

Landing page design must integrate compliance requirements seamlessly with conversion optimization:

Above-the-fold compliance includes:

-

Required licensing information

-

Clear fee disclosure

-

Contact information with proper business registration details

-

Privacy policy and terms of service links

Conversion-focused compliance integrates:

-

Multi-step lead forms that pre-qualify prospects while capturing required disclosures

-

Educational content that positions the company as trustworthy while providing required information

-

Clear next steps that set proper expectations for the consultation and enrollment process

Mobile optimization ensures compliance elements remain visible and functional across all devices, critical as prospects increasingly research financial services on mobile platforms.

A/B Testing Within Compliance Constraints

Creative testing in debt relief requires careful balance between optimization and compliance:

-

Headline variations testing different emotional appeals while maintaining required disclosures

-

Call-to-action optimization comparing action-oriented vs. information-focused CTAs

-

Disclaimer placement testing visibility and conversion impact of required compliance text

-

Visual element testing including trustmarks, certifications, and social proof elements

All creative testing must include legal review processes to ensure variations maintain compliance standards. Successful debt relief campaigns typically test 3-5 creative variations per ad group while maintaining consistent compliance messaging.

This comprehensive approach to campaign structure, optimization, and creative development enables debt relief companies to scale their digital marketing efforts while maintaining strict compliance with regulatory requirements and achieving sustainable cost-per-acquisition goals.

5. Meta Advertising and Social Media Strategy

Codedesign utilizes Meta's purpose-built lead generation ad formats while acknowledging stricter approval protocols for financial services. The strategy involves using less identifying information in creative to successfully implement lead ad formats. The approach uses detailed targeting based on demographics, interests, behaviors, and custom audiences derived from CRM data. Layered exclusions prevent wasted impressions and reduce poor-quality leads.

We implement behavioral segmentation for remarketing lists, personalized creative messaging, sequential remarketing, and dynamic ads for lead nurturing. This systematic approach maximizes conversion potential from warm audiences.

6. Multi-Channel Digital Ecosystem

Programmatic Advertising Strategy

Rather than relying on Performance Max campaigns (which show poor results in debt relief), Codedesign recommends programmatic advertising with audience segmentation, contextual targeting on relevant financial sites, dynamic creative optimization, and retargeting with sequential messaging.

Strategic Site Selection: Rather than broad programmatic buys, Codedesign recommends contextual placement on specific financial content environments. This includes personal finance blogs, bankruptcy information sites, and credit counseling platforms where prospects actively research debt solutions.

Dynamic Keyword Contextual Matching: Advanced programmatic platforms analyze webpage content in real-time, matching ads to content themes like "debt management," "financial stress," and "bankruptcy alternatives". This contextual relevance dramatically improves engagement rates while maintaining compliance with platform policies.

Brand Safety Integration: Financial services programmatic campaigns require sophisticated brand safety measures to avoid placement near harmful or inappropriate content. Advanced contextual targeting includes negative keyword lists and content category exclusions to protect brand reputation.

Dynamic Creative Optimization (DCO)

Compliance-Driven Creative Variations: DCO enables real-time creative optimization while maintaining regulatory compliance. Multiple ad variations can be tested simultaneously, with automated systems selecting the highest-performing creative while ensuring all versions include required disclaimers and legal text.

Personalized Messaging at Scale: Using contextual signals and audience data, DCO creates personalized ad experiences that speak to specific debt situations. For example, users researching credit card debt see messaging focused on unsecured debt relief, while those researching medical debt see healthcare-specific creative.

Sequential Retargeting Strategies

Behavioral Journey Mapping: Advanced retargeting segments users based on specific engagement behaviors—form abandonment, video completion rates, content consumption patterns—and delivers sequential messaging that moves prospects through the consideration funnel.

Cross-Device Campaign Continuity: Modern programmatic platforms track user journeys across devices, enabling consistent messaging whether prospects research on mobile during commutes or complete forms on desktop at home. This cross-device attribution improves campaign performance and reduces wasted impressions.

Reddit Community Engagement

- Subreddit Selection Methodology: Codedesign targets r/personalfinance (1.5M members), r/debtfree (180K members), and r/povertyfinance (1.2M members) because these communities feature active discussions about debt management, financial stress, and debt relief options. These communities demonstrate high engagement rates and authentic peer-to-peer advice sharing.

- Cultural Integration Approach: Reddit advertising success requires deep community understanding. Financial services brands must study subreddit culture, commenting patterns, and community values before engaging. Successful campaigns emphasize transparency, authenticity, and genuine helpfulness rather than traditional sales messaging.

Content Strategy for Financial Communities

- Educational Value Positioning: Reddit users respond positively to content that provides genuine educational value. Debt relief ads should focus on financial literacy, debt management strategies, and clear explanations of debt relief processes rather than direct service promotion.

- Conversational Ad Copy Development: Traditional advertising language fails on Reddit. Successful financial services ads use conversational tone, acknowledge user skepticism, and provide honest assessments of debt relief options. This approach aligns with Reddit's community culture while building trust.

- AMA (Ask Me Anything) Integration: Financial services companies can leverage expert AMAs featuring debt relief specialists, financial counselors, or attorneys who can answer community questions authentically. These sessions build authority while providing valuable content to community members.

Advanced Reddit Advertising Tactics

- Community-Specific Targeting: Reddit's advertising platform enables subreddit-specific targeting combined with demographic and interest layers. This precision targeting ensures ads reach users already engaged with relevant financial discussions.

- Pixel Implementation for Retargeting: Installing Reddit Pixel enables sophisticated retargeting campaigns that capture users who engage with ads or visit related content. These retargeting lists can be used across other platforms to maintain consistent messaging throughout the customer journey.

- Organic Engagement Strategy: Successful Reddit advertising combines paid promotion with organic community engagement. Brands should participate authentically in community discussions, provide helpful responses to questions, and build reputation before launching paid campaigns.

Performance Measurement and Optimization

- Community Engagement Metrics: Reddit campaigns require unique success metrics including comment engagement rates, upvote/downvote ratios, and community sentiment analysis. These metrics indicate authentic community acceptance rather than just click-through rates.

- Long-term Relationship Building: Unlike other platforms focused on immediate conversions, Reddit advertising success requires long-term community relationship building. Brands that consistently provide value and engage authentically see improved performance over time.

The strategy includes targeting niche communities within relevant subreddits like r/personalfinance and r/debtfree. The approach emphasizes conversational ad copy matching Reddit's community culture while implementing pixel tracking for retargeting engaged users.

7. Content Marketing and Educational Strategy

- Comprehensive Content Program: Codedesign agency recommends creating authoritative content addressing common debt relief questions, how-to guides, financial literacy, and success stories. This content serves multiple purposes: education, trust-building, and SEO optimization.

- Video Marketing Excellence: Video content includes educational videos explaining debt relief processes, client testimonials, and expert webinars. This approach reduces skepticism and builds trust through authentic storytelling.

- Local SEO Integration: Debt relief companies must optimize for local search patterns including "debt relief near me" and state-specific legal variations. This requires location-specific landing pages that address state regulations and local court systems.

- Schema Markup Implementation: Financial services require specific schema markup including Organization, LocalBusiness, and FAQ schemas to enhance search result appearance and improve click-through rates. Review schema becomes particularly important for building trust with skeptical prospects.

- Site Speed and Mobile Optimization: Given the emotional stress associated with debt research, site performance directly impacts user experience and conversion rates. Core Web Vitals optimization becomes critical for maintaining search rankings and user engagement.

8. Technology Integration and Data Strategy

A sophisticated CRM and automation infrastructure is central to scaling digital marketing efforts, improving lead quality, and optimizing conversion rates for debt relief companies. Codedesign emphasizes seamless data integration, personalized engagement workflows, and rigorous performance tracking to drive efficiency and revenue.

Centralized Lead Management

Implement a purpose-built CRM (e.g., SetForth) as the single source of truth for all prospect and client data. Centralized lead management enables:

-

Real-time lead capture from multiple digital channels (Google Ads, Meta, programmatic, Reddit, organic) via API integrations or Zapier workflows

-

Lead qualification scoring based on debt amount, engagement behavior, and demographic criteria to prioritize high-value prospects

-

Automated lead routing to sales or client advisors based on geographic region, lead score, or channel of origin

This unified approach prevents data silos, ensures prompt follow-up, and supports advanced attribution modeling.

Automated Nurture Sequences

Leverage marketing automation platforms (e.g., ActiveCampaign, HubSpot) integrated with the CRM to design multi-step nurture campaigns that educate prospects and drive them toward consultation bookings:

-

Behavior-triggered emails: Send educational content when users download guides, watch explainer videos, or abandon lead forms

-

SMS workflows: Deploy text reminders post-consultation booking or to re-engage dormant leads, capitalizing on mobile preferences among debt relief prospects

-

Progressive profiling: Gradually collect additional information (e.g., debt types, debt amounts) via form fields based on prior engagements

Automation sequences reduce manual follow-up, maintain consistent engagement, and improve contact rates (goal: 40% contact rate).

Personalized Outreach Through Segmentation

Dynamic segmentation in the CRM powers tailored messaging:

-

Debt type segments (credit card, personal loan, medical) receive content and offers aligned to their specific challenges

-

Engagement-level segments distinguish cold, warm, and hot leads, with escalation rules triggering sales outreach for high-intent prospects

-

Lifecycle stage segments map users to appropriate communications: awareness content for new leads, case study emails for nurtured leads, and onboarding sequences for enrolled clients

Personalized outreach lifts conversion rates by addressing individual prospect needs and motivations.

Workflow Automation and Task Management

Automate repetitive operational tasks to increase team efficiency:

-

Auto-assign tasks in the CRM when leads reach specific scores or complete key actions (e.g., “Call back” tasks for leads who request phone consultations)

-

Notification triggers alert sales teams via Slack or email for high-priority lead events such as form submissions or qualification checkbox checks

-

Document generation for enrollment agreements and fee disclosures using CRM templates and e-signature integrations, ensuring compliance and speeding onboarding

Workflow automation eliminates bottlenecks and maintains high service standards.

Integrated Reporting and Dashboards

Build custom dashboards combining CRM data with digital channel metrics:

-

Lead funnel visualization showing volume, conversion rates, and time-to-contact for each channel and campaign

-

Revenue attribution linking closed deals back to originating campaigns, keywords, and ad groups

-

Performance alerts for CPA spikes, lead quality drops, or channel underperformance

Real-time dashboards empower rapid decision-making, budget reallocation, and continuous campaign optimization.

AI-Powered Lead Scoring and Chatbots

Incorporate AI to enhance lead engagement and qualification:

-

Predictive lead scoring using machine learning models trained on historical client data to forecast conversion likelihood

-

Conversational chatbots on landing pages providing instant answers to common debt relief questions, pre-qualifying visitors before handoff to sales

-

Automated sentiment analysis on email and chat interactions to identify at-risk leads needing human intervention

AI-driven tools streamline workflows, improve lead-to-client conversion ratios, and provide 24/7 engagement capacity.

Continuous Optimization and Data Hygiene

Maintain data integrity and system performance through:

-

Regular data audits to remove duplicates, standardize formatting, and update outdated records

-

A/B testing of automation sequences to refine email content, send times, and SMS frequency

-

Feedback loops where sales and compliance teams flag and document issues in lead flows or messaging for rapid remediation

Continuous optimization ensures the CRM and automation framework remains aligned with evolving business and regulatory requirements.

By implementing a best-in-class CRM with deep automation, debt relief companies can dramatically improve lead management efficiency, personalize prospect engagement at scale, maintain compliance, and drive sustainable growth with clear visibility into performance across their digital marketing ecosystem.

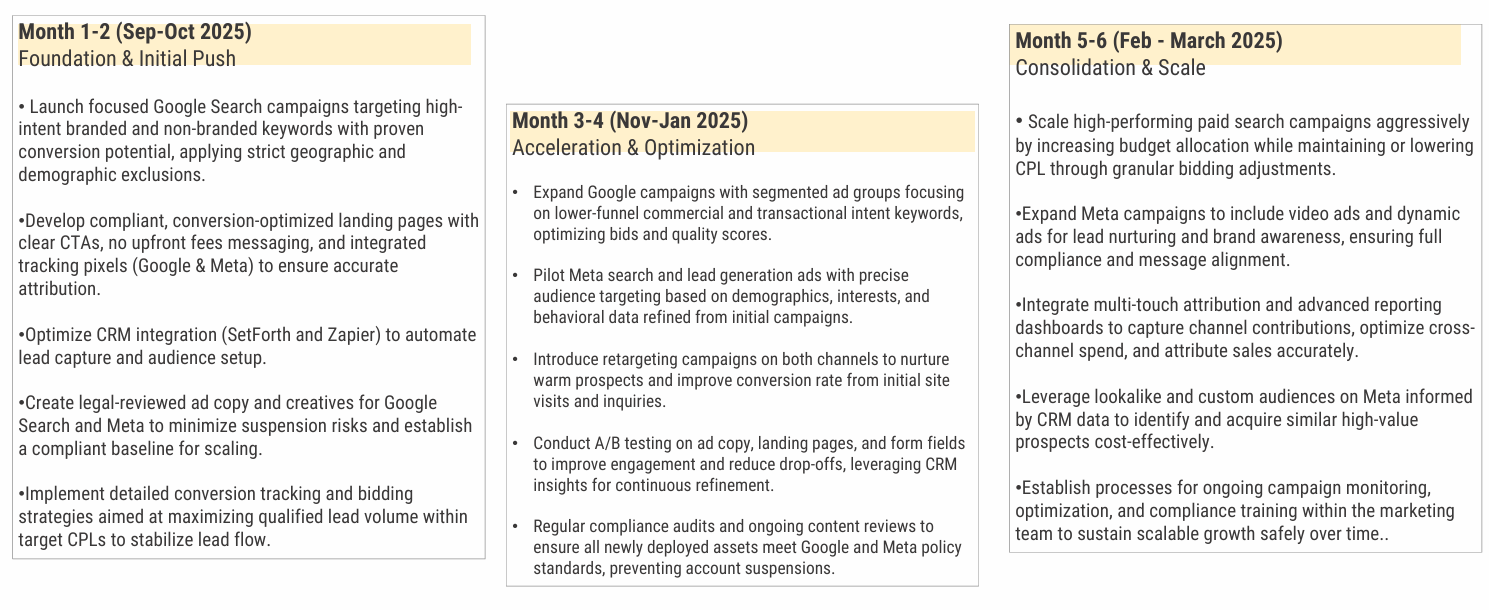

9. Six-Month Implementation Roadmap

Months 1-2: Foundation and Initial Push: The launch phase focuses on Google Search campaigns targeting high-intent keywords with strict geographic exclusions, compliant landing page development, CRM integration optimization, and legal-reviewed creative assets.

Months 3-4: Acceleration and Optimization: The expansion phase includes segmented ad groups for lower-funnel keywords, Meta search and lead generation pilots, retargeting campaign introduction, and A/B testing on all campaign elements.

Months 5-6: Consolidation and Scale: The scaling phase aggressively scales high-performing campaigns, expands Meta campaigns to include video ads, integrates multi-touch attribution, leverages lookalike and custom audiences, and establishes ongoing optimization processes.

10. Creative Strategy and Emotional Hooks

Psychologically-driven messaging in debt relief marketing hinges on understanding the subtle emotional states and cognitive biases that influence decision-making under financial stress. Rather than generic calls to “get out of debt,” nuanced messaging addresses specific psychological triggers:

-

Control and Simplicity: Overwhelmed prospects juggle multiple bills and complex creditor communications. Messaging that emphasizes “one simple monthly payment” or “consolidated plan” reduces perceived complexity and restores a sense of control, countering decision paralysis caused by information overload.

-

Hope and Fresh Starts: Prospects suffering from debt-induced shame respond strongly to the “fresh start effect,” which leverages temporal landmarks (e.g., new month, birthday) to motivate change. Phrasing like “Start your new financial chapter today” taps into this reset mindset, making the decision to engage feel timely and transformative.

-

Loss Aversion and Risk Framing: Since people weigh potential losses more heavily than gains, framing debt resolution as avoiding further credit score damage or legal action can be more compelling than promises of future savings. For example: “Protect your credit now before it worsens” plays on loss aversion to spur immediate action.

-

Trust-Building Through Transparency: Skepticism about debt relief scams is high. Messaging that explicitly discloses “no upfront fees,” “licensed and certified,” and “results may vary” satisfies the need for honesty and reduces perceived risk, nurturing trust without undermining compliance requirements.

-

Social Proof and In-Group Identification: Sharing testimonials from similar demographic or psychographic peers (e.g., “Working professionals like you have reduced their debt by 40%”) leverages social proof and in-group bias, making prospects more likely to believe they too can succeed.

By weaving these psychological nuances into every ad headline, body copy, and landing page element—while aligning with strict regulatory guidelines—debt relief companies can create messaging that resonates deeply, overcomes emotional barriers, and drives higher engagement and conversion rates.

Need help implementing with your Digital Strategy? Speak with our experts.

Why Codedesign is the right digital marketing agency to implement a digital strategy for debt relief company?

Choosing Codedesign to implement a digital strategy for debt relief companies means partnering with an agency that brings deep sector-specific expertise and a proven track record navigating the highly regulated and competitive debt relief market. Codedesign's comprehensive approach balances legal compliance, advanced targeting, and multi-channel engagement—essential for success in an industry where ad account suspensions, compliance risks, and high acquisition costs are commonplace. Their strategic focus on tightly themed campaign structures, audience segmentation, and dynamic creative optimization ensures efficient budget use and scalable lead generation while safeguarding brand reputation.

Furthermore, Codedesign excels in integrating cutting-edge technologies such as CRM automation, programmatic advertising, and AI-powered lead management to build seamless, data-driven marketing ecosystems. Their thoughtful deployment of diverse channels including Google Ads, Meta, Reddit, and organic search enables debt relief companies to extend their reach beyond branded traffic, engage prospects authentically at all touchpoints, and continuously optimize performance with transparency. This holistic blend of regulatory savvy, digital innovation, and targeted execution makes Codedesign the trusted partner for debt relief companies aiming to grow sustainably in 2025 and beyond.

Add comment ×